Electric Car Salary Sacrifice: A Sceptic's Guide to Driving a Posh EV for Peanuts

An electric car salary sacrifice scheme is a frightfully clever way to lease a brand-new EV through your work. The payments come straight out of your salary before tax and National Insurance are deducted. This simple bit of accounting jiggery-pokery effectively lowers your taxable income , which can make getting into a shiny new electric car much cheaper than you'd think. It's easily one of the most tax-efficient wheezes for UK employees to start driving a zero-emission vehicle.

The Secret Handshake With The Tax Man

Let’s be honest, the term "salary sacrifice" sounds a bit grim, doesn't it? It conjures up images of giving up your hard-earned cash for the greater good of the company. The reality, however, is less of a sacrifice and more of a seriously crafty financial move that could put a new electric car on your driveway for much less than you'd pay normally.

Think of it this way. Normally, you'd lease a car personally using your net pay—that's the money left in your bank account after HMRC has had its slice. With a salary sacrifice scheme, your employer leases the car on your behalf. They then deduct the monthly cost from your gross salary, which is that much bigger, more optimistic figure you see on your payslip before any tax is taken.

Why Does This Matter So Much?

Because you're reducing your gross salary, you're also shrinking the amount of Income Tax and National Insurance you owe each month. This means the actual reduction in your take-home pay is significantly less than the headline cost of the car lease.

This isn’t some dodgy tax loophole. It’s a government-backed initiative designed to get more people driving electric cars. The key to making it all work so well is the incredibly low Benefit-in-Kind (BIK) tax rate slapped on electric vehicles.

In essence, an electric car salary sacrifice scheme lets you pay for a new car using money that would have otherwise gone straight to the tax man. You get a new EV, and your tax bill gets smaller—a genuine win-win.

Most schemes bundle everything into a single, fixed monthly payment, taking the stress out of running a car. This package typically includes:

- The brand-new electric car

- Fully comprehensive insurance

- All servicing and maintenance

- Road tax (Vehicle Excise Duty)

- Breakdown cover

This simple, all-in-one approach is a big reason why more drivers are leasing EVs than ever before. It removes the unpredictable costs and general faff of car ownership. It’s less like buying a car and more like having an all-inclusive subscription to a new EV without any of the usual headaches.

Breaking Down The Financial Savings

Alright, let's get to the important bit—the money. How does this clever trick of "sacrificing" part of your salary actually leave you better off? It's not some baffling accounting loophole; it's just a smart way to make the tax system work for you.

The magic all comes down to one simple fact: the car lease payment is deducted from your gross salary . That’s your total earnings before HMRC takes its slice for Income Tax and National Insurance. By reducing that top-line number, you automatically and legally reduce the amount of tax you have to pay.

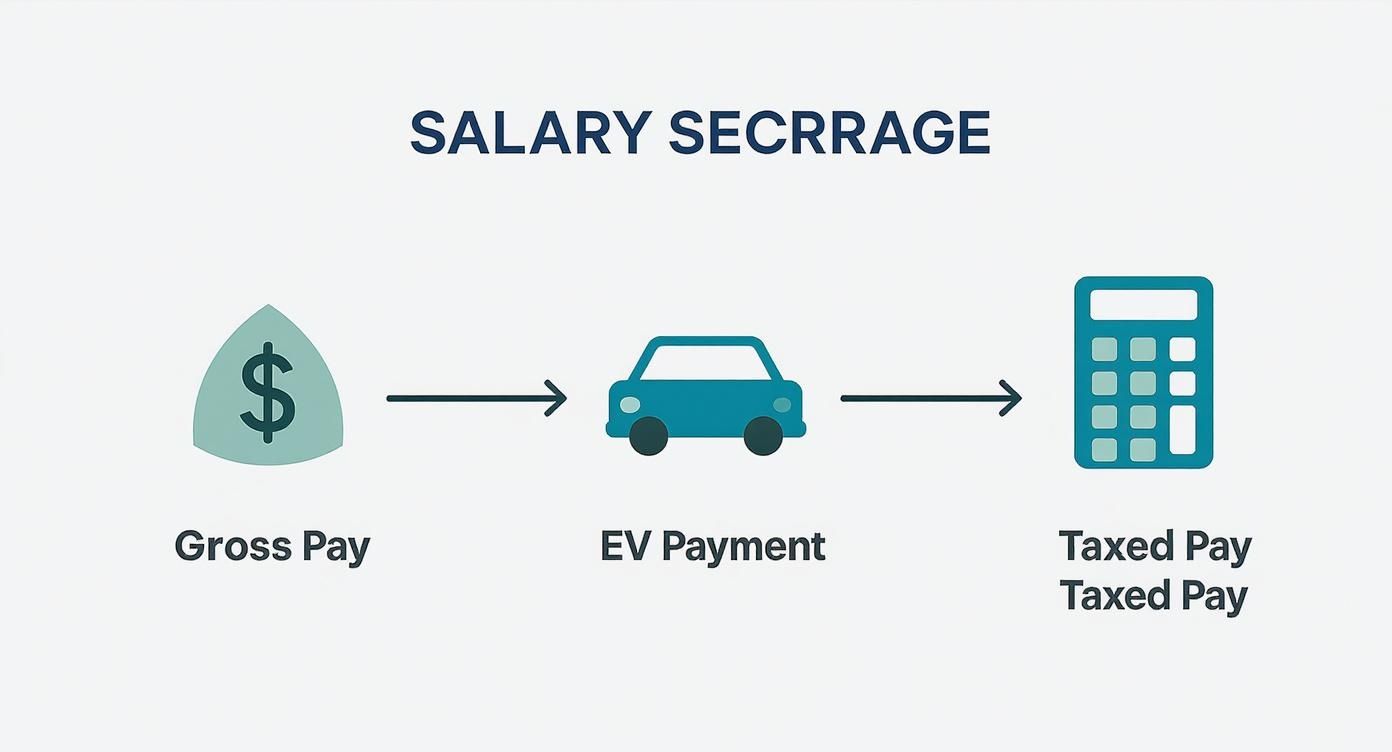

This infographic lays it out visually, showing how the money flows from your gross pay, gets diverted for the EV payment, and leaves a smaller amount to be taxed.

As you can see, by funnelling a chunk of your pre-tax earnings towards the car, the pot of money HMRC can tax gets smaller. That's where your savings come from.

The Real-World Impact On Your Wallet

Let's put some actual numbers on this. The amount you save is directly tied to your income tax bracket. It’s a beautifully simple relationship: the higher your tax rate, the bigger your savings.

- A basic-rate taxpayer can expect to shave over 30% off the real-world cost of the car.

- For a higher-rate taxpayer , the savings get even better, often approaching an impressive 40% .

Suddenly, that premium EV you’ve been eyeing up doesn't seem quite so far out of reach, does it? The monthly lease price you see isn't what you'll actually feel coming out of your take-home pay.

The core takeaway is this: An electric car salary sacrifice scheme weaponises your pre-tax earnings. You're effectively paying for a chunk of your new car with money that would have otherwise been sent straight to HMRC.

To put it another way, a basic-rate taxpayer earning £35,000 who leases an EV for £300 a month might only see their net pay drop by around £195. That's a saving of over £1,200 a year. For a higher-rate earner on £60,000, a £450 monthly lease could reduce their take-home pay by just £270, saving them more than £2,100 annually.

Crucially, these deals usually wrap in insurance, maintenance, and breakdown cover, so they’re genuinely all-inclusive packages.

Salary Sacrifice Vs Personal Lease: A Head-to-Head

To really see the financial muscle of these schemes, you have to compare them to the traditional way of getting a new car: a Personal Contract Hire (PCH), or personal lease. This is where the penny really drops.

With a personal lease, the legwork is all on you. You find the car, sort the deal, and pay for it every month from your bank account—after you’ve been taxed. With salary sacrifice, your employer arranges the lease, and the payment structure automatically creates the savings.

Let’s run through a quick comparison to see how this plays out for a basic-rate taxpayer looking at the same electric car.

Salary Sacrifice vs Personal Lease: A Cost Breakdown

Here’s a simplified table to show the difference in real terms.

| Cost Element | Personal Lease (PCH) | Salary Sacrifice Scheme |

|---|---|---|

| Gross Monthly Salary | £3,000 | £3,000 |

| Car Lease Cost | £400 (paid from net) | £400 (paid from gross) |

| Adjusted Gross Salary | £3,000 | £2,600 |

| Tax & NI (Approx) | £600 | £472 |

| Benefit-in-Kind Tax | £0 | £17 |

| Net Reduction in Pay | £400 | £289 |

Note: Figures are illustrative to demonstrate the principle.

The difference is stark. In this example, the salary sacrifice driver saves over £100 every single month on the exact same car. Why? Because the tax and National Insurance savings are far greater than the tiny amount of Benefit-in-Kind (BIK) tax you pay on an EV.

If you want to get into the nitty-gritty of BIK, have a look at our simple guide to UK electric car tax benefits. It’s this incredibly low BIK rate that makes the whole scheme so powerful for electric cars right now.

The Pros And Cons You Must Weigh Up

Let's be brutally honest. Anyone who tells you a financial product is perfect, with absolutely no downsides, is probably trying to sell you something questionable from the back of a van. An electric car salary sacrifice scheme is brilliant, but it’s not a magic unicorn. It’s a deal with clear benefits and some very real trade-offs you need to understand before you dive in.

Weighing these up isn’t just sensible; it’s essential. For many people, the pros will steamroll the cons, making it a complete no-brainer. For others, though, the potential pitfalls might be a deal-breaker. So, let's lay it all out, warts and all.

The Undeniably Brilliant Bits

First up, the good stuff. And let’s be clear, it’s very good stuff. The reasons people are flocking to these schemes are compelling, making electric motoring accessible in a way that simply wasn’t possible a few years ago.

- Massive Tax Savings: This is the headline act. Paying for your car before tax and National Insurance is the core of the deal, slashing the real-world cost by a huge margin. It’s the closest most of us will get to feeling like a high-flying accountant has sorted our finances.

- A Fixed, All-Inclusive Monthly Cost: Say goodbye to the anxiety of MOTs, services, and insurance renewals. One single, predictable payment covers the car, maintenance, insurance, breakdown cover, and road tax. It’s car ownership on easy mode.

- No Deposit Needed: Unlike most personal lease or PCP deals that demand a hefty upfront payment, salary sacrifice schemes typically require zero deposit . This removes a massive barrier for anyone wanting to get into a brand-new EV.

- Access to Posh Cars: The tax efficiency brings otherwise eye-wateringly expensive EVs within reach. That Tesla or Polestar you were admiring from afar? Suddenly, it’s a realistic option, not just a lottery-win fantasy.

Put simply, the biggest pro is the sheer simplicity and financial clout. You get a brand-new, fully managed electric car for a fixed monthly cost that’s significantly lower than you could achieve on your own. It's the ultimate hassle-free package.

The Potential Pitfalls To Ponder

Now for the other side of the coin. Ignoring these would be like ignoring the "check engine" light—a decision you’ll likely regret later. These are the serious considerations you must factor into your decision.

The most significant risk is tied directly to your employment. Because the car is a company benefit, your access to it is linked to your job.

- Leaving Your Job: This is the big one. If you resign, you will almost certainly face an early termination fee , which is often several months' worth of payments. Redundancy is usually covered by insurance, but handing in your notice will come with a financial sting.

- The Employer Roadblock: You can’t just decide to do this on your own. Your employer has to be signed up to an electric car salary sacrifice provider. If they aren't on board, the whole conversation is a non-starter.

- Reduced "On-Paper" Salary: While you save a packet on tax, your official gross salary is lower. This can have knock-on effects that need careful consideration, as it might impact your financial life in other areas.

The Ripple Effect Of A Lower Salary

This last point deserves a closer look. A lower gross salary can affect more than just your tax bill, because lenders and pension providers often base their calculations on this headline figure.

- Mortgage Affordability: When you apply for a mortgage, lenders assess what you can afford based on your gross salary. A lower figure could reduce the amount they are willing to lend you.

- Pension Contributions: If your pension contributions are calculated as a percentage of your salary, a lower gross pay means less money going into your retirement pot from both you and your employer. Some employers agree to use your original, higher salary for this calculation, but you absolutely must check.

Ultimately, the decision rests on balancing the immediate, tangible benefits against the potential long-term risks. For a stable employee with no plans to move jobs or apply for a mortgage soon, it’s an incredible deal. For someone else, that lack of flexibility might just be too high a price to pay.

Popular EVs Available On Salary Sacrifice Schemes

Right, you’ve waded through the financial jargon and thought about the practicalities. Now we get to the fun bit: the cars themselves. This is the point where the abstract concept of tax efficiency gets a set of keys and a shiny new paint job. So, what are people actually driving home with these schemes? Let's just say it’s not a parade of beige hatchbacks.

The real magic of an electric car salary sacrifice scheme is how it bends financial reality. Suddenly, premium models that might have seemed completely out of reach become genuinely affordable. The combination of taking the payment from your pre-tax salary and the tiny Benefit-in-Kind (BIK) tax rate acts as a great leveller, putting top-tier EVs on driveways all over the UK.

The A-Listers Of The Salary Sacrifice Scene

If you take a walk down any reasonably well-to-do street, you'll start to see the usual suspects. These are the cars that have become the poster children for salary sacrifice, thanks to their desirable badges, solid tech, and—most importantly—numbers that just work when you run them through the tax-saving calculator.

It’s no surprise that the Tesla Model Y is the undisputed king of the salary sacrifice world. It’s the EV equivalent of telling everyone you’ve “made it” without saying a word. It’s practical, ridiculously quick, and gets you access to the best charging network in the business. It’s the sensible choice that also happens to be incredibly cool.

But it's not a one-horse race. Other very popular choices include:

- Kia Niro EV: A brilliantly practical and efficient family crossover that does everything well without shouting about it. A real thinking person’s choice.

- MG4: The plucky upstart that’s giving the big names a run for their money. It’s shockingly good value, fun to drive, and proof you don’t need to spend a fortune for a great EV.

- Polestar 2: For those who find a Tesla just a bit too… obvious. It’s a slice of Swedish cool with a beautifully crafted interior and a real focus on the driving experience.

These models consistently top the charts because they hit that sweet spot of desirability, range, and a price point that becomes seriously tempting once the salary sacrifice magic is applied.

Making The Numbers Make Sense

Let’s talk brass tacks. It’s all well and good saying these cars are "affordable," but what does that actually mean for your pay packet? This is where the scheme’s power becomes undeniable.

Take that ubiquitous Tesla Model Y. A personal lease might set you back £650 a month, a figure that would make most people’s wallets audibly weep. Through salary sacrifice, however, the story changes dramatically. For a higher-rate taxpayer, that £650 deduction from their gross salary could translate to a net reduction in their take-home pay of closer to £365 .

Yes, you read that correctly. You could be saving almost £300 a month on one of the most sought-after cars on the planet, simply by letting the tax system work in your favour. It feels like cheating, but it’s all perfectly above board.

This financial alchemy is why EV uptake is soaring. In fact, the market is expanding at a blistering pace, with EV sales growing by over 34% year-on-year and now accounting for nearly a quarter of all new car registrations. Schemes like this are a huge part of that growth. Find out more about how salary sacrifice is shaping the top EV choices on ElectricCarScheme.com.

Beyond The Obvious Choices

While the big names dominate, the market is full of fantastic alternatives that become even more appealing through a salary sacrifice scheme. Don’t just follow the herd; there’s real value to be found if you look beyond the usual suspects.

Consider the stylish Omoda E5 or the family-friendly Skoda Enyaq . These are excellent vehicles that offer tremendous value, and when you factor in the tax savings, they can feel like an absolute steal.

The scheme gives you the freedom to choose a car that perfectly fits your life, not just one that fits a restrictive budget. It’s your chance to get the car you actually want , rather than the car you thought you had to settle for.

How To Convince Your Boss To Launch A Scheme

Right, you’ve crunched the numbers, weighed up the pros and cons, and you've probably even got your eye on a specific EV. Now for the final hurdle: getting your boss on board. This is usually the point where the dream of tax-free driving meets the cold, hard reality of a corporate spreadsheet.

You're completely sold on the idea, but convincing the people in charge to adopt an electric car salary sacrifice scheme can feel like an uphill battle. They hear "new company scheme" and their minds immediately jump to "massive administrative headache".

Your job is to completely reframe the conversation. This isn't just about you getting a new car; it's a smart business move that benefits the company just as much as it does you. You need to speak their language, and that means talking about money, talent, and reputation.

Framing The Perfect Pitch

Forget asking for a favour. You need to walk into that meeting with a solid business case, not a personal wish list. The key is to relentlessly focus on what the company gets out of it.

Start with the one thing every business understands: saving money. For every single employee who signs up, the company saves cash. How? By not having to pay the Employer's National Insurance Contributions (NICs) on the slice of salary being sacrificed.

Think of this as your killer opening line. An electric car salary sacrifice scheme isn’t a new expense; it’s a way to reduce an existing one. The business literally cuts its tax bill by helping its staff drive greener cars.

This point alone can shift the conversation from being about an "employee perk" to a "smart financial strategy". It’s a direct, simple benefit that goes straight to the bottom line.

More Than Just Money

Once you have their attention with the NICs savings, it's time to build out your case. In today's market, companies are in a constant fight for good people, and a decent salary isn't always enough to seal the deal. Unique benefits that actually make a difference are what set a great employer apart.

- Attracting and Keeping Talent: Offering an EV scheme is a huge drawcard in recruitment. It sends a clear signal to potential hires that the company is modern, forward-thinking, and genuinely cares for its staff.

- Boosting Green Credentials: Every business wants a positive public image. Helping staff move into electric vehicles is a very visible and powerful way to show a commitment to sustainability. It's fantastic for their corporate social responsibility (CSR) profile.

- Improving Employee Morale: It's a simple truth: people who feel valued work harder and are more loyal. A high-impact benefit like this shows the company is invested in its team's financial and environmental wellbeing.

The popularity of EV salary sacrifice in the UK has skyrocketed, thanks to major tax incentives. A huge and growing number of new EV registrations are now done this way, making it a highly sought-after benefit. For employers, offering it is a clear sign they’re keeping up with what modern employees expect. You can find out more about this trend at The Car Expert.

Handling The Objections

Be ready for the pushback. The two biggest concerns you'll likely face are the perceived admin burden and the question of what happens if an employee leaves the company. Thankfully, the providers have already solved these problems.

Modern schemes are specifically designed to be light-touch for the employer. The provider handles almost everything, from sourcing the vehicles to managing all the paperwork. The "it's too much admin" argument is largely a thing of the past. If your company already juggles a vehicle fleet, our sceptic's guide to UK electric vehicle fleet management might be a useful read.

As for someone leaving early? That risk is also covered. The schemes include robust insurance that protects the company from early termination fees if an employee is made redundant or leaves for other specified reasons. Your job is to present the scheme not as a risk, but as what it is: a fully managed, insured, and financially sound benefit for everyone.

Frequently Asked Questions

Right, you’re nearly there, but a few questions are probably still bouncing around your head. Let’s tackle the most common ones head-on so you have the straight answers you need.

What Happens If I Leave My Job During The Lease?

This is the big one, isn't it? The question on everyone's mind.

If you're made redundant, most good schemes include early termination protection insurance, so you're covered. But what if you just decide to leave for another job? In that case, you'll almost certainly have to pay a termination fee, which is typically a few months' worth of payments. Always, always read the small print before you sign anything.

Does Salary Sacrifice Affect My Pension Contributions?

Potentially, yes, and this is a crucial point to get right. Because your pension contributions are usually a percentage of your salary, a lower "on-paper" gross salary means less is funnelled into your retirement pot.

However, any decent employer will agree to calculate pension contributions based on your original, higher 'reference' salary to make sure this doesn't happen. It’s absolutely vital you clarify this with your HR department before you commit.

The key is to check if your employer will use your 'reference salary' for pension calculations. This ensures your retirement savings aren't penalised for getting a shiny new EV.

Who Is Actually Eligible For A Salary Sacrifice Scheme?

First, and most obviously, your company has to offer a scheme in the first place. If they do, the main rule is that your salary after the sacrifice can't drop below the National Minimum Wage.

Most companies also have their own internal policies, like requiring you to have passed your probation period and be on a permanent contract.

Is Benefit-In-Kind Tax A Big Deal For EVs?

For electric cars, it's a gloriously small deal—and that’s the magic ingredient that makes this whole thing work so well.

The Benefit-in-Kind (BIK) tax rate for zero-emission vehicles is incredibly low (currently just 2% and set to rise very slowly). If you tried to do this with a petrol or diesel car, the BIK tax would be so high it would completely wipe out any savings. The low BIK rate is the scheme's secret sauce.

At VoltsMonster , we cut through the noise to bring you honest reviews and straight-talking advice on everything EV. If you're navigating the switch to electric, check out our latest articles and reviews at https://www.voltsmonster.com.