Electric Car Incentives UK: Your Not-So-Serious Guide to Saving a Packet

Right then, let's get straight to it. When we talk about electric car incentives in the UK , what does that actually mean for your wallet? In short, it’s about a relaunched Electric Car Grant that might knock up to £3,750 off a new EV, combined with some seriously tasty tax breaks. Think zero road tax (for now) and company car tax rates so low they're practically giving them away.

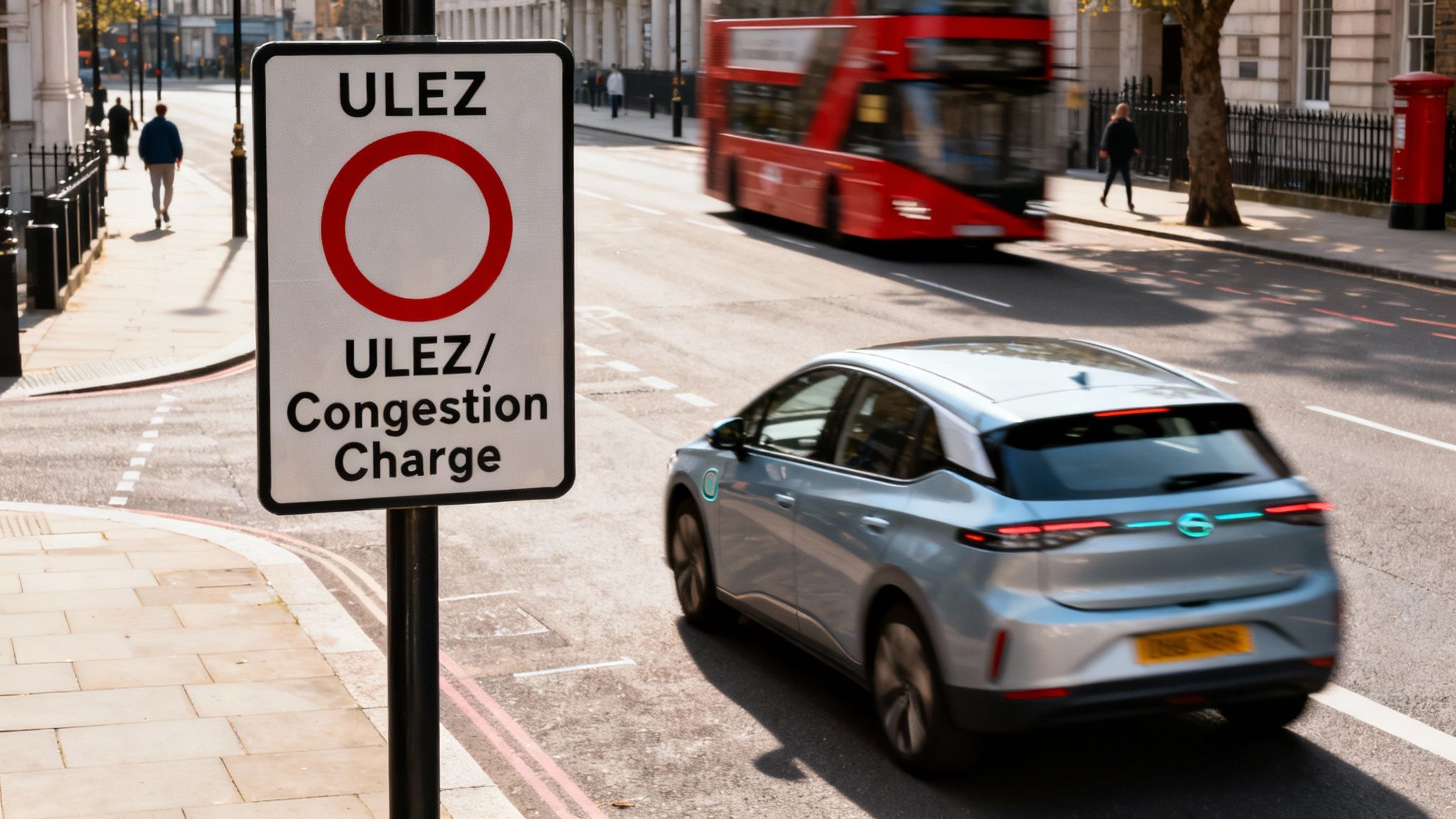

Chuck in the ability to dodge city-centre shakedowns like London's ULEZ, and the financial argument for going electric starts to look rather compelling.

Why Your Next Car Should Probably Be Electric

Let's be honest, the prospect of a discount on a spanking new car is always appealing. The government is desperate to see more of us piloting battery-powered vehicles, and to encourage the switch, they've cobbled together a package of financial perks. The whole point is to make ditching petrol or diesel feel less like a painful compromise and more like a smugly smart financial decision.

This isn't just about saving the planet, one polar bear at a time. It's about saving cold, hard cash. The world of electric car incentives in the UK is a potent cocktail of upfront grants, ongoing tax dodges, and city-specific exemptions that can dramatically slash your overall cost of ownership.

This infographic gives a decent overview of the main areas where you can save.

As you can see, the benefits aren't just a one-time bung when you buy the car; they're a continuous stream of perks that keep costs down for as long as you own the thing.

Understanding The Logic

Think of it this way: buying a petrol car is like paying a monthly subscription and then having to cough up extra for every single feature you use. With an electric car, the government is offering a hefty discount on the initial subscription and making many of the best features free.

We'll break down the key benefits in detail, but they generally fall into three camps:

- Purchase Grants: A straightforward discount that comes directly off the price of a qualifying new electric car. Simple.

- Tax Savings: Clever ways to keep more of your own money, especially through the Benefit-in-Kind (BiK) scheme for company cars and Vehicle Excise Duty (VED) exemptions.

- Running Cost Reductions: The ability to avoid daily charges for daring to drive in clean air zones in major cities like London.

The goal is simple, really: make the electric option so financially appealing that sticking with a fossil-fuelled car starts to feel like a properly daft choice. It’s a classic carrot-and-stick approach, and right now, the carrot is pretty chunky.

For a quick gander, this table summarises the main perks on offer.

UK Electric Car Incentives At A Glance

| Incentive Type | Potential Saving | Who It's For |

|---|---|---|

| Electric Car Grant | Up to £3,750 off specific new models | Buyers of qualifying new EVs from participating dealerships |

| Benefit-in-Kind (BiK) Tax | Thousands a year vs petrol/diesel | Company car drivers |

| Vehicle Excise Duty (VED) | £190 a year (plus 'luxury' tax savings) | All EV drivers (until April 2025) |

| ULEZ & Congestion Charge | Up to £27.50 per day in London | Drivers entering London's central zones and other UK Clean Air Zones |

| Home & Workplace Charging | Up to £350 or 75% off charger costs | Renters, flat-owners, and businesses installing chargepoints |

These incentives work together to significantly lower both the purchase price and the day-to-day running costs, making the switch to electric more accessible than ever.

The Return Of The Electric Car Grant

Just when we all thought the free money for electric cars had vanished for good, the government’s had a change of heart. For a while there, the old Plug-in Car Grant felt like a distant, fond memory. We even wrote about how its disappearance wasn't the end of the world, but let's be honest, a discount is a discount.

And now, it’s back. It might have a new name and a fresh lick of paint, but the idea is the same. Say hello to the Electric Car Grant (ECG) , the government's latest attempt to dangle a juicy carrot in front of potential EV buyers and make the switch from a fossil-fuelled motor that bit more tempting.

The beauty of this scheme is its simplicity. It’s a straight-up discount applied at the point of sale. That means the price on the windscreen is slashed before you even reach for your wallet. No faffing about with tedious forms or clawing money back from HMRC later. The dealership sorts it all out, which is exactly how it should be.

How The New Electric Car Grant Works

So, how much cash are we actually talking about? This is where things get a bit more specific. The new ECG isn't a one-size-fits-all deal; it’s a two-tier system designed to reward manufacturers who are truly committed to sustainability.

Everything hinges on a price cap. To be eligible for any grant at all, a new electric car must have a list price of £37,000 or less . This is a deliberate move to push incentives towards more affordable, mainstream models rather than subsidising eye-wateringly expensive luxury EVs.

From there, the grant is split into two bands:

- Band 1: This is the big one, offering a rather lovely £3,750 discount . To get this top-tier grant, a car must not only be under the price cap but also meet some pretty stringent sustainability criteria. Think of it as a gold star for the manufacturers building their cars in the greenest way possible.

- Band 2: This band offers a still-very-welcome £1,500 discount . Cars in this category are still priced under £37,000 and meet certain environmental standards, just not the top-tier ones needed for the full whack.

It’s a clever way of nudging carmakers to clean up their entire act, from the factory floor to the finished product, not just what comes out of the tailpipe (or doesn't, in this case).

The Nitty Gritty Behind The Numbers

This relaunch is a serious statement of intent. The government brought this incentive back in July 2025, backed by a hefty £650 million fund that’s set to run until the 2028/29 financial year. It’s the UK's most significant push for EV sales since the original Plug-in Car Grant was axed back in June 2022.

The logic is crystal clear. By rewarding manufacturers for their green credentials, the government is directly influencing which cars offer the best value for money. A model that qualifies for the full £3,750 suddenly looks far more attractive than a similarly priced rival that only gets the £1,500 discount. The pressure is now squarely on the carmakers to up their game.

For you, the buyer, the process couldn't be easier. Just find a qualifying car at a participating dealership, and the discount is applied automatically. The final price is simply reduced, making your shiny new electric motor instantly more affordable.

This new grant system breathes new life into the market for accessible electric cars. While the old grant was missed, its return, in this more focused form, is a massive win for anyone looking to buy a new, affordable EV in the UK.

Tax Breaks And Company Car Benefits

Right, you’ve managed to get a grant and knocked a bit off the sticker price. Fantastic. But if you think the savings stop there, you're in for a pleasant surprise. The real magic, the kind of stuff that makes accountants genuinely excited, happens when HMRC gets involved. This is where owning an electric car, especially as a company car, goes from being a smart move to one of the biggest financial no-brainers going.

Forget the upfront discount; the ongoing tax benefits are where you'll really see the difference. For company car drivers, the savings are so massive they can justify the switch all by themselves. On top of that, every EV driver currently gets a lovely pass on road tax, at least for a little while longer.

The Glorious World Of Benefit-in-Kind Tax

Anyone who's had a company car will know the sting of Benefit-in-Kind (BiK) tax. It’s the tax HMRC charges you for the 'perk' of having a car your employer pays for. For a petrol or diesel model, this can easily run into thousands of quid a year, as the tax is based on the car's price and, most importantly, its CO₂ emissions. Higher emissions mean a higher BiK percentage and a much bigger dent in your salary.

Electric cars, with their total lack of tailpipe emissions, blow this whole system wide open.

For the 2024/25 tax year, the BiK rate for pure electric vehicles is an almost unbelievable 2% . To give you some context, a fairly standard petrol or diesel car can sit in a BiK band anywhere from 25% to 37% . The difference this makes to your monthly pay packet is genuinely staggering.

Let's put some real numbers on that:

- Petrol Car: Take a £40,000 petrol car with a 30% BiK rate. If you're a 40% taxpayer, you’d be paying around £400 a month in tax for the privilege. Ouch.

- Electric Car: Now, picture a £40,000 electric car. With its tiny 2% BiK rate, the same 40% taxpayer would pay just £27 a month . That’s an annual saving of over £4,400 , straight back into your pocket.

This isn’t some sneaky loophole; it's a deliberate government incentive designed to get company car drivers into EVs. The rates are scheduled to creep up by 1% each year from April 2025, but they will still be miles lower than their fossil-fuelled equivalents for years to come. For a more detailed breakdown, our guide to UK electric car tax benefits provides a simple guide to dodging HMRC has all the figures you need.

Saying Cheerio To Road Tax For Now

Another major perk in the EV's corner is the current exemption from Vehicle Excise Duty (VED) , which everyone knows as road tax. While someone buying a new petrol or diesel car pays a first-year rate based on emissions followed by a standard annual fee of £190 (for 2024/25), pure electric car owners pay absolutely sod all.

This also means EVs sidestep the "luxury car" supplement. This is an extra £410 annual charge that applies for five years to any new car with a list price over £40,000. For a premium EV, this exemption alone saves you more than £2,000 .

Be warned, though: this free ride is pulling into the station. From 1st April 2025 , electric cars will be brought into the VED system. New EVs registered from that date will pay the lowest first-year rate of £10 and then the standard annual rate from then on. It’s a bit of a shame, but let's be honest, it was brilliant while it lasted.

A Sweet Deal For Businesses

It isn't just the drivers who get the benefits. Businesses wanting to update their fleets can make use of Enhanced Capital Allowances . This tax break allows a company to write off the full cost of a new, zero-emission vehicle against its pre-tax profits in the very first year of ownership.

It’s a powerful tool that dramatically reduces the real-world cost of buying EVs for the business, making a fleet-wide switch an incredibly smart financial decision.

Dodging City Centre Charges With Local Perks

While the big national grants and tax breaks get most of the attention, don't forget about the local heroes in the world of electric car incentives uk . Your postcode can unlock a whole other level of savings, especially if you live in a city and are sick of paying just to drive on your own streets.

For years, councils have been trying to tackle air pollution in our congested city centres, and their main tool has been charging zones. Think of them as invisible walls that hit your bank account every time you cross them in a car that doesn't meet certain emissions standards. But in an electric car? You can sail right through, no charge.

It’s a simple trade-off. Your car produces no fumes, so the city doesn’t penalise you for driving it. This is where the day-to-day running cost benefits of an EV really start to mount up, particularly for commuters.

The Ever-Expanding Map Of Clean Air Zones

It all started in London, but the idea of charging more polluting vehicles to enter city centres has caught on fast. A growing list of UK cities now have their own Clean Air Zones (CAZ) or, in London’s case, the well-known Ultra Low Emission Zone (ULEZ) . These zones typically operate 24/7 and can cost you a daily fee if your car isn’t up to scratch.

The rules and charges vary from place to place, but one thing is consistent: pure electric vehicles are always exempt. With zero tailpipe emissions, they are your golden ticket.

- Birmingham: The Clean Air Zone covers the area inside the A4540 Middleway Ring Road and charges non-compliant cars £8 a day.

- Bristol: A daily charge of £9 applies to older, more polluting cars driving in the central zone.

- Sheffield: The CAZ here currently targets taxis and commercial vehicles, but it shows the direction of travel for urban transport policy.

- Portsmouth: Like Sheffield, the focus is on commercial vehicles for now, but the principle is the same.

For city drivers, these local perks are a huge part of the EV ownership puzzle. The money saved by avoiding daily charges can be massive, completely changing the sums on whether going electric makes sense for you.

London: The Big One

Nowhere are the savings more dramatic than in the capital. Driving in central London can be incredibly expensive, thanks to a double whammy of charges. First, you have the ULEZ, which now covers all London boroughs and costs £12.50 per day for non-compliant cars. Then, if you head right into the very centre, you're hit with the Congestion Charge – another £15 a day .

That’s a potential sting of £27.50 for a single day’s driving.

An EV, however, is your shield against both. You're completely exempt from the ULEZ charge, and for the time being, you also get a 100% discount on the Congestion Charge. For someone commuting into central London five days a week, that’s a saving of over £137 a week , which adds up to more than £6,500 a year . That's not just an incentive; it's a game-changer.

While national grants help with the initial purchase, it's these local schemes that really boost the long-term savings of owning an EV. The ability to sidestep daily fees that can reach around £70 weekly is a massive benefit.

But be warned: London's 100% Congestion Charge discount for electric cars is scheduled to end on 25 December 2025 . It’s a great example of why you need to stay on top of the latest rules. To learn more about these city schemes, you can find more details on how EV grants and incentives in the UK work.

The world of electric car incentives uk is always changing, and a perk that saves you a fortune today might not be there tomorrow. For now, though, if you live or work in a major city, an EV is your best defence against the rising cost of urban driving.

Powering Up For Less With Charging Grants

Let’s face it, an electric car with a dead battery is about as useful as a chocolate teapot. And while topping up with electricity is far cheaper than a tank of petrol, the upfront cost of getting a proper charger installed at home can still make you wince.

Thankfully, the government hasn't entirely forgotten that you need a plug to go with your new EV. There are still a few specific grants available to soften the blow of that initial installation cost.

The glory days of a grant for every homeowner with a driveway are long gone, though. The powers that be decided that if you can afford a house with its own parking space, you can probably stump up the cash for the charge point. A bit harsh, perhaps, but that's the reality of it now.

The focus has shifted to helping those who don't have it so easy. It’s a much more targeted approach, aimed squarely at renters and people living in flats, alongside a pretty tasty incentive for businesses.

The EV Chargepoint Grant For Renters And Flat Dwellers

This is the main grant left for us mere mortals, but it comes with some pretty specific rules. The EV Chargepoint Grant is designed for people who can't just decide to drill a hole in their own wall on a whim. If you live in a flat (whether you own it or rent it) or a rental property, this one’s for you.

So, what do you get? The grant covers up to 75% of the cost of buying and installing a home charger, capped at a maximum of £350 . It’s not going to pay for the whole thing, but it certainly makes a noticeable dent in the final bill.

To get your hands on this cash, you'll need to tick a few boxes:

- You must live in a rental property or own/live in a flat.

- You need to have your own dedicated, off-street parking space.

- You must own, lease, or have primary use of an eligible EV.

- If you're moving, the installation date can't be more than four months before you get the keys.

The process itself is pretty slick. You just need to use an OZEV-approved installer. They’ll claim the grant on your behalf and simply knock the £350 off your final invoice. Easy. For a deeper dive into the practicalities, our full guide to home EV charger installation will ensure you don't be a muppet and get it right the first time.

The Workplace Charging Scheme For Businesses

Now, this is where it gets really interesting. The Workplace Charging Scheme (WCS) is a brilliant incentive for businesses of any size, from a small startup to a massive corporation. It’s a voucher-based system that helps companies cover the cost of putting EV chargepoints in their car parks.

The scheme offers up to £350 per socket , and a single business can claim for a whopping 40 sockets. Do the quick maths on that – it’s a potential saving of £14,000 . That’s a serious chunk of change that can transform a company car park into an EV-friendly hub.

This isn't just about ticking a "green" box. Offering workplace charging is a massive perk for employees, especially those who can't charge at home. It's fast becoming a key benefit that can attract and retain top talent in a competitive market.

Eligibility is surprisingly broad, too:

- The applicant must be a registered business, charity, or public sector organisation in the UK.

- You need to have dedicated off-street parking for staff or your fleet.

- Crucially, you don't even need to have any electric vehicles yet – you just need to declare an intention to encourage their uptake.

Just like the home grant, the process is straightforward. You apply for the voucher online, and once approved, you hand it over to your approved installer. They handle the paperwork and deduct the grant from your bill. It’s a simple, effective way to future-proof your business and make life much easier for staff who've made the electric switch.

How These Incentives Shape The UK EV Market

So, let's pull back and look at the bigger picture. We've talked about grants, tax breaks, and charging perks – all great for your wallet. But what does all this government support actually mean for the UK's electric car market? Is it a well-oiled machine driving us to an electric future, or just a lot of cash being chucked about?

Honestly, it's a bit of both. This strategy isn't just about getting a few more premium EVs onto suburban driveways. It’s a massive, calculated push to build an entire industry, bolster our national charging infrastructure, and nudge the everyday driver towards making the switch.

A Calculated Push Into The Mainstream

At its core, this is all about investment. The government's broader commitment to speed up EV adoption includes a total fund of £4.5 billion . This money is earmarked for fuelling industry growth, expanding charging networks, and providing those all-important consumer subsidies.

A great example of this in action was back in August 2025, when the grant was expanded to cover 13 more popular EV models from manufacturers like Nissan, Renault, and Vauxhall. This move allowed drivers to save £1,500 on qualifying EVs under £37,000, sending a clear message: this is about volume and making EVs a realistic choice for everyone. You can read more about this government grant expansion on the official site.

This targeted approach is designed to make electric cars from familiar brands the default, affordable option for families and commuters, not just a lifestyle accessory for the wealthy.

The Stick Behind The Carrot: The ZEV Mandate

Of course, it's not all about friendly discounts. Behind the consumer-facing electric car incentives uk is a much bigger policy tool: the Zero Emission Vehicle (ZEV) mandate . This is the government's way of forcing the hand of car manufacturers.

The ZEV mandate dictates that a certain percentage of a manufacturer's total sales each year must be zero-emission vehicles. If they fall short of that target, they face hefty fines. Suddenly, selling you an electric car isn't just a nice idea for them; it's a financial imperative.

This puts carmakers in a tough spot. They have to hit these demanding targets while dealing with the real-world chaos of supply chains, battery costs, and fluctuating buyer demand.

The constant tweaking of grants and incentives is a direct result of this high-wire act. It’s the government trying to balance its ambitious green targets with the messy reality of the market. They need people to buy electric, and they're using a potent mix of public money and manufacturer pressure to make it happen.

Got Questions About UK EV Incentives? We’ve Got Answers.

Right, so you’ve waded through the grants, tax breaks, and local perks. You’re practically an expert on UK electric car incentives at this point. Still, there are always a few niggling questions that pop up, aren't there?

Let's clear up any last bits of confusion with a quick Q&A. Think of this as the final once-over before you stride into a dealership, fully clued-up and ready to talk business.

Do I Have To Apply For The Electric Car Grant Myself?

Nope, and this is one of the best things about it. The grant is applied right at the 'point of sale', meaning the dealer sorts out all the boring paperwork for you.

They simply knock the grant amount off the total price before you pay. No forms to fill out, no chasing rebates – it’s designed to be completely hassle-free.

Are There Any Incentives For Buying A Used Electric Car?

This is a big one we get asked all the time. Right now, the main government grants are only for brand-new vehicles, which is a bit of a shame for the second-hand market.

But don't let that put you off. Buying a used EV still bags you some serious savings on running costs. You’ll pay zero road tax (Vehicle Excise Duty) until April 2025 and can drive straight through Clean Air Zones, including London's ULEZ, without paying a penny. Those savings alone can really add up over the year.

How Do I Know If My Home Is Eligible For A Charging Grant?

The rules for the EV Chargepoint Grant have tightened up a fair bit recently. It’s now squarely aimed at people who rent or live in flats and have their own dedicated off-street parking space.

If you own a house (like a detached or semi-detached) with your own driveway, you probably won't be eligible for this particular grant anymore. The goalposts do move, so it's always worth checking the latest official guidance or chatting with an OZEV-approved installer who can confirm exactly where you stand.

At VoltsMonster , we cut through the noise to bring you honest, entertaining, and practical advice on everything EV. From in-depth reviews to navigating the maze of incentives, we're your go-to source for making the switch. Check out our latest articles and videos at the VoltsMonster website.