Electric Vehicle Road Tax UK: The No-Nonsense Guide

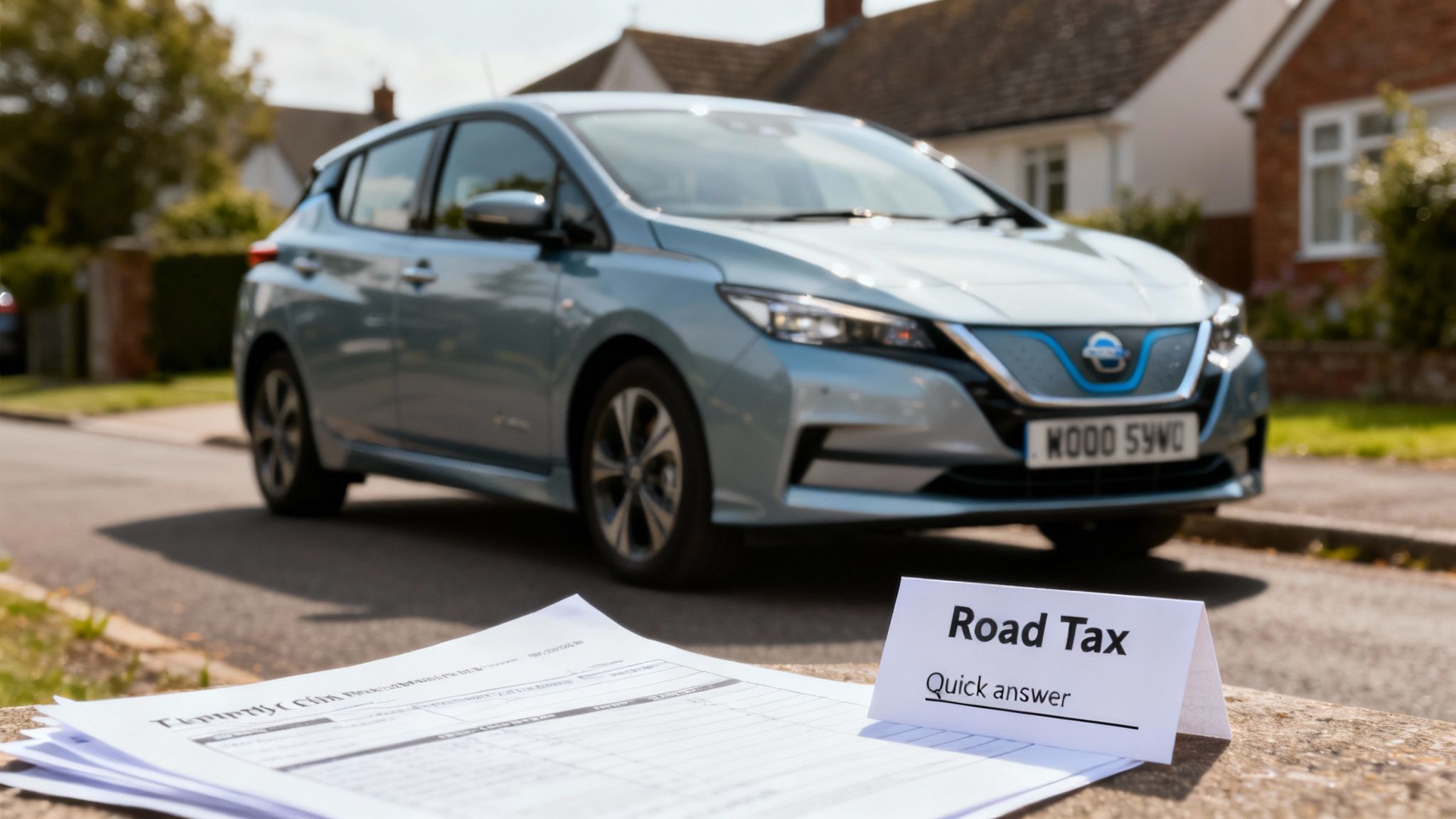

Electric vehicle road tax UK used to be a freebie for eco-warriors until 1 April 2025. As the taxman sharpens his quill, this no-nonsense guide breaks down the annual rates without any legal waffle. Bonus: as shiny newcomers like Tesla’s Model 2 and Nissan’s refreshed Leaf line up, don’t let your wallet miss the memo.

Evolution Of UK Electric Vehicle Road Tax

Once upon a time, zero-emission cars waltzed through toll booths without coughing up a penny – almost like nibbling a side salad and skipping the bacon-double stack charge. That green rush saw 129,000 new EVs by Q1 2025, a 41% surge according to GOV.UK, and the SMMT recorded November growth at 30.1% .

From 1 April 2025, the VMU (Very Mundane Update) arrived:

- Post-2017 EVs now pay £195 a year

- Cars registered 2001–17 settle on £20 annually

- Brand-new models start at £10 in Year One, then £195 from Year Two

- Electric vans face a flat £355

Discover more insights on Cinch.

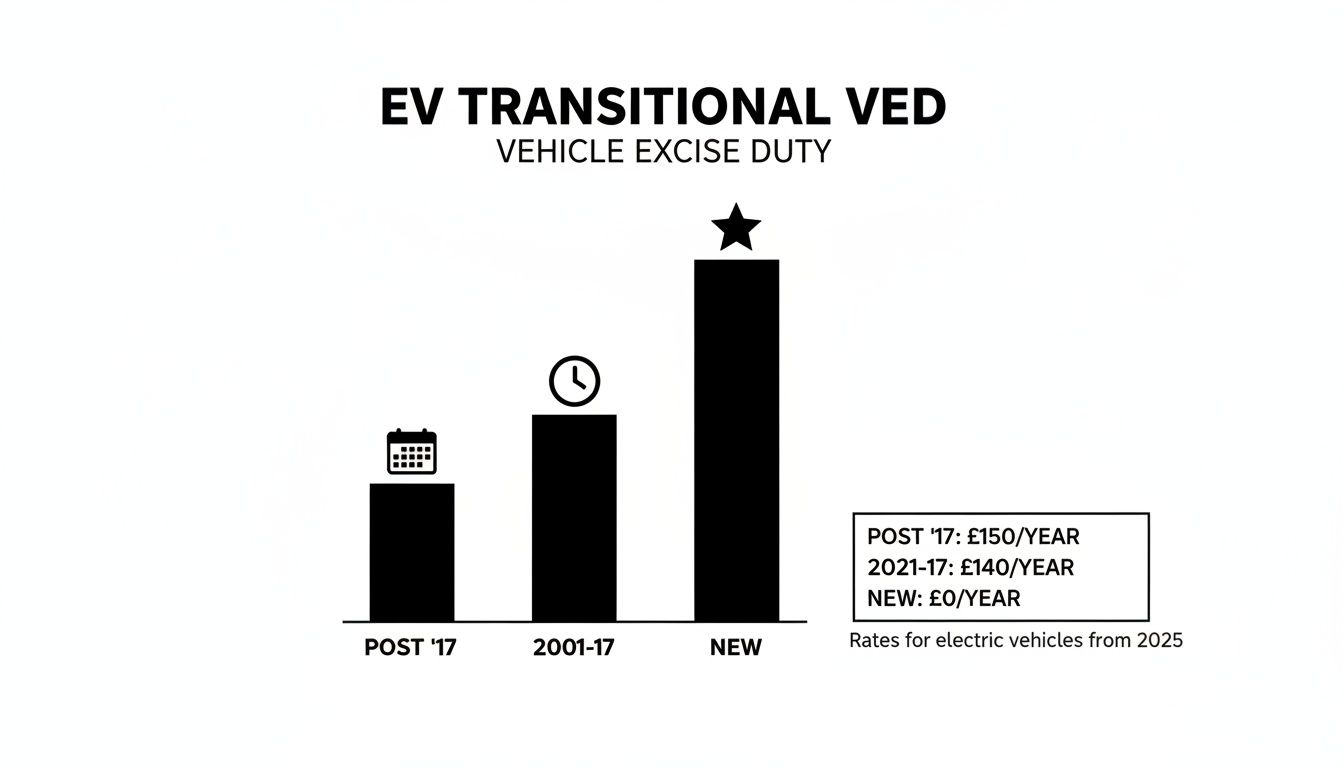

How VED Works Now

Vehicle Excise Duty (VED) funds our pothole-riddled roads and splits into a first-year fee plus a flat annual rate. Electric cars enjoy a cheeky discount initially, then queue behind petrol and diesel.

| Registration Period | First-Year VED | Standard Annual Rate |

|---|---|---|

| Post 1 April 2025 | £10 | £195 |

| Registered 2001–17 | £0 until 2025 | £20 |

| Post-2017 Models | £0 until 2025 | £195 |

| Electric Vans | £0 until 2025 | £355 |

From a complimentary Year One to a £195 annual tick-off – it’s a jolting shift from salad to steak.

Planning Your VED Budget

Treat VED like your council tax for the road. Plan or pay the penalty:

- Check your registration date – it flags the end of free motoring

- Set a reminder for late March to renew before the new rates bite

- Factor in £195 for second-year costs when hunting a used EV

Detailed Breakdown Of EV VED Components

If your EV’s list price exceeds £40,000 , expect a £425 supplement each year for five years. Here’s the lowdown:

- First-Year Fee : £0 to £10 depending on reg date

- Standard Annual Charge : £20 or £195 after Year One

- Expensive Car Supplement : £425 per year (for pricier EVs)

- Electric Vans : Flat £355 annual rate

These bits cover roughly £35 billion in lost fuel duty and keep our highways from falling apart.

Electric Vehicle Road Tax Exemptions

Before you wrestle the DVLA form, know who still squeaks by without paying and who faces the music after 1 April 2025.

Who Pays Nothing

EVs registered before 1 April 2025 keep a £0 VED rate until March 2025:

- 2001–2017 EVs : £0 VED until 31 March 2025

- Post-2017 models : also free until the cut-off

- All electric vans : clear until new rules kick in

Who Faces Charges

From 1 April 2025, most EVs lose the free pass:

- Post-2017 models pay £195 annually from Year Two

- 2001–2017 cars drop to £20 per year

- Regs from 1 April 2025 start with £10 then £195

- Luxury supplement of £425 for list prices over £40,000

Local authorities may add clean-air or ULEZ fees, so scope out your council’s scheme.

In March 2025, 244,598 EVs renewed VED early – a 1,467% jump from 2024 – saving an eye-watering £47.7 million . Read more on Wealth & Finance.

VED Rates By Registration Period

| Registration Period | First Year Rate | Annual Rate From Year Two |

|---|---|---|

| 1 Apr 2001–31 Mar 2017 | £0 | £20 |

| 1 Apr 2017–31 Mar 2025 | £0 | £195 |

| On or After 1 Apr 2025 | £10 | £195 |

| Electric Vans (Any Reg Date) | £0 | £355 |

Practical Tips

- Alert your calendar on 28 March to beat the rush

- Scout your council for EV rebate schemes

- Use the DVLA checker to nail your exact rate

Applying And Paying EV Road Tax

Tackling DVLA red tape feels like herding manic meerkats in wellies. Thankfully, the online portal slashes the faff to under five minutes – quicker than crawling on the M25. Have your V5C and MOT lined up before you log in.

Required Documents Checklist

- V5C Log Book – proves ownership and reg date

- Valid MOT Certificate (for cars over three years old)

- Proof of Insurance matching your reg number

- Payment Method (debit card or direct debit details)

Payment Pathways

- Online via GOV.UK – five minutes flat

- Direct debit – split the bill over 10 months

- Telephone – chat to a human or follow the robot prompts

- Post Office – take your V11 form, pay in person

“Direct debit turned a chore into a footnote,” says EV owner Laura.

Pro Tips For Timing

- Pop a reminder for 28 March to avoid palace of procrastination

- Check MOT and insurance expiry in advance

- Use phone alerts to flag renewals

Upcoming EV Road Tax Policy Changes

Buckle up: a full pay-per-mile scheme lands in April 2028. Until then, enjoy transitional annual charges.

- From 1 April 2025: £10 first-year VED on new EVs

- Year Two onwards (post-2017 models): £195 per year; older EVs £20

- Electric vans stay at £355 annually

Pay Per Mile Charge

From April 2028, eVED kicks in at 3p a mile for BEVs and 1.5p for PHEVs. Your driving habits now dictate the bill.

Most drivers won’t top fossil-fuel costs: at 20,000 miles, EV mileage fees still undercut petrol.

Read more at ElectricCarScheme.

Real World Cost Comparison With Petrol And Diesel Cars

Let’s pit electric vehicle road tax UK against petrol and diesel across three mileage bands.

Key Comparison Assumptions

- EV VED : £195 after Year One

- eVED : 3p /mile from April 2028

- Petrol VED : £180 annually

- Diesel VED : £205 annually

- Petrol duty : 6.5p /mile

- Diesel duty : 6p /mile

Annual Tax Comparison

| Annual Mileage | EV Total Tax | Petrol Equivalent Tax | Annual Saving |

|---|---|---|---|

| 8,500 miles | £450 | £741 | £291 |

| 10,000 miles | £495 | £1,035 | £540 |

| 20,000 miles | £780 | £2,070 | £1,290 |

Case Studies & Maintenance

- Urban commuter Mary (10,000 miles) saves £540 vs petrol.

- High-miler Tom (20,000 miles) pockets £1,290 .

- EV servicing (brakes, tyres): ~£80; petrol service (oil, belts): ~£230.

Key Takeaways

- EVs win beyond 8,500 miles

- Low-milers (<5,000) might prefer petrol

- Maintenance still swings in EV’s favour

- Future eVED demands you track miles

- Always factor tax + servicing

Practical EV Buyer Tips And Deal Of The Week

Timing is everything. Snag that lease or purchase before 28 March to dodge Year Two’s £195 spike. Add in 0% deposit deals or cashback for extra relish.

- Monitor DVLA updates in January.

- Order by February; sign by mid-March.

- Use our Lemon Index for residual value smarts.

Deal of the week:

36-month lease on Blossom EV Hatchback – 200-mile range

, £249 PCM

, £0

deposit, 10,000

miles/yr, VED included.

| Feature | Details |

|---|---|

| Model | Blossom EV Hatchback |

| Range | 200 miles real-world |

| Monthly Payment | £249 PCM |

| Initial Rental | £0 |

| Annual Mileage | 10,000 miles |

| Included VED | Yes |

Bust moves: haggle for wallboxes, charging credits and software boosts.

Quick review: agile handling, hushed cabin, slow 7 kW home charge but trusty 50 kW rapid inlet.

EV Road Tax UK FAQ

Got queries on electric vehicle road tax uk ? We’ve bared the DVLA’s fine print.

-

What counts as zero-emission?

Any pure BEV with 0 g/km CO₂ stamps it VED-free in Year One. -

How do reg dates shape costs?

Your initial reg date fixes your first-year discount; after, you slot into pre- or post-2017 bands. -

Can you challenge a DVLA mistake?

Yes – flash your V5C, emissions data and renewal docs. Most scrabble sorted within 14 days . -

Exceed eVED miles?

Extra miles cost 3p (BEVs) or 1.5p (PHEVs).

“Log miles monthly to avoid shock invoices,” advises Dan Clarke.

Ready for more electric musings? Charge over to VoltsMonster for reviews and banter.