Company Car Tax on Electric Vehicles: Your Guide to a Sly Tax Win

Let's be honest, you've probably heard the rumour: getting an electric vehicle as a company car is a proper financial fiddle. And for once, the rumours are bang on. The tax benefits are so massive, it feels like a loophole HMRC forgot to close, letting you drive a top-spec EV for less than the cost of a clapped-out petrol hatchback.

Why Your Payslip Will Give You a Standing Ovation for Going Electric

Right, let's get down to the brass tacks of why your accountant will be doing a little dance. The whole company car tax system revolves around something called Benefit-in-Kind , or BIK . It’s just the taxman's way of putting a value on the 'perk' of having a company car for your own personal jaunts.

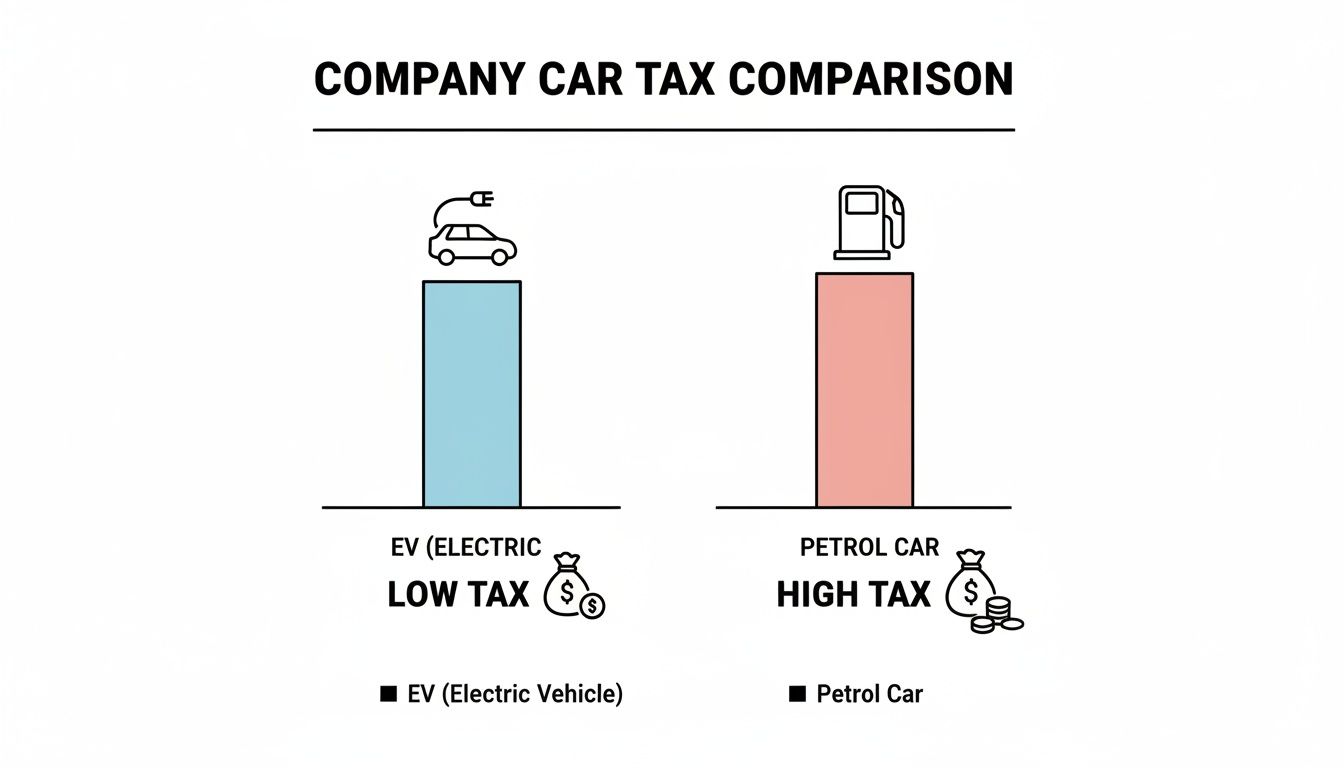

For petrol and diesel cars, this BIK tax can be a real stinger, often costing thousands of pounds a year. The calculation is based on the car's list price (its P11D value) and, crucially, its CO2 emissions. The more it chuffs out, the more you pay. It’s a not-so-subtle system designed to nudge people towards cleaner cars.

This is where electric cars play their joker. Since they have zero tailpipe emissions, they land in the very lowest BIK tax band imaginable. This isn't just a small saving; it's a game-changing financial haymaker that completely rewrites the rules of company car ownership.

The Numbers Don't Lie (Unlike Some Politicians)

So, what does this actually look like on your payslip? In short, the government has created a system that makes choosing an EV an absurdly smart move. Here's why it's such a big deal:

- Rock-Bottom BIK Rates: Fully electric cars currently have a BIK rate of just 2% . To put that in perspective, a similar petrol or diesel car could easily be in a tax band of over 30% .

- Serious Monthly Savings: A lower BIK rate means a much smaller taxable benefit, which translates directly to more cash in your skyrocket every month. We're talking hundreds of pounds, not just shrapnel.

- Locked-in for the Future: These ludicrously low rates are confirmed for years to come, with only tiny, planned increases. This gives you peace of mind that this savvy financial move will stay that way.

Put simply, opting for an electric company car is less of a choice and more of a total no-brainer. It's the closest you'll get to the taxman actually paying you to drive a brand-new car, while your colleagues in their diesel saloons are helping to fund HMRC's Christmas do. The EV revolution isn't just about saving the planet; it's about saving your bank balance.

Decoding BIK Rates and What They Mean for Your Wallet

Alright, let's cut to the chase. The numbers behind choosing an electric company car are so compelling, it’s less of a choice and more of a blindingly obvious decision. The magic ingredient is the Benefit-in-Kind (BIK) rate, which for EVs is almost laughably low.

While your colleagues in their petrol or diesel saloons are facing a hefty tax bill from HMRC, you could be swanning around in a top-spec EV with a fraction of the impact on your payslip. We’re not talking about saving a few quid here and there; the difference is genuinely massive.

This stark contrast in company car tax is the government's way of giving a huge thumbs-up to going electric.

As you can see, the financial weight of a fossil-fuelled company car is dramatically higher, making the electric option the clear winner for any savvy employee.

The Gloriously Low EV BIK Rate

So, what’s the golden number? For a pure electric vehicle, the current BIK rate is a mere 2% . That’s it. To put that into perspective, a comparable petrol or diesel car could easily attract a rate anywhere from 25% up to the maximum of 37% .

This enormous difference is what turns a company car from a tax headache into a real, tangible perk of the job.

It's no accident either. The government deliberately set the electric company car tax this low to encourage the shift to cleaner vehicles. In fact, for the 2020/21 tax year, the BIK rate for EVs was an incredible 0% , before settling at the current 2% for 2024/25. You can get more background on how these rates have evolved from the experts at Drive Electric.

This means the taxable value of your shiny new EV is just a tiny fraction of its list price. In turn, the amount of tax you actually pay is incredibly small.

Think of it like this: your colleague's high-emission company car is shouting at the taxman for attention. Your EV, on the other hand, is whispering, making it almost invisible to HMRC's radar.

How the Numbers Stack Up: EV vs Petrol

To see just how big the gap is, let's run a quick comparison. Imagine you’re a 40% taxpayer choosing between a great electric car and a similar petrol model. The difference in what you pay each year is staggering.

EV vs Petrol BIK Tax: A Tale of Two Payslips

| Vehicle Example (P11D Value) | BIK Rate | Taxable Benefit | Annual Tax for 40% Taxpayer |

|---|---|---|---|

| Electric Car (£45,000) | 2% | £900 | £360 |

| Petrol Car (£45,000) | 31% | £13,950 | £5,580 |

The table doesn't lie. In this scenario, choosing the EV saves you over £5,200 a year in tax. That’s a significant sum that goes straight back into your pocket, not to the taxman.

The Future of EV Tax Certainty

"This sounds too good to be true. Surely this amazing deal won't last?" It’s a fair question, but for once, the government has given us some welcome clarity. They've already published the BIK rates for the next few years, giving you confidence that you won't face a sudden, nasty surprise.

Here’s the confirmed roadmap for zero-emission vehicle BIK rates:

- 2024/25: 2%

- 2025/26: 3%

- 2026/27: 4%

- 2027/28: 5%

Yes, the rates are creeping up, but they're doing so at a snail's pace. Even in 2028, you’ll still be paying a BIK rate that drivers of petrol or diesel cars can only dream of. This isn’t a short-term gimmick; it’s a long-term strategy that puts thousands of pounds back into your bank account.

How to Calculate Your Savings

Want to work out the exact figures for a car you have your eye on? The formula is beautifully simple.

- Start with the car's P11D value: This is basically the list price, including VAT and delivery charges. It excludes the first year's road tax and registration fee.

- Multiply by the BIK rate: For an EV right now, that's 0.02 (for the 2% rate).

- Multiply by your income tax band: This will be 0.20 if you're a basic rate (20%) taxpayer or 0.40 if you're a higher rate (40%) taxpayer.

The number you're left with is your total annual company car tax bill. Now, run those same numbers for a petrol car with a 30% BIK rate. The difference will speak for itself. You’ll quickly see you're not just saving a bit of cash; you're effectively giving yourself a pay rise.

Calculating Your Real-World Savings

Theory is all well and good, but what really matters is the cash in your pocket. Let's move beyond percentages and look at the cold, hard figures that make the case for an electric company car so compelling. It's time to get down to brass tacks.

We're talking about a tangible difference to your monthly budget. The savings aren't trivial either—we're talking about enough to fund a rather nice holiday, pay off a chunk of the mortgage, or simply make life a bit more comfortable.

Let’s run the numbers and see how this plays out in the real world.

The Face-Off: EV vs Petrol

To make this brutally clear, let's pit a popular electric car against a similarly priced petrol rival. Imagine your company offers a choice between a sleek Tesla Model Y with a P11D value of £45,000 and a petrol-powered BMW 3 Series, also valued at £45,000.

The Tesla, being fully electric, sits in the rock-bottom 2% BIK rate . The BMW, with its CO2 emissions, gets lumped into a much less friendly 31% BIK band . Let’s see how that simple difference hammers your annual tax bill.

It’s a classic head-to-head, but in the world of company car tax, the petrol car is fighting with one hand tied behind its back. It simply can't compete.

Savings for a Basic Rate (20%) Taxpayer

If you're a 20% taxpayer, the choice is stark. The maths is simple, but the result is profound.

- Tesla Model Y (EV): £45,000 P11D x 2% BIK = £900 taxable benefit. At 20%, your annual tax is a measly £180 . That's just £15 a month.

- BMW 3 Series (Petrol): £45,000 P11D x 31% BIK = £13,950 taxable benefit. At 20%, your annual tax bill rockets to £2,790 .

By choosing the Tesla, you save £2,610 a year . That’s a serious chunk of change for doing nothing more than picking the smarter option.

Savings for a Higher Rate (40%) Taxpayer

Now, if you're a higher-rate taxpayer, the savings become almost ludicrous. The financial incentive to go electric gets dialled all the way up.

- Tesla Model Y (EV): The taxable benefit is still just £900. At 40%, your annual tax comes to only £360 , or £30 a month for a premium EV.

- BMW 3 Series (Petrol): That hefty £13,950 benefit, taxed at 40%, results in a painful annual bill of £5,580 .

In this scenario, opting for the Tesla puts an astonishing £5,220 back in your pocket every single year . This isn't just a perk; it's a massive financial win.

The Sweetener for Your Boss

And it gets better. Your employer also gets a juicy financial reward, which makes pitching the idea to them an absolute doddle. Businesses pay Class 1A National Insurance Contributions (NICs) on the value of most employee benefits, and company cars are no exception.

The current rate is 13.8% . So, for the BMW 3 Series with its £13,950 taxable benefit, your company owes HMRC £1,925 in NICs. For the Tesla, with its tiny £900 benefit, the company’s bill plummets to just £124 .

That’s an annual saving of over £1,800 for the business on your car alone. When you present this argument, you’re not just asking for a new car; you’re proposing a cost-saving measure for the company. You'll look like a financial genius.

How EV Salary Sacrifice Schemes Work

If the low company car tax on EVs is the brilliant opening act, then salary sacrifice is the headline performance everyone’s been waiting for. This isn't some dodgy tax dodge; it's a completely legitimate, government-endorsed scheme that makes getting into a brand-new electric car far more affordable than most people realise.

It’s fast becoming the premier league of employee perks. At its core, a salary sacrifice scheme is a straightforward agreement. You agree to give up a portion of your gross (pre-tax) salary, and in return, your company leases a shiny new electric car for you using that money.

The real magic happens with the tax. Because the car payment comes out of your salary before tax and National Insurance are calculated, your taxable income is lower. This means the actual hit to your take-home pay is much, much smaller than the car's monthly lease price.

Breaking It Down

Let's cut through the jargon with a simple example. Say you agree to sacrifice £500 a month for a new EV. That £500 is taken from your gross pay. If you’re a higher-rate taxpayer, you’d normally lose 42% of that £500 to tax and NI, leaving you with just £290 in your pocket.

With salary sacrifice, the entire £500 goes towards the car before the taxman can touch it. So, while the car lease costs £500, the actual reduction in your monthly pay packet is only £290. It’s a clever bit of financial gymnastics that works squarely in your favour.

Think of it this way: a personal lease is paid with money that's already been taxed. A salary sacrifice scheme lets you pay with 'untaxed' money, making it significantly cheaper right from the start.

This is exactly why these schemes often blow personal leasing deals out of the water. You're effectively getting a massive discount on your monthly car payment, courtesy of HMRC.

It's More Than Just the Car

Another huge plus is that these schemes are almost always all-inclusive. You’re not just getting the car; you're getting a full-service package designed to make life as easy as possible. It’s less like leasing a vehicle and more like buying complete peace of mind.

So, what’s usually bundled in?

- The Car Itself: A brand-new electric vehicle of your choice.

- Fully Comprehensive Insurance: No need to spend hours shopping for quotes; it’s all sorted.

- Servicing and Maintenance: All routine checks, services, and MOTs are covered.

- Breakdown Cover: Roadside assistance is included, just in case.

- Tyre Replacement: Covers fair wear and tear, so no nasty surprises down the road.

This all-in-one approach gets rid of the hassle and unpredictable costs that come with running a car. All your main motoring expenses are rolled into one predictable monthly payment, taken straight from your salary. This elevates the company car tax for electric vehicles benefit from a simple tax saving into a complete, hassle-free driving solution.

When you add up the tax savings and the all-inclusive package, the deal is hard to beat. You get a new EV with all major running costs covered for a net price that a personal lease just can't match. It’s simply the smartest, most cost-effective way to get behind the wheel of an electric car today.

Looking Beyond Tax to Other EV Perks

The spectacular savings on company car tax are, frankly, enough to seal the deal for most people. But that’s just the glorious, cherry-topped beginning of your financial victory lap. Once you look past the payslip, you'll discover that running an electric vehicle day-to-day is a masterclass in thriftiness.

Living with an EV completely rewrites your budget for running a car. Those enormous bills for fuel and maintenance that we’ve all come to accept as normal simply evaporate, replaced by much smaller, more predictable costs. It’s not just a cheaper way to drive; it’s a smarter one.

This shift towards EVs as company cars isn't some niche trend anymore; it's a full-blown movement. In the 2023-2024 tax year, a staggering 41% of all company car benefit recipients were driving fully electric vehicles. That's around 340,000 cars, a massive jump that proves the irresistible pull of the tax breaks and lower running costs. This surge has even dragged down the average CO2 emissions across all UK company cars to just 56 g/km. You can dive into the official figures in the Benefit-in-Kind statistics on GOV.UK.

Saying Goodbye to the Petrol Station

The most obvious daily win is ditching the forecourt for good. Charging an EV at home, especially on an off-peak electricity tariff, is ridiculously cheap compared to filling up with petrol or diesel. While your colleagues are wincing at the prices on the pumps, you’ll be 'fuelling' up overnight for just a few quid.

Think of it like this: a full 'tank' of electricity might cost you less than a posh coffee while giving you hundreds of miles of range. Compare that to the eye-watering cost of 50 litres of unleaded, and the savings become impossible to ignore. This alone can save you thousands of pounds a year.

The Bliss of Minimal Maintenance

Electric cars are beautifully simple machines. With no engine oil, spark plugs, clutches, or exhaust systems to worry about, their servicing schedule is far less demanding.

An electric car has fewer moving parts than a fancy Swiss watch. This means fewer things to go wrong, fewer trips to the garage, and fewer surprise bills for parts you’ve never heard of.

This mechanical simplicity leads to a delightful reduction in maintenance costs. While these savings are often baked into an all-inclusive salary sacrifice lease, it’s a key reason why the total cost of owning an EV is so much lower.

City Driving Perks and Reclaiming Mileage

The benefits keep stacking up, especially if you drive in urban areas.

- Congestion Charge Exemption: Pure electric vehicles are currently exempt from London's Congestion Charge, saving you a hefty daily fee if you commute into the capital.

- ULEZ Compliance: By their very nature, EVs are ULEZ (Ultra Low Emission Zone) compliant, meaning no charges for driving in the clean air zones sprouting up across UK cities.

- Advisory Fuel Rates (AFRs): If you use your electric company car for business miles, you can reclaim the cost of electricity from your employer at an HMRC-approved rate. It’s another small but satisfying way the taxman gives something back.

When you add up the low BIK tax, the minimal 'fuel' costs, reduced maintenance, and city driving exemptions, the total cost of ownership argument for an EV becomes undeniable. It’s a brilliant deal for both your bank balance and your peace of mind.

Your Checklist for Making the Electric Switch

Right, you’re convinced. The numbers add up, the perks are too good to ignore, and the idea of waving goodbye to petrol stations for good is a powerful one. But what’s the next step? Going from "that's a brilliant idea" to having the keys in your hand requires a solid plan.

This is that plan. Whether you're an employee keen to get behind the wheel of a new EV, or an employer thinking about launching a scheme, this is your guide to getting it done. It’s time to stop dreaming and start driving.

The Employee's Action Plan

So, you’re ready to pitch the idea to your boss. Walking into that meeting armed with the right information will make the conversation go a lot smoother. Remember, you aren't just asking for a shiny new car; you're presenting a smart financial move that benefits everyone.

Here’s how to make your case:

- Do Your Homework: First, get to grips with your company's current car policy. Do they already have a company car scheme, or would a salary sacrifice setup be a completely new thing for them? Understanding the starting point is crucial.

- Build a Business Case: Don't just focus on the low BIK tax for yourself. The real clincher for your employer will be the savings on their Class 1A National Insurance contributions. Frame it as a cost-saving initiative that also happens to boost staff morale and burnish the company's green credentials.

- Choose Your Car: Have a couple of specific EVs in mind. Head over to VoltsMonster's reviews to find a car that fits your life and falls within a reasonable budget. Knowing the P11D value means you can walk in with actual, concrete figures to show them.

When you approach your employer, think of yourself as a strategic partner, not just an employee asking for a perk. You're proposing a modern, cost-effective, and environmentally friendly benefit that makes the whole company look good.

The Employer's Checklist

Thinking about offering electric vehicles to your team? Excellent move. It's a fantastic tool for attracting and keeping top talent, and it comes with some very attractive financial benefits for the business.

Here's how to roll it out successfully:

- Run the Numbers: Start by calculating the potential National Insurance savings across your payroll. If you currently run a pool of company vehicles, factor in the massive reduction in running costs (no more fuel cards!). The figures often speak for themselves.

- Find the Right Partner: Don't try to manage a salary sacrifice scheme in-house. It's a specialist area. Team up with an established provider who can handle all the admin, leasing, and fiddly legal bits. They make the whole process painless.

- Communicate the Benefits Clearly: Once you're ready to launch, make some noise about it. Explain how it all works in simple terms—what salary sacrifice is, the tax savings involved, and what’s included in the package. The better your team understands the offer, the higher the uptake will be.

- Solve the Charging Puzzle: Think about installing workplace chargers. It's a highly visible sign of your commitment and a huge perk for employees, especially those without a driveway at home. There are often government grants available to bring down the installation cost, too.

Frequently Asked Questions

Alright, we’ve covered a lot of ground, and it’s natural if your head is still spinning a bit. All this talk of BIK rates and tax codes can feel complicated. Let's tackle some of the most common questions that pop up when people start looking into getting an electric company car.

Is an Electric Company Car Genuinely a Good Deal?

Yes, without a shadow of a doubt. From a purely financial standpoint, it's one of the best employee benefits available in the UK right now. The rock-bottom 2% Benefit-in-Kind (BIK) rate means your tax bill is a tiny fraction of what you’d pay for a comparable petrol or diesel car.

We’re talking about saving potentially thousands of pounds every single year. It feels less like a simple 'perk' and more like a massive, government-endorsed financial win.

What if I Can't Charge at Home?

This is a very common concern, but it's becoming less of an issue every day. For starters, many companies are now installing chargers at the workplace, so you can just plug in when you arrive for the day.

On top of that, the UK's public charging network is expanding incredibly quickly. A bit of planning with an app like Zapmap is all it takes to find chargers on your regular routes. For most drivers, it's a perfectly manageable situation.

Not having a driveway isn't the deal-breaker it used to be. Between workplace charging and the ever-growing public network, it’s more of a logistical puzzle to solve than a genuine barrier.

Are Hybrids a Sensible Middle Ground?

For company car tax purposes? Honestly, not anymore. A plug-in hybrid (PHEV) might seem like a safe bet, but HMRC's tax rules are pretty clear. Their BIK rates are based on CO2 output and, crucially, how far they can go on electric power alone.

Even the most efficient plug-in hybrids face tax rates that are several times higher than a pure EV's 2% . And as for 'self-charging' hybrids, they're taxed just like standard petrol cars, so they offer no tax advantage at all.

What Happens if I Leave My Job?

This is a key question, especially for anyone considering a salary sacrifice scheme. Every agreement will have an early termination clause, so it's vital you read it carefully.

Typically, leaving your job mid-lease means you'll be liable for a fee to settle the contract. Some providers do offer insurance policies that can protect you in specific circumstances, like redundancy. The golden rule is to always understand the small print before you commit.

Ready to put a stop to hefty tax bills and get behind the wheel of something better? At VoltsMonster , we give you the straight-talking reviews and expert advice you need to find the best EV deals in the UK. Find your perfect electric company car with us today at https://www.voltsmonster.com.