Decoding Electric Car Insurance Costs

So, you've done it. You’ve embraced the future, bought a shiny new electric car, and are loving those silent, smug getaways. But then the insurance renewal letter drops through the letterbox, delivering a jolt stronger than a dodgy charging point. Suddenly, the dream of saving the planet and your pennies on petrol feels a bit... fraudulent.

The Great EV Insurance Swindle

Let's cut right through the greenwash. You’re not imagining it; insuring your eco-friendly chariot is often costing an absolute fortune compared to your old petrol clunker. It’s a phenomenon that has caught countless UK drivers on the hop. While you're basking in the glory of zero road tax and cheap 'fuel', insurers are quietly pricing in a whole new world of risk.

The hard truth is, while the day-to-day running costs of an EV look fantastic on paper, the insurance premium can often wipe out a huge chunk of those savings. Recent analysis shows a significant gap, with the average comprehensive premium for an EV often being more than 50% higher than for a similar petrol or diesel car. This massive difference is leaving many new owners feeling properly stitched up.

What's Fuelling the Fire?

This isn't just a case of insurers being miserable Scrooges who hate progress. They're looking at a few key factors that make their palms sweat. Think of it as the unholy trinity of EV insurance headaches:

- Costly Repairs: That sleek, minimalist bodywork hides a spider's web of complex tech. A minor prang in a Fiesta might mean a quick trip to Dave's Bodyshop, but in an EV, it often requires specialist kit and technicians who charge a hefty premium for their skills.

- Battery Anxiety (for Insurers): The battery is the heart of your EV and can cost more than a decent second-hand family car to replace. Even a minor knock can raise serious questions about its integrity, and that makes insurers very, very nervous.

- Specialist Labour: Not just any mechanic can start poking around a high-voltage system without risking a rather hair-raising experience. Finding qualified technicians is harder, and their time simply costs more.

Petrol vs Electric: A Quick Look at the Premium Divide

To put this into perspective, let's look at how the numbers can stack up. This isn't a scientific study, but it's a good illustration of the 'EV tax' you might find on your insurance bill.

| Vehicle Type | Example Model | Typical Annual Premium | Wallet Pain Level |

|---|---|---|---|

| Petrol | Vauxhall Corsa | £750 | Manageable Ouch |

| Electric | Vauxhall Corsa-e | £1,200+ | Serious Sting |

| Petrol | VW Golf | £820 | A Familiar Grumble |

| Electric | VW ID.3 | £1,350+ | Tears Expected |

As you can see, the difference is rarely just a few quid. It’s a substantial jump that can change the entire financial equation of EV ownership.

This isn't just a perception; it's a financial reality. When you're weighing up your options, understanding the real cost of owning an EV compared to petrol cars is crucial for avoiding any nasty surprises down the road.

Consider this guide your bracing cuppa before we dive into the nitty-gritty of why your premium is so high and, more importantly, what on earth you can do to fight back.

Why Insurers See Your EV as a Pricey Gamble

Ever wondered what an insurance underwriter sees when they look at your gleaming new EV? They're not picturing a planet-saving marvel with a halo. Instead, they see a high-tech, high-risk gadget on wheels, and their job is to calculate just how big a financial headache it could become.

It’s not personal, and it’s certainly not an anti-EV conspiracy. It's just that insuring your electric car feels a bit like covering a Fabergé egg that can do 0-60 in three seconds flat. The risk calculation is worlds away from a trusty old petrol car, and it all comes down to a few key areas that make insurers incredibly twitchy.

The Battery: The Elephant in the Room

Let's get straight to the big one: the battery. This slab of lithium-ion technology is by far the single most expensive component in your car, often accounting for a huge chunk of its total value. It isn't just another part; it's practically a second mortgage strapped to the chassis.

If your EV is involved in a prang, even a seemingly minor one, alarm bells start ringing about the battery's integrity. A small knock or dent to the battery's casing could easily result in the entire car being written off, because a full replacement pack can cost tens of thousands of pounds . For an insurer, that’s a catastrophic financial black hole just waiting to open up.

The Specialist Skills Shortage

Next up is the human factor. You can't just let any old grease monkey loose on a high-voltage system—not unless you want them to end up with a hairstyle that would make Doc Brown from Back to the Future jealous. Repairing an EV safely requires technicians with specific, high-level training to handle the complex electronics and high-voltage architecture.

This creates a perfect storm for higher costs:

- Fewer qualified mechanics: There’s a nationwide shortage of technicians who are actually trained and certified to work on EVs.

- Higher labour rates: Simple supply and demand means those who are qualified can charge a premium for their expertise.

- Longer repair times: Specialised diagnostics and painstaking safety procedures mean your car spends more time in the garage, pushing claim costs up even further.

A fairly standard claim on an EV can be around 30% more expensive than the exact same claim on a comparable petrol car. That's a statistic that makes insurers sit up and take notice, and it directly bumps up the electric car insurance costs you face.

The deeply interconnected tech in an EV, from the battery management system to the advanced driver-assistance features, all needs specialised attention and is often much dearer to fix after a crash. This leads to bigger insurance claims, forcing companies to adapt to this new risk profile. As more EVs hit UK roads, insurers are having to develop specific policies that properly account for these unique risks, as explained in this look at how EVs are shaping the insurance market.

The Price of Parts and Software

Finally, it’s not just the big components that cost a fortune. The intricate network of sensors, cameras, and software that makes your car so clever is also eye-wateringly expensive to repair or replace. A cracked bumper is no longer just a piece of plastic; it's a housing for a dozen sensors that need to be painstakingly recalibrated by a specialist.

When you add it all up—pricey parts, a shortage of skilled labour, and the constant risk of a battery write-off—it becomes pretty clear why insurers see your eco-friendly motor as a pricey, high-stakes gamble.

How Your Choice of EV Impacts Your Premium

Right, let’s be brutally honest. Lumping all electric cars into one big, expensive insurance bucket is a bit like saying all biscuits are the same. It’s nonsense. The humble Rich Tea is worlds away from a chocolate-covered Hobnob, and the same logic applies to EVs.

Your choice of model is often the single biggest factor determining whether your premium is merely pricey or genuinely eye-watering. An insurer doesn’t just see an ‘electric car’; they see a specific set of risks tied to a particular make and model.

A zippy little Fiat 500e, with its modest price tag and sensible performance, is a completely different proposition to a high-performance Porsche Taycan that can launch itself into the next county before you can say "ludicrous mode." The latter will have underwriters reaching for the smelling salts and hiking your premium accordingly.

The Price Tag and The Power

Two of the biggest culprits driving up insurance costs for specific EV models are the initial purchase price and its performance. It’s basic insurance maths: a more expensive car costs more to replace if it’s written off or stolen. This is also where the spectre of what finance companies need to know about EV depreciation comes into play, as insurers have to calculate the car's value over time.

Then there's the power. That instant torque that makes EVs so much fun to drive is, frankly, a massive red flag for insurers. A car that can do 0-60 mph in under four seconds is statistically more likely to be involved in a high-speed incident than a sensible runabout designed for the weekly shop.

The rule is simple: the faster and more expensive your EV, the more an insurer will see you as a glorious, high-value risk. A Tesla Model 3 Performance will always cost more to cover than a Nissan Leaf for this very reason.

For instance, a 2025 analysis of insurance quotes found that the typical annual premium for an EV is around £654 , but this figure masks a huge range. Less powerful models like the Mini Cooper Electric often start at about £400 per year, while premium EVs like a Tesla Model 3 can demand quotes upwards of £900 . This huge variation is driven by factors like the car's initial price and its specific risk profile. You can find more details in the full insurance cost research from NimbleFins.

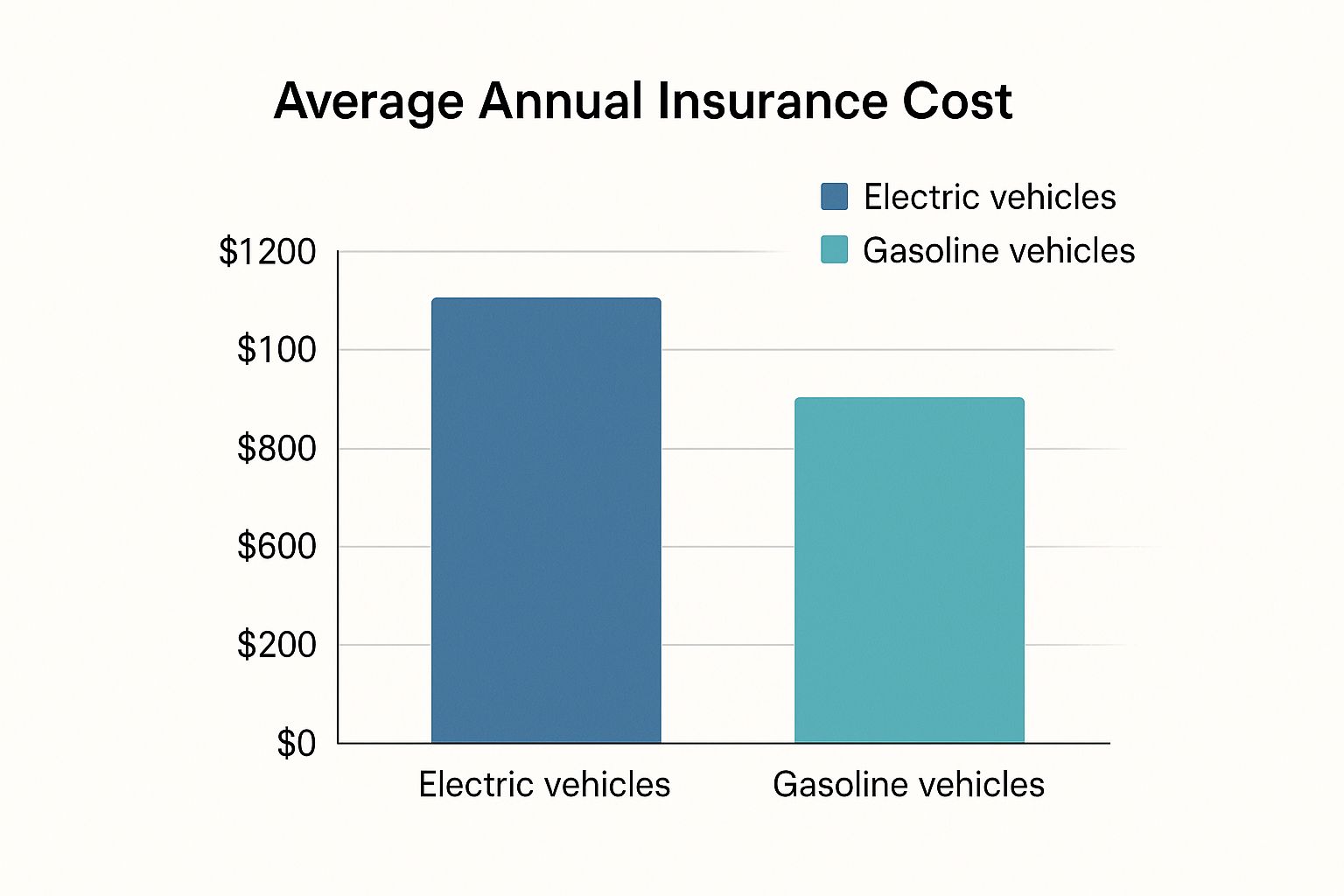

This chart gives a clear visual on the average difference in annual premiums between electric and petrol vehicles.

As you can see, insuring an EV comes with a noticeable financial premium compared to its petrol-powered counterparts on average.

Practical Ways to Lower Your EV Insurance Costs

Right, enough of the doom and gloom. Staring at an eye-watering insurance quote can make you want to trade your EV in for a rusty bicycle, but don't despair. It’s time to fight back against outrageous premiums with a proper battle plan.

This isn't about the blindingly obvious "try not to crash" advice. This is your arsenal of practical, no-nonsense tactics to lower your electric car insurance costs. Forget accepting the first price you're given; it’s time to get savvy and make the system work for you.

Become a Comparison Site Champion

The single most powerful weapon you have is your ability to shop around. Insurers are not a monolith; some are still terrified of EVs, while others are actively courting electric drivers. This creates massive price differences, so loyalty is for pets, not insurance providers.

Fire up those comparison websites and get quotes from everyone. Pay special attention to specialist EV insurers who actually understand the technology. They’re less likely to have a panic attack over the cost of a battery and may offer more competitive, realistic rates based on actual data, not just fear.

Embrace Your Inner Bond Villain with Security

Insurers love security. The harder your car is to nick, the less of a risk you are. While most new EVs come with decent built-in security, going the extra mile can shave a noticeable amount off your premium.

Consider these upgrades:

- A Thatcham-approved tracker: This is the gold standard. A high-quality tracker makes your car far less appealing to thieves and gives insurers peace of mind.

- A steering wheel lock: Yes, it’s old school, but it’s a brilliant visual deterrent. Sometimes the simple solutions are the most effective.

- Secure overnight parking: If you have a garage, use it. If you have a driveway, a security camera or motion-sensor light can also help reduce your perceived risk.

Don’t just accept your renewal quote at face value. A quick phone call to your current provider to haggle, armed with cheaper quotes from competitors, can often result in a surprise discount. They rarely want to lose your business.

Tweak the Policy Details

Fine-tuning your policy is another way to chip away at the cost. One of the easiest adjustments is your voluntary excess . This is the amount you agree to pay towards any claim. Increasing it from, say, £250 to £500 can lower your overall premium. Just be sure you can comfortably afford to pay it if the worst happens.

Another powerful tool is a telematics or 'black box' policy. Yes, it feels a bit like having your mum in the car, but it’s the perfect way to prove you’re a sensible driver. The box monitors your speed, acceleration, and braking, rewarding smooth driving with lower premiums. It's the ultimate rebuttal to the idea that you’re using that instant torque to launch yourself into the next postcode at every traffic light.

What the Future Holds for EV Insurance

So, will insuring your electric car always require you to remortgage the house? Or is there a brighter, more affordable future flickering on the horizon for UK drivers? Let's take a look at what’s coming down the road for EV insurance costs.

The good news is that this painful period of high premiums is probably temporary. As more and more EVs hit the tarmac, the insurance market will be forced to adapt and mature. It’s a bit like the early days of smartphones; they were eye-wateringly expensive to insure until they became a part of everyday life. The same logic applies here—familiarity should eventually lead to fairer premiums.

A Growing Army of EV Mechanics

A huge factor driving up current costs is the shortage of qualified technicians. Right now, finding a mechanic who can safely work on a high-voltage EV system is tough, and their specialist skills come at a premium price.

But the industry is racing to catch up. As thousands more technicians get trained up and dedicated EV repair centres become more common, the laws of supply and demand will start to work in our favour. More competition and a larger skills pool will inevitably bring down repair bills, which is exactly what insurers want to see.

A more robust supply chain for spare parts will also make a massive difference, meaning cars spend less time off the road and claim costs are reduced.

Smarter Tech and Savvier Insurers

The technology inside the cars is also evolving at an incredible pace. Battery designs are becoming more resilient and modular. In the future, a minor bump might only require swapping out a single small module instead of replacing the entire, hugely expensive pack. This shift alone would dramatically lower the single biggest financial risk for an insurer.

As insurers gather more real-world data on EV accidents and repairs, they can move away from pricing based on fear and uncertainty towards pricing based on facts. This data-driven approach should lead to more accurate, and hopefully lower, premiums for the average driver.

On top of this, we're already seeing the emergence of specialist EV insurance products . These are policies built specifically for electric cars, often bundling in cover for charging cables, battery health, and even breakdown assistance if you run out of juice. As this niche market grows, competition will heat up and drive better value for customers.

When combined with government initiatives designed to make switching easier, the whole picture starts to look much more positive. To understand how official schemes impact the market, you can read about the role of government policies in accelerating EV adoption here.

So, while your current renewal quote might still make you wince, the long-term forecast is definitely optimistic. The road ahead for EV insurance costs looks set to become a whole lot smoother.

Your Burning EV Insurance Questions Answered

We’ve covered the nuts and bolts of what drives up premiums and the role of specialist mechanics. Now, let's get straight to the questions you've probably been itching to ask. Here are the answers you need about the real-world costs of insuring an electric car.

Is It a Myth That EV Insurance Is Always More Expensive?

For the most part, it’s not a myth – it’s just an inconvenient truth. Insuring an EV in the UK will, more often than not, cost you more than insuring a similar petrol or diesel car. It all comes down to risk, and recent data shows that EV insurance claims are around 25.5% more expensive for insurers to handle. That cost, unfortunately, gets passed on to you.

Of course, there are always exceptions to the rule. A modest city car like a Smart EQ will likely be cheaper to insure than a hulking petrol-powered SUV. But when you compare like-for-like models, the electric version almost always comes with a higher premium.

Will My Insurance Cover My Expensive Charging Cable?

Yes, in most cases, it will. Any decent EV insurance policy these days will include cover for your charging cables, wall box, and any adaptors against accidental damage, fire, or theft. This is a vital piece of the puzzle, especially when a replacement high-quality cable can easily cost you a few hundred pounds.

But never just assume it's included. Always, always read the small print of your policy document to check the exact cover limits and any specific conditions. Some of the cheaper policies out there might sneakily list it as an optional extra.

Does a Black Box Policy Actually Work for EVs?

It can be a genuine game-changer. That instant torque EVs are famous for makes insurers a bit nervous; they tend to assume every EV driver is secretly a drag racer. A telematics policy, often called a 'black box', is your chance to prove them wrong.

By monitoring how you actually drive, the black box provides hard data showing you're a smooth, sensible motorist who isn't rocketing away from every set of traffic lights. This real-world evidence can lead to some hefty discounts because it replaces the insurer's anxious assumptions with cold, hard facts.

Think of it this way: a telematics policy is the ultimate proof that you’re using your EV for the school run, not for setting lap records around the local roundabout. It’s one of the most effective ways to slash your electric car insurance costs.

What Happens if My Battery Is Damaged in a Crash?

This is the big one, the question that gives insurance underwriters sleepless nights. If the main battery pack is damaged in an accident, it generally goes one of two ways. If the damage is relatively minor and the battery has a modular design, a specialist technician might be able to repair or replace just the damaged cells.

However, if the damage is severe or the battery's protective casing is compromised, the car will almost certainly be written off. The cost of replacing an entire battery pack is so enormous—often tens of thousands of pounds—that it’s just not economically viable for the insurer to approve the repair.

Ready to dive deeper into the world of electric vehicles? At VoltsMonster , we cut through the noise with honest reviews, practical guides, and entertaining content to help you navigate your EV journey. Join our community and get the real story at https://www.voltsmonster.com.