A Guide to the Salary Sacrifice Car Calculator UK

A salary sacrifice car calculator is your crystal ball for figuring out just how much cash you can save by swapping a chunk of your gross pay for a shiny new electric car. By paying for the motor before the taxman gets his grubby mitts on your cash, you cunningly lower your taxable income. This clever bit of financial jiggery-pokery makes getting into a brand-new EV far less painful than a bog-standard personal lease.

Believe it or not, it's a completely legit, HMRC-approved wheeze to get a new car, especially when it comes to the electric ones.

Decoding the Black Magic Behind a Salary Sacrifice Calculator

Let’s be honest—firing up a salary sacrifice calculator for the first time can feel a bit like trying to land a jumbo jet. You’re bombarded with fields asking for your gross salary, the car's P11D value, and something called a 'BiK rate'. It feels deliberately confusing, but I promise the idea behind it is beautifully simple.

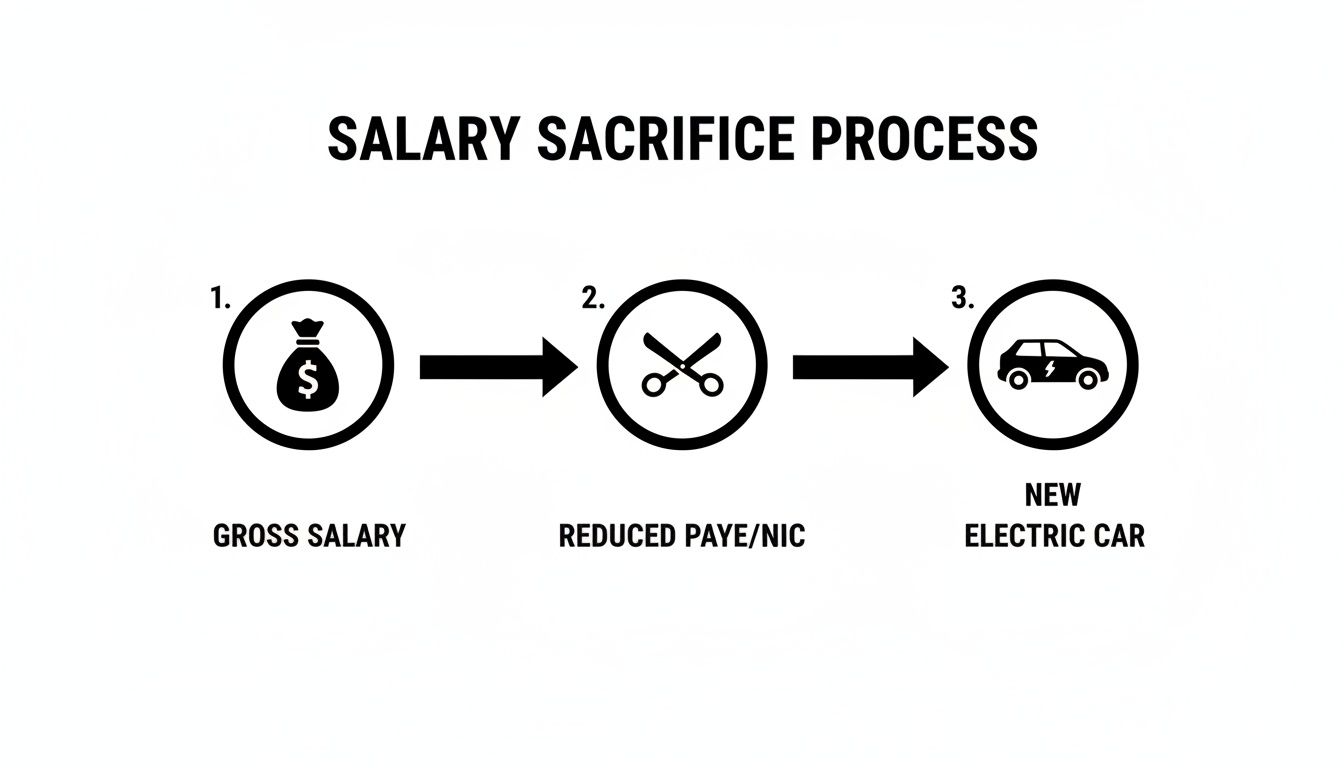

Instead of leasing a car with your sad, post-tax, take-home pay, you strike a deal with your employer to "sacrifice" part of your salary to cover the cost. Because this amount is nicked from your gross pay, your taxable income magically shrinks.

How This Financial Wizardry Works

Think of it like this: your employer is basically leasing the car on your behalf, and in return, you agree to a lower salary on paper. This one change sets off a domino effect of savings, which is exactly what these calculators are built to untangle for you.

- Lower Income Tax: A smaller gross salary means you pay less Income Tax. The savings are particularly juicy if you’re a 40% taxpayer.

- Reduced National Insurance: It's a proper win-win. You pay less in National Insurance Contributions (NICs), and so does your boss.

- EVs are the Secret Sauce: The real voodoo here comes from the ridiculously low Benefit-in-Kind (BiK) tax rates for electric cars.

This isn't some dodgy loophole you've stumbled upon on a Reddit forum. It's a government-backed scheme designed specifically to bribe drivers into switching to greener transport. The whole thing works because the tax you save on your salary massively outweighs the piddling amount of company car tax you'll pay for the EV.

Before we dive deeper, you'll see a lot of jargon on these calculators. Here’s a quick cheat sheet to make sense of it all.

Key Terms Your Calculator Will Throw at You

This table breaks down the essential gobbledegook you'll need to understand before punching in your numbers.

| Term | What It Actually Means | Why You Should Give a Toss |

|---|---|---|

| Gross Salary | Your total pay before any tax, National Insurance, or pension deductions are pilfered. | This is the starting block for all calculations. Your savings are directly tied to how much tax you're coughing up on this figure. |

| P11D Value | The list price of the car, including VAT and any factory-fitted extras, but excluding the first-year road tax and registration fee. | This is the number HMRC uses to work out your Benefit-in-Kind tax bill. A bigger P11D means slightly more tax. |

| Benefit-in-Kind (BiK) Rate | A percentage set by HMRC based on a car's CO2 emissions. It decides how much company car tax you'll pay. | For EVs, this rate is so low it's almost a joke, which is the key to making the whole scheme worthwhile. For petrol cars, it's often too high to bother. |

| Net Salary Impact | The final, actual cost of the car to you. It's the amount your monthly take-home pay will shrink by after all the tax and NI savings. | This is the big one! It shows you the true monthly cost, which is often a heck of a lot lower than the 'gross' sacrifice amount. |

Getting a grip on these terms is the first step. Once you get them, the calculator stops being a mystery and becomes a powerful weapon in your financial arsenal.

Why Benefit-in-Kind (BiK) Tax Matters

The only "catch" in this whole setup is the Benefit-in-Kind tax. Because the car is provided by your employer, HMRC sees it as a taxable perk, and you have to pay a tiny bit of tax on its value. For petrol and diesel cars, this BiK rate can be so eye-watering that it completely torpedoes any potential savings from the scheme.

But for electric cars? It's a different story. The BiK rate is currently fixed at a laughable 2% until 2025, and it only climbs by 1% each year after that until 2028. This makes the company car tax almost invisible.

When you start plugging numbers into a salary sacrifice car calculator for the UK , you’ll see with your own eyes how this low rate is the key that unlocks those massive monthly savings. It's what transforms a posh EV from a pipe dream into a genuinely affordable reality. If you want to get into the nitty-gritty, you can learn more about how UK electric car salary sacrifice schemes work in our full guide.

Getting Started: What the Calculator Needs From You

Alright, let's get our hands dirty. Opening up a salary sacrifice calculator for the first time can feel a bit daunting, like being handed a complex tax form by a man in a cheap suit. But honestly, it's a lot simpler than it looks once you've got the right info. Think of it as a quick fact-finding mission – and your payslip is the treasure map.

The first, and most important, piece of the puzzle is your Gross Annual Salary . This is the big number on your employment contract, the one you see before any tax or National Insurance is swiped. Don't confuse this with your take-home pay, or the results will be completely skewed. Your monthly payslip should have this figure plastered on it.

Next up, you'll need your tax code . This little string of numbers and letters is how HMRC keeps tabs on how much tax you should be paying. You'll find it on your payslip, usually lurking near your National Insurance number. For most people in the 2024/25 tax year, this will be 1257L .

This simple diagram shows exactly how a portion of that gross salary gets magically turned into a brand-new electric car.

As you can see, the beauty of the scheme lies in giving up that slice of your pre-tax salary. Because you're paying less tax and National Insurance, the actual hit to your wallet is much lower than you'd expect.

Finding Your Car and Contract Details

Now for the fun bit – moving on from dreary payroll details to the car itself. The calculator will need a few specifics about the vehicle and the lease deal you're eyeing up.

- P11D Value of the Car: This is essentially the car's list price, including VAT and any factory-fitted options. It's the official figure HMRC uses to work out your company car tax.

- Contract Length: You'll usually have a choice of 24 , 36 , or 48 months . A longer-term deal generally brings the monthly payment down, but it's a longer commitment, obviously.

- Annual Mileage: Be brutally honest with yourself here. Are you just doing the school run and local trips, or are you a motorway warrior? Typical options are 8,000 , 10,000 , or 15,000 miles per year. Exceeding your agreed mileage will lead to wallet-busting charges, so it pays to be accurate.

For an electric vehicle, the most crucial number is the Benefit-in-Kind (BiK) rate. For the 2024/25 tax year, this is an incredibly low 2% for pure EVs. This tiny rate is the secret sauce that makes salary sacrifice such a ridiculously good deal.

Let's Run Through a Real-World Example

Let's say you're interested in a new Tesla Model 3. Your gross salary is £60,000 , which plonks you in the 40% higher-rate tax bracket, and your tax code is the standard 1257L .

Here’s what you would punch into the calculator:

- Gross Annual Salary: £60,000

- Tax Code: 1257L

- P11D Value of Car: £42,990 (for a Model 3 RWD)

- Benefit-in-Kind (BiK) Rate: 2%

- Contract Length: 36 months

- Annual Mileage: 10,000 miles

Once you've fed it those details, the calculator will work its magic. It will calculate the gross amount sacrificed from your salary each month, but the number you really want to fixate on is the net impact on your payslip .

This is the final, true cost after all your Income Tax and National Insurance savings have been factored in. It's often this figure that has people doing a double-take, realising just how absurdly affordable a brand-new EV can be.

Let's Run the Numbers on a New Electric Car

It’s all well and good talking theory, but the magic of salary sacrifice really smacks you in the face when you see the numbers in black and white. Let's walk through a proper, real-world example to show you how a top-tier electric car becomes surprisingly affordable. We’re going to see exactly how a UK salary sacrifice car calculator turns a hefty monthly figure into something far easier to swallow.

Imagine getting the keys to a brand-new electric car, like a Nissan Ariya, and actually cutting your monthly motoring costs. It sounds like a scam, but it's all down to the tax system. For the 2025/26 tax year, pure electric cars (or BEVs) have a rock-bottom Benefit-in-Kind (BiK) tax rate of just 3% .

What does that mean for you? Well, if you’re a 40% taxpayer leasing an Ariya with a P11D value of £40,000 , you’d pay a measly £55 a month in company car tax. Better yet, you’d also save around £234 in income tax and another £12 on National Insurance each month. That’s how employees can see total savings of between 20-50% .

This simple example shows how your tax bracket is the secret ingredient that makes the whole thing work. Suddenly, a premium EV is well within reach, and personal leasing starts to look like a mug's game by comparison.

Breaking Down the Numbers

Let's make this real. Meet Sarah, a marketing manager earning £70,000 a year. This puts her firmly in the 40% tax bracket. She's decided a new Nissan Ariya is the car for her.

Here are the key figures we'll plug into the calculator:

- Gross Annual Salary: £70,000

- Tax Bracket: 40% (Higher Rate)

- Car P11D Value: £46,145

- Gross Monthly Sacrifice: £650 (this is the headline figure from the leasing company)

Normally, that £650 would come straight out of her bank account after she’s already been clobbered for tax and National Insurance. But with salary sacrifice, it's deducted from her gross pay, which immediately lowers the amount of salary she pays tax on.

The most important thing to grasp is this: the 'Gross Monthly Sacrifice' is not what you actually pay from your pocket. The real figure is the 'Net Salary Impact' after the calculator factors in your tax and NI savings. For most people, this is the lightbulb moment.

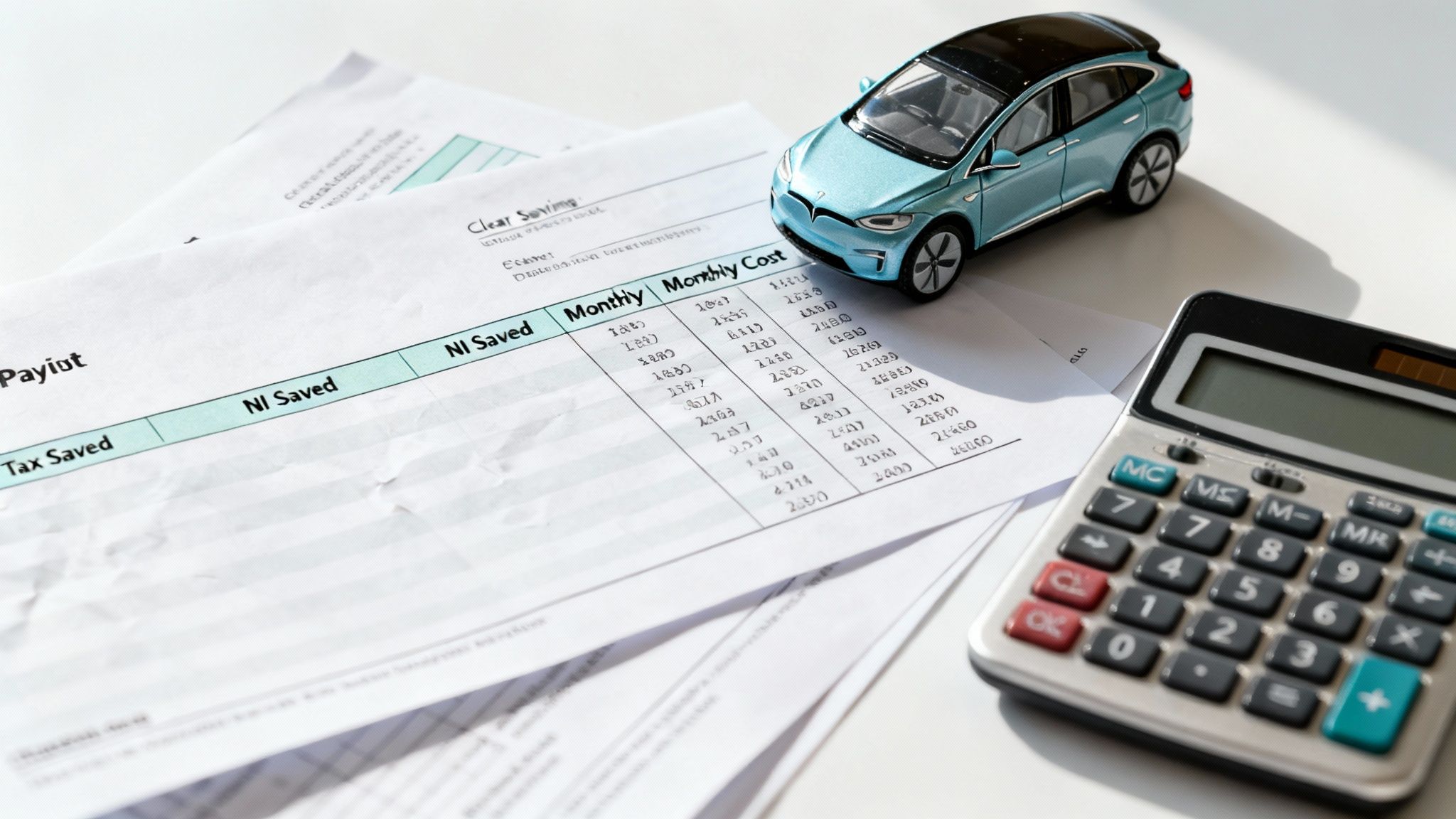

Worked Example: Nissan Ariya (40% Taxpayer)

Okay, let's see what the calculator spits out for Sarah’s new Ariya. The table below shows a clear, line-by-line breakdown of how the savings stack up, month by month.

| Cost Component | Before Salary Sacrifice (£/month) | After Salary Sacrifice (£/month) | Your Monthly Saving (£) |

|---|---|---|---|

| Gross Salary | £5,833 | £5,183 | N/A |

| Income Tax | £1,113 | £853 | £260 |

| National Insurance | £110 | £97 | £13 |

| Benefit-in-Kind Tax | £0 | £46 | -£46 |

| Net Cost of Car | £650 (from take-home pay) | £423 | £227 |

The results are pretty stark. The gross cost of £650 is immediately slashed by £273 in combined tax and NI savings. We then have to add back the small amount of company car tax ( £46 ), which gives Sarah a final, true monthly cost of just £423 .

That’s a real-world saving of £227 every single month compared to getting the same car on a personal lease. Over a typical three-year agreement, she'll be an incredible £8,172 better off. Savings like this completely change the conversation around the real cost of owning an EV compared to petrol cars.

Potential Pitfalls the Calculators Don't Mention

That shiny new figure from the salary sacrifice car calculator looks spectacular, doesn't it? But before you start picking out paint colours, we need to have a frank chat about the things the calculator conveniently forgets to mention. It’s a brilliant tool, but it’s programmed to show you the rosiest scenario, not the full, unvarnished truth.

The biggest elephant in the room is your gross salary . When you sacrifice a portion of it for the car, you're technically earning less. This isn't just a number on a payslip; it's the core figure that mortgage lenders, loan companies, and even pension providers gawp at. A lower gross salary could genuinely kneecap your borrowing power when it’s time to remortgage or apply for another loan.

The Knock-On Effect on Your Finances

It's not just about big loans, either. This salary reduction can ripple through other areas of your financial life in ways that aren't immediately obvious.

Here are the key areas you absolutely must investigate:

- Pension Contributions: If your pension contributions are a percentage of your salary, a lower gross salary means both you and your employer will be paying less into your pot. Over several years, this can make a noticeable dent in your retirement fund.

- Statutory Payments: Things like Statutory Maternity Pay (SMP), Paternity Pay, or Statutory Sick Pay are usually calculated based on your average earnings. A reduced salary could mean you get less during these crucial times.

- Life Insurance: Many 'death in service' benefits are calculated as a multiple of your annual salary. It's vital to check if sacrificing salary will shrink this payout for your family.

The crucial takeaway is this: salary sacrifice is a modification of your employment contract. While the tax savings are real and frankly brilliant, you have to understand the full consequences of that lower headline salary figure.

Leaving Your Job Mid-Contract

What happens if you find a new job or are made redundant halfway through your three-year lease? This is where the dreaded early termination clause rears its ugly head, and it can be punishing. The calculator doesn't model this scenario, but it’s a massive real-world risk.

Most agreements will slap you with a hefty fee if you leave your job voluntarily. While many modern schemes now offer protection against redundancy, you must read the fine print. Some only offer this protection after a qualifying period, like the first three or six months.

Before you sign a single thing, demand to see the early termination policy. Understand exactly what you’d be on the hook for if you handed in your notice. It’s the single most important bit of due diligence you can do to ensure a great deal doesn’t morph into a financial nightmare down the road.

How to Verify Your Calculator Results

Right, the salary sacrifice calculator has spat out a number so low you're wondering if it’s a wind-up. It looks almost too good to be true, which, in the world of cars, usually means it is. Before you start planning a road trip to the south of France, it's time for a proper sanity check to make sure the figures are grounded in reality, not just clever marketing fluff.

Don't just take the algorithm's word for it. You can do a rough 'back-of-a-fag-packet' calculation yourself to get a feel for things. Take the gross monthly sacrifice amount, figure out your marginal tax rate ( 20% , 40% , or 45% ), and calculate what that chunk of your salary would have cost you in Income Tax and National Insurance. This gives you a ballpark for your actual savings. If the calculator’s final number is miles off this, it’s time to raise a suspicious eyebrow.

Double-Check the Official Sources

Next up, it’s time to get a bit forensic with the details. The Benefit-in-Kind (BiK) rate is the absolute cornerstone of this whole deal, so you need to be damn sure it's correct. Don't just rely on the provider's website.

- HMRC is your friend (sort of): The official gov.uk website lists all company car tax rates for the upcoming years. You need to verify the percentage for your chosen EV is spot on.

- P11D Value: A quick search on the manufacturer’s website or a reputable car review site will confirm the car's official list price. If the P11D value used in the calculation is wrong, the final BiK tax figure will be wrong too.

Honestly, getting your head around BiK is crucial. We’ve put together a detailed guide you can check out to learn more about company car tax on electric vehicles and how to make it work for you.

The Formal Quote is Gospel Truth

An online calculator is a brilliant starting point—a fantastic guide to see what's possible. But it's not a binding contract. You absolutely must get a formal, written quote from your scheme provider before you even think about committing.

Treat the calculator's output as an educated estimate. The formal quote is the gospel truth. It will have the finalised figures, including any sneaky admin fees or specific costs tied to your employer's particular scheme.

This is also why different providers can quote differently for the exact same car. One might bundle in premium insurance and a home charger installation, while another offers a more stripped-back package. The formal quote puts all the cards on the table, letting you see precisely what you're paying for and why.

This transparency is a big reason these schemes are becoming such a powerful tool for companies to keep their staff. In fact, one survey found that 27% of employees are far more likely to stay with a company that offers an EV scheme.

Got a Few Lingering Questions?

Even after you've crunched the numbers with a calculator, a few common queries tend to pop up. Let's tackle them head-on so you can move on to the fun part: choosing your new electric car.

Will This Scupper My State Pension?

For the vast majority of people, the answer is a firm no. Your State Pension entitlement builds up based on your National Insurance record. As long as your reduced salary remains above the Lower Earnings Limit (which is £6,396 a year for the 2024/25 tax year), you’ll continue to accumulate qualifying years without a problem.

Since the rules state your post-sacrifice salary can't drop below the National Minimum Wage, virtually everyone using a car scheme will be well clear of this threshold. That said, if you work part-time or are on a lower salary, it’s always a smart move to double-check with your HR or payroll team before you commit.

What Happens If the Car Is Damaged or Written Off?

This is a big one, but the answer is reassuringly simple. Every legitimate salary sacrifice scheme will include fully comprehensive insurance as part of the deal. It's not an optional add-on; it's a core component of the monthly cost you see.

If you have a minor prang, you just follow the insurer's claims process as you would with any car. If the worst happens and the car is a total write-off, the insurance payout covers the outstanding finance owed to the lease company. The only thing you’ll need to confirm is the policy excess you're responsible for, but you won't be left facing a massive bill for a car that no longer exists.

In short, you're covered. The scheme providers have seen it all before, and they build these insurance policies in to protect everyone involved—you, your employer, and themselves—from a financial nightmare.

Can I Use the Car for Both Personal and Business Trips?

Absolutely. This is one of the biggest perks. Your agreement will specify an annual mileage limit—say, 10,000 miles per year—and you're free to use those miles however you see fit. The daily commute, school runs, weekend trips to B&Q... it’s your car to use as you please.

What about work travel? If you use the car for genuine business journeys (which doesn't include your regular commute), you can typically claim a mileage allowance from your employer. This is based on HMRC's advisory fuel rates for electric cars and is intended to reimburse you for the cost of charging. You can’t claim for the car itself, of course, because that's already handled through the salary sacrifice. It keeps everything clean and straightforward.

Ready to see how much you could save? VoltsMonster brings you the best deals and no-nonsense reviews to help you navigate the world of electric vehicles. Stop guessing and start saving today at https://www.voltsmonster.com.