What Finance Companies Need to Know About EV Depreciation

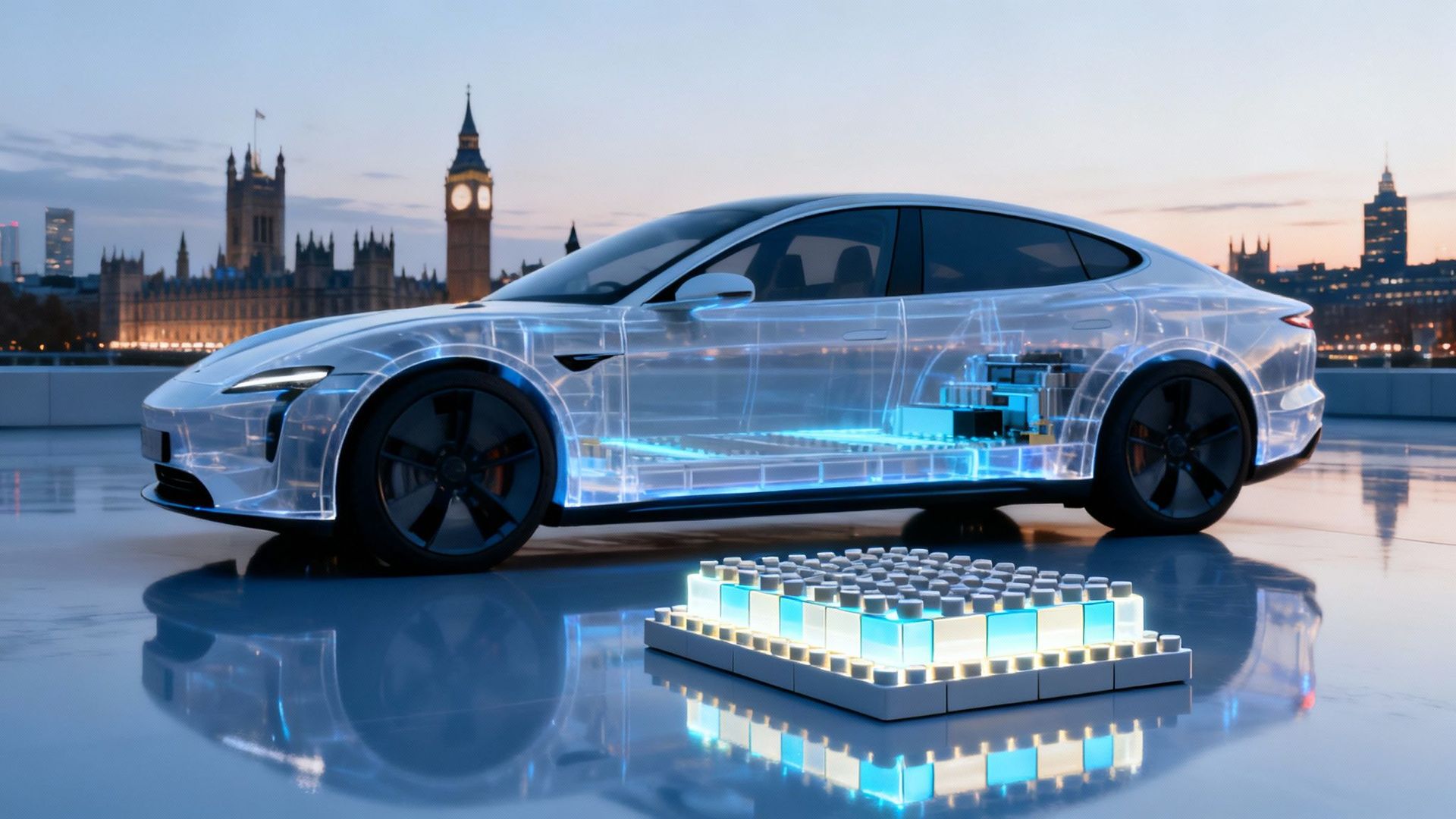

Navigating residual values battery health and market trends for confident financing decisions

Electric vehicles are transforming the automotive finance landscape presenting new challenges and opportunities for lenders lessors and leasing firms. Understanding how EV depreciation differs from that of internal combustion models is essential for accurate risk assessment and profitable portfolio management. Below we explore five key considerations every finance company should bear in mind when dealing with electric vehicle depreciation.

Unique Depreciation Drivers for Electric Vehicles

Unlike petrol or diesel cars electric vehicles exhibit distinct factors that influence their rate of value decline:

- Battery condition: As the most expensive component the health and remaining capacity of the battery pack heavily impact resale value

- Incentive fluctuations: Government grants and tax benefits for new EV purchases can shift market demand for used models

- Rapid technology advancement: Frequent software upgrades and new battery chemistries may render older models less desirable

By recognising these drivers finance companies can adjust depreciation schedules and residual forecasts more precisely.

Assessing Battery Health and Warranty Impact

Battery performance underpins residual values in the EV market so lenders must incorporate battery metrics into valuation models:

- State of health reports: Obtain diagnostic data on capacity retention and cycle count

- Warranty coverage: Determine whether any transferable battery warranty remains valid and the conditions of its application

- Degradation rate projections: Apply conservative estimates for annual capacity loss typically ranging from two to three per cent

Factoring in battery health ensures residual values reflect true replacement risk and prevents unexpected losses at vehicle return.

Market Trends and Residual Value Benchmarks

Staying informed about secondary market trends helps finance companies set realistic residual values and lease rates:

- Used EV pricing indexes: Monitor reported sale prices across major platforms and auction houses

- Model popularity: Track shifting consumer preferences towards certain marques or sizes of electric cars

- Geographic variations: Recognise that depreciation might differ between urban centres with extensive charging infrastructure and rural areas

Regularly updating internal benchmarks against market data allows you to offer competitive financing products while protecting margins.

Regulatory and Incentive Considerations

Policies and incentives have a direct bearing on EV values so understanding their evolution is crucial:

- Grant eligibility: Changes to consumer or corporate grant schemes can suddenly affect demand for late model EVs

- Emission based taxation: Anticipate how shifts in benefit in kind rates or low emission zones influence fleet replacement cycles

- End of life regulations: Be aware of battery recycling mandates and decommissioning costs that buyers factor into used vehicle prices

Aligning residual value forecasts with the regulatory environment helps finance teams mitigate policy related risks.

Forecasting Depreciation for Portfolio Management

Accurate forecasting underpins effective risk management and capital allocation. Consider these best practices:

- Scenario modelling: Create multiple depreciation curves reflecting optimistic base and conservative cases for battery longevity and market uptake

- Dynamic adjustments: Update forecasts quarterly to react to evolving sales volumes technological breakthroughs and regulatory announcements

- Cross asset comparison: Benchmark EV depreciation against comparable petrol diesel or hybrid models to gauge relative performance

Such robust forecasting not only aids in setting appropriate lease rentals but also informs residual based lending limits.

Conclusion

Electric vehicle depreciation presents a distinct set of variables that finance companies must master to underwrite confidently and maintain healthy portfolios. By focusing on battery health warranty status market dynamics regulatory influences and rigorous forecasting methods lenders and lessors can better predict residual values and protect their investments. Embracing these insights will position finance teams to capitalise on the growing EV market while managing depreciation related risks effectively.