The Utterly Bonkers UK Electric Vehicle Supply Chain, Explained

Ever wondered how an electric car actually gets made? It's a journey that makes traditional car manufacturing look like a gentle stroll in the park. Forget the familiar, greasy process of pressing steel and dropping in an engine. The electric vehicle supply chain is an incredibly complex, global affair that starts long before a single part clatters onto a factory floor.

This journey begins with grubbing for essential raw materials like lithium and cobalt , moves through high-tech battery production that costs a king's ransom, and navigates some truly unique logistical puzzles before a new EV ever reaches your driveway.

The Wild Ride From Mine to Motorway

So, how does that brand-new electric car appear at the dealership, all shiny and ready to silently judge your parking? It’s not magic, and it’s a world away from the old-school assembly lines we’re used to seeing oily blokes tinker with.

The modern electric vehicle supply chain is a sprawling, globe-trotting operation that makes a mockery of borders. It kicks off in a remote mine, sparks a global scramble for rare minerals, and then becomes a high-stakes game of pass-the-parcel with huge, temperamental batteries. It’s less of a straightforward production line and more of a logistical epic with its own messy geopolitical drama.

This is a completely different ball game compared to your grandad’s Cortina. The process involves:

- Global Sourcing: Digging for critical minerals, often in politically… interesting parts of the world.

- High-Tech Manufacturing: Assembling incredibly complex battery packs in huge facilities known as 'gigafactories'.

- Specialised Logistics: Carefully shipping these heavy, hazardous battery units across oceans and continents without them going bang.

- Final Assembly: Gutting and re-tooling legendary car plants to build vehicles that are fundamentally different from their petrol-powered ancestors.

Understanding this remarkably complex journey is more than just a bit of trivia for the pub. For drivers in the UK, it’s a look behind the curtain at the forces shaping the cars we'll all be driving, the frankly eye-watering prices we'll pay, and the national push to secure our place in this new automotive era before we get left behind.

Why This Global Chain Matters to You

Alright, but why should you give a toss about this complex logistical puzzle? Because every hiccup, every delay, and every political squabble in this chain has a direct impact on you. The availability of raw materials, for instance, dictates the price of your car's battery—which just so happens to be the single most expensive component in the entire vehicle.

With the UK government aiming for an all-electric future (whether we're ready or not), our national success depends on getting this supply chain right. If we can't secure a steady flow of materials, build batteries here at home, and assemble cars efficiently, we risk becoming completely reliant on other countries. This section is all about mapping out that wild ride, from a hole in the ground to the gleaming car on your street.

Digging for Lightning: The Raw Materials Scramble

Long before an electric car glides silently down your street, its journey starts in the mud and dust of a mine somewhere on the other side of the world. The heart of every EV—the battery—is a complex cocktail of minerals pulled from the Earth. And we’re not talking about your run-of-the-mill iron ore; this is the stuff of geopolitical power plays. Think lithium, cobalt, and nickel: the new oil, but with more ethical headaches.

This first stage of the electric vehicle supply chain is a frantic, global free-for-all. It’s the gritty, often morally dubious prequel to your clean, green commute. Securing these materials isn’t a simple case of ticking a box on a procurement form. It's about navigating a minefield of ethical dilemmas, environmental damage, and political tensions that stretch across continents.

The Unholy Trinity of EV Minerals

While a battery pack contains a whole chemistry set of materials, three stand out for their critical importance—and the monumental headaches they cause. Each one is essential for making your car go, but they all come with their own baggage, from questionable labour practices to a colossal environmental footprint that slightly tarnishes the green halo of electric motoring.

These elements are the very foundation of modern EV batteries, and figuring out how to source them reliably is one of the biggest challenges facing the UK's flailing automotive industry.

The uncomfortable truth is that the green revolution is built on some very dirty industries. The rush for these minerals often involves open-pit mines that scar landscapes and processing methods that demand colossal amounts of water and energy, frequently in regions ill-equipped to handle the fallout.

This shot of an open-pit mine gives you a sense of the sheer scale of excavation needed just to get these materials out of the ground.

It’s a stark image, capturing the raw, industrial beginning of the journey—a world away from the polished final product sitting in a dealership, waiting for a test drive.

The UK’s Race Against Time

So, where does Britain fit into this global treasure hunt? For the most part, we're on the sidelines, heavily reliant on a supply chain that begins thousands of miles away. This puts the UK in a very precarious position. Without a secure, direct supply of these essential battery materials, our car manufacturing future is basically held hostage by other nations.

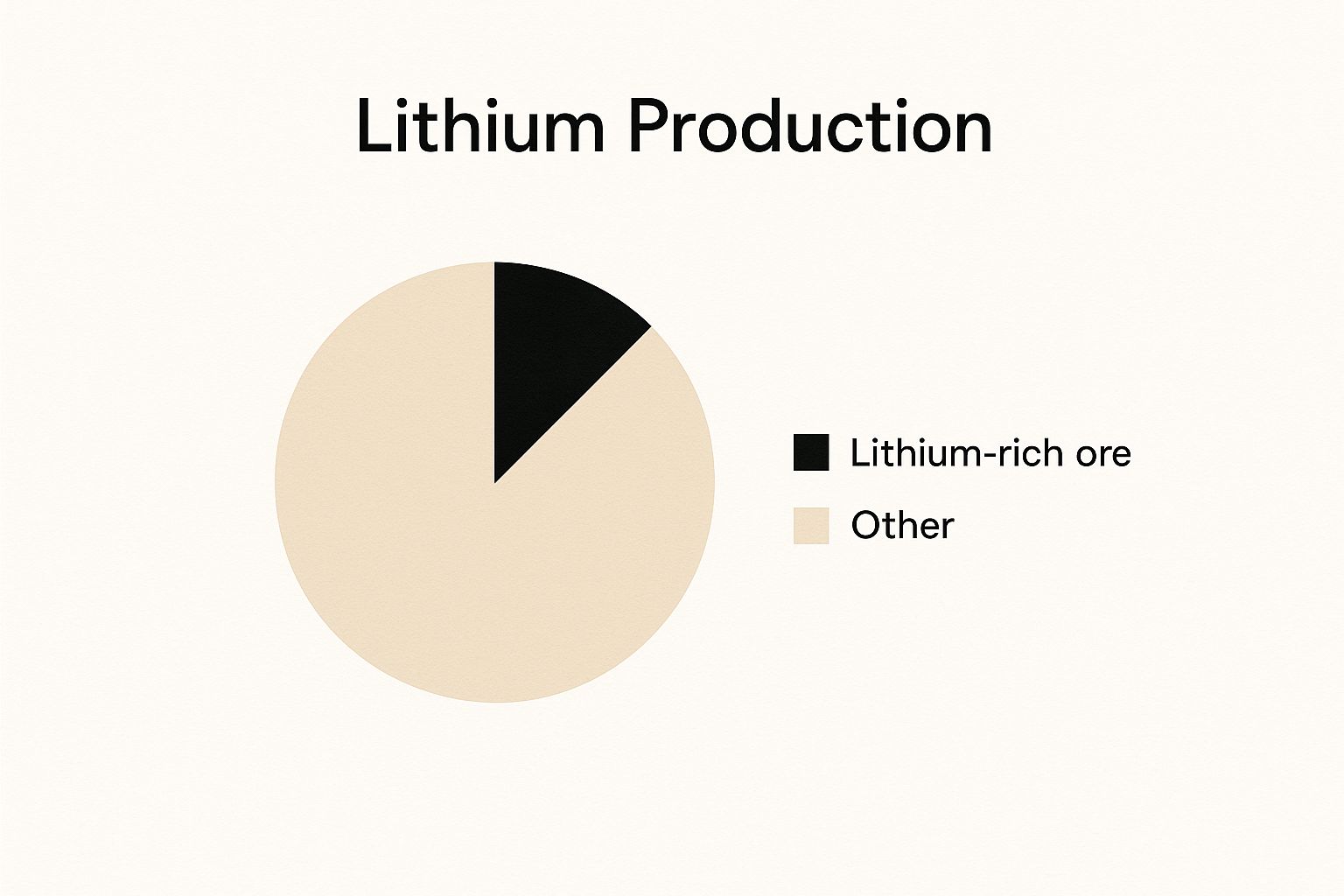

China, for example, doesn't just mine these materials; it utterly dominates their processing. It controls around 60-70% of the world's refining capacity for lithium and cobalt. This means even if the UK strikes a deal with a mine in Australia or Africa, the raw material probably has to pass through China first, adding another layer of geopolitical risk to an already fragile system.

To really get to grips with the problem, it helps to look at each key mineral, what it does, and the specific challenges it poses.

The EV Battery's Critical Ingredients and Their Headaches

Let's break down the key players in the battery game. The table below outlines what these materials do and why getting our hands on them is so bloody complicated.

| Material | Primary Role in Battery | Main Sourcing Challenges |

|---|---|---|

| Lithium | This is the star player. It provides the high energy density that gives an EV its range, allowing ions to move between the cathode and anode to create a current. | Most of it comes from Australia, Chile, and China. There are huge environmental concerns around water usage in South American salt flats, and the UK has almost no domestic production. Bugger. |

| Cobalt | It acts as a stabiliser for the cathode, stopping it from overheating and degrading. This ensures the battery is safe and lasts a long time—which is pretty important. | Over 70% of the world's cobalt comes from the Democratic Republic of Congo (DRC), where its mining is notoriously linked to severe human rights issues, including child labour. Cheery stuff. |

| Nickel | A key component in high-performance cathodes, nickel boosts energy density. This means a longer range without adding too much weight to the car. | Sourcing is concentrated in Indonesia, the Philippines, and Russia. Environmental standards can be patchy, and recent geopolitical events have made relying on Russian supply a major gamble. |

This breakdown makes one thing painfully clear: for the UK to build a resilient electric vehicle supply chain , we have to confront these messy realities head-on.

We're in a race against time. The options are to find our own domestic sources, pioneer new battery chemistries that use less of these difficult materials, or build a robust recycling network to reclaim what we've already imported. If we don't, the UK's electric dream could stall before it ever really gets going.

From Cells to Gigafactories: Building the Heart of the EV

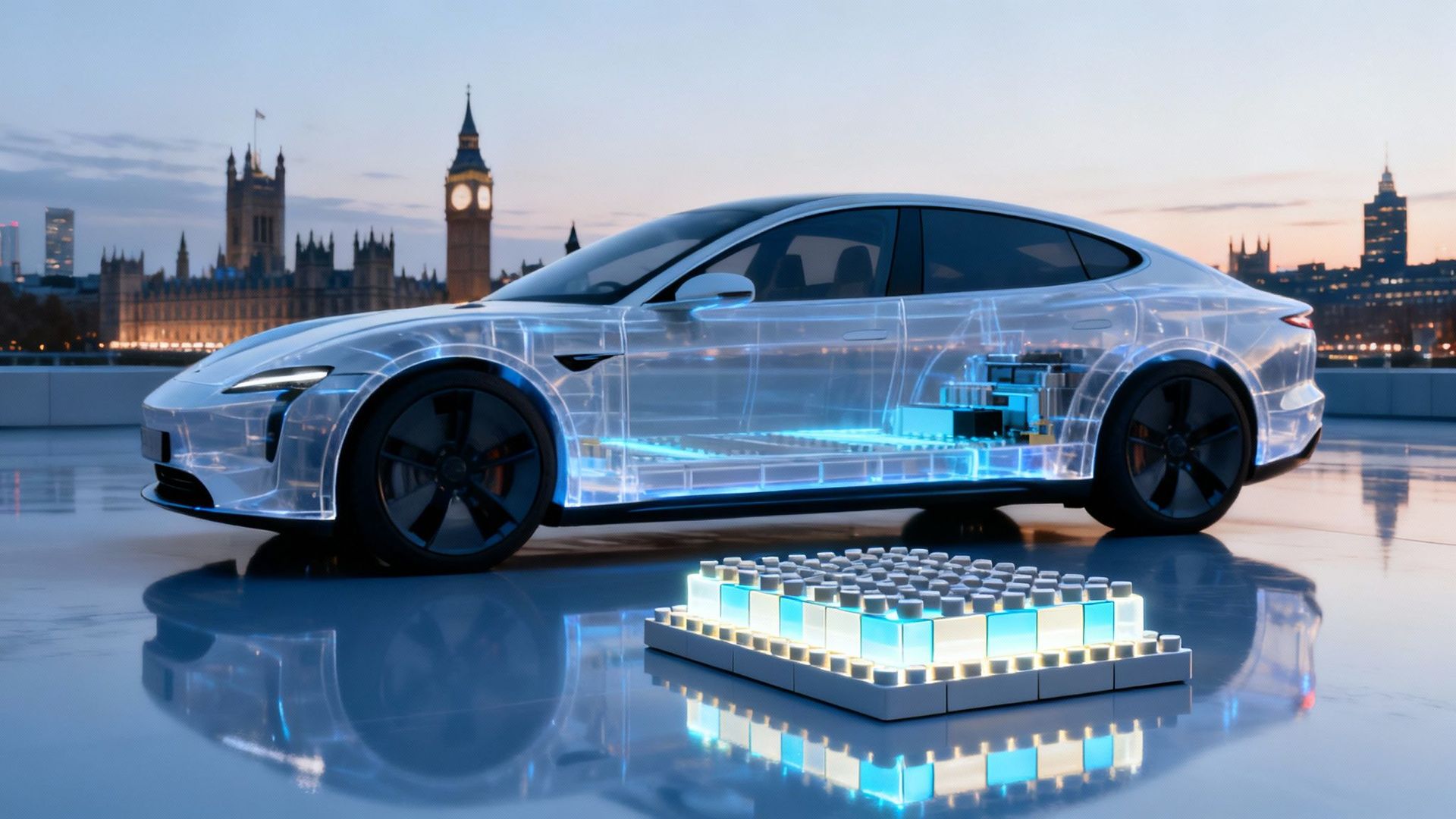

So, you’ve gone to the trouble of sourcing a mountain of expensive, politically sensitive dust from every corner of the globe. What's next? You have to transform that pile of refined minerals into the single most crucial—and costly—component of any electric car: the battery. This is where the real alchemy happens in the electric vehicle supply chain , and it involves a mind-boggling amount of capital.

This isn't as simple as popping a couple of AAs into your telly remote. We’re talking about a highly technical, industrial-scale process that starts with making millions of individual battery cells. These are then painstakingly assembled into monstrously large, high-voltage packs. It’s a delicate dance of chemistry, precision engineering, and robotics, and one wrong move can have, well, rather explosive results.

This entire operation unfolds in facilities that have become the modern-day cathedrals of the automotive world: the gigafactory.

The Rise of the Gigafactory

The term 'gigafactory', once a niche bit of industry jargon, is now front and centre in the EV conversation. These aren't just big sheds; they are colossal manufacturing hubs, often sprawling over millions of square feet, all dedicated to churning out batteries on an epic scale. The name itself comes from the unit used to measure battery capacity—the gigawatt-hour (GWh) . A single gigafactory can produce enough batteries to power hundreds of thousands of cars every single year.

These facilities represent a huge punt. They require billions in investment and take years to build, but without them, a country’s car industry is essentially dead in the water. Having a domestic battery supply is no longer a 'nice-to-have'—it's a matter of national economic survival.

The logic is painfully simple: if you have to import all your batteries, you are completely at the mercy of another country's prices, politics, and production schedules. You aren't really building cars; you're just doing the last bit of assembly on someone else's product.

This is precisely why there's a fierce global race to build as many gigafactories as possible. China is currently leagues ahead, with Europe and the US scrambling to catch up. And the UK? Well, we’re trying to muscle our way into the game, but it's a brutal contest.

Why the UK Desperately Needs Homegrown Batteries

For the UK, securing domestic battery production is absolutely critical. Without it, our storied car manufacturing industry faces an existential threat. Building batteries locally slashes logistical costs (shipping a tonne of volatile lithium-ion packs across the sea is no one’s idea of fun), insulates us from geopolitical spats, and creates thousands of skilled jobs right here at home.

The UK's electric vehicle market is already a serious business, with revenues projected to hit around £40.9 billion . This boom is fuelled by drivers wanting cleaner, cheaper-to-run cars and government targets to speed up the transition. But to sustain this growth and keep our car factories humming, we must fix the weak points in our supply chain—namely, our crippling reliance on imported batteries. You can find more data on the UK's EV market growth over on Statista.

Building a resilient electric vehicle supply chain on British soil is non-negotiable. It means we control our own destiny rather than waiting for a shipping container to arrive from Asia. That's why the announcement of new UK-based gigafactories is met with such fanfare—they are the keystones of our entire electric future. If you're wondering what all the fuss is about, you can learn more about what a gigafactory is and why you should give a toss in our detailed guide. It sounds technical, but it’s the difference between a thriving UK car industry and a load of empty factories.

Assembling the UK's Electric Future

So, you’ve managed to get your hands on a mountain of precious minerals and convinced a gigafactory to turn them into a massive, high-voltage battery. Brilliant. Now for the part everyone seems to forget: actually getting that enormous, volatile lump of metal and chemicals to a car factory. This isn't quite like sending a box of spark plugs through the post.

The logistics leg of the electric vehicle supply chain is a completely different animal to what the old guard of the automotive world is used to. You’re dealing with components that are not only incredibly heavy and awkward but are also classed as dangerous goods. Drop one, and you’re not just looking at a costly write-off; you’re risking a spectacular fire that fire crews have a devil of a time putting out.

This reality calls for specialised transport, bespoke safety protocols, and drivers trained to handle what is essentially a bomb on wheels if treated incorrectly. It’s a logistical headache of the highest order.

A New Kind of Logistics Game

The shift to EVs is forcing a total rethink of automotive logistics across the UK. It's no longer just about moving parts; it’s about specialised handling and using data to manage these unique, high-value components. With the global EV battery market worth well over $69 billion , establishing dedicated channels to prevent fires or leaks during transit is non-negotiable. You can learn more about how EV parts supply chains are changing at EV Powered.

Once the battery finally arrives safely, the final assembly can begin. This is the stage where all the disparate parts of this global puzzle come together on British soil.

Retooling Britain's Motoring Icons

Many of the UK’s legendary car plants, once churning out petrol and diesel models, have undergone massive transformations to build EVs. This isn't a case of just swapping a few tools around; it’s a fundamental re-engineering of the entire assembly process.

In some ways, building an EV is simpler. There’s no clunky engine, no complex exhaust system, and no gearbox with a million fiddly parts. The EV ‘skateboard’—a flat chassis that houses the battery and motors—is a far more elegant piece of engineering.

In other ways, it’s vastly more complex. The sheer amount of wiring and electronic control units (ECUs) in a modern EV is staggering. The vehicle's nervous system is an intricate web of high-voltage cables and data connections that must be installed with absolute precision.

A traditional car might have around 1,500 wires totalling a mile in length. A premium EV, on the other hand, can have more than double that, with wiring stretching over three miles. It's less of an assembly line and more like complex neurosurgery.

This has demanded a complete overhaul of factory floors and a major upskilling of the workforce. The greasy-rag mechanic of old is being replaced by a technician who's as comfortable with a laptop as they are with a spanner.

The Modern British Assembly Line

So, what does this retooled process actually look like? It’s a beautifully choreographed dance between humans and robots, where the new heart of the car is carefully installed.

- The 'Marriage' Ceremony: The most critical step is the 'marriage', where the complete body of the car is lowered onto the skateboard chassis. This is the moment the vehicle truly becomes an EV.

- High-Voltage Specialists: Specially trained technicians handle the installation of the bright orange high-voltage cabling—the arteries of the electric powertrain. Safety is absolutely paramount here.

- Software Integration: Before the car even rolls off the line, it undergoes extensive software flashing and diagnostics. The car’s brain is programmed, and all its systems are tested to ensure they can talk to each other.

This is where the electric vehicle supply chain culminates: a finished car, built in Britain, ready to silently hit the road. It’s the final, crucial link connecting a hole in a distant mine to the vehicle sitting in your driveway, proving that the future of British car making, while different, is very much alive.

Britain's EV Supply Chain: Woes and Wins

Right, let’s bring this whole conversation back home. After tracing materials across the globe and gawking at massive factories in Asia and Europe, it's time for a proper look at the electric vehicle supply chain right here in the UK. Are we leading the charge, or are we about to be lapped by the competition while we're still faffing about?

The truth, as it often is, is a bit of both. On one hand, you can’t deny the buzz. EV sales are climbing, and drivers are clearly keen to ditch the petrol pump. But on the other, our national strategy sometimes feels like it was scribbled on the back of a fag packet.

We've legislated an all-electric future, which is incredibly ambitious. The challenge is, the roadmap for actually getting there can feel a bit like we're just crossing our fingers and hoping for the best.

A Tale of Two Supply Chains

Let's start with the good news. The UK is not starting from scratch here. We have a rich automotive history, a pool of skilled engineers, and some major players are placing significant bets on Britain. Slowly but surely, the outlines of a coherent strategy are beginning to take shape.

But then there's the other side of the coin. Our supply chain has some serious vulnerabilities. We are heavily reliant on imported components—especially the all-important batteries—leaving us exposed to global politics and shipping delays.

We're in a tricky spot: cheering on a revolution from the sidelines while other countries build the factories that will power it. For every win we celebrate, there's a nagging weakness that threatens to undermine the progress.

This isn't just industry talk; it's a reality check that affects every potential EV driver in the UK. It’s vital to be honest about where we stand and the mountain we still have to climb.

Celebrating the Wins (Let's Be Positive for a Minute)

It’s not all doom and gloom, of course. There are genuine reasons for optimism. The UK EV market has seen a huge surge, with sales jumping by 31% from January to August compared to the previous year. This reflects a real shift in what drivers want: cleaner, cheaper-to-run cars. You can see a breakdown of regional sales data from Benchmark Mineral Intelligence.

On top of that, we're finally seeing some gigafactory projects get off the ground. These investments are absolutely crucial. They provide the homegrown battery supply needed to secure the future of car plants from Sunderland to Somerset. These are the victories we need more of.

Facing the Glaring Weaknesses

Now for a dose of reality. Our single biggest weakness is our dependence on foreign batteries. While Europe and China are racing to build up their domestic capacity, the UK has been slower off the mark. This isn't just an economic risk; it's a strategic one.

- Geopolitical Risk: If our battery supply comes from a country we have a falling out with, our entire car industry could grind to a halt almost overnight.

- Logistical Headaches: Shipping batteries across the world is expensive, complicated, and adds no value. The only sensible long-term solution is to build them where you build the cars.

- Missed Economic Opportunity: For every battery we import, we’re sending jobs and investment overseas that should be staying right here in the UK.

The government's role in all of this has been inconsistent. While grants and targets exist, a clear, long-term industrial strategy has been missing. This uncertainty makes businesses hesitant to commit the billions required for these huge infrastructure projects. To better understand the impact of government action, you can read our guide on the role of government policies in accelerating EV adoption.

Ultimately, Britain is at a crossroads. We have the potential, the demand, and the heritage to be a major player in the electric era. But without a robust and secure domestic electric vehicle supply chain , we risk becoming little more than a showroom for cars designed, engineered, and powered by everyone else.

Closing the Loop: What Happens When an EV Battery Dies?

So, your trusty electric car has finally driven its last mile. After years of service, it’s ready for the great scrapheap in the sky. But what about the heart of the vehicle – that huge, complex, and expensive battery pack? Simply dumping it in a landfill would be a monumental environmental cock-up.

This brings us to the final, and perhaps most critical, piece of the electric vehicle supply chain puzzle: recycling. It’s the stage where the entire process comes full circle. The industry is now working flat out to perfect methods for safely dismantling old EV batteries to reclaim the precious materials locked inside, like lithium, cobalt, and nickel.

This isn't just about being green. It’s a strategic imperative. For the UK, creating a strong battery recycling industry is our best chance to reduce our dependence on overseas mines and unpredictable global supply chains. It’s how we build a true 'circular economy', where today's knackered battery provides the raw materials for tomorrow's EV.

More Than Just an Eco-Friendly Endeavour

At its core, the drive for a closed-loop supply chain is about cold, hard economics and national security. Why pay a fortune to ship raw materials from the other side of the planet when we can create our own 'urban mines' right here, processing the millions of EV batteries that will eventually come off the road?

Every single battery we recycle is one less we need to import. This builds a far more resilient and sustainable local source of the critical minerals that power the whole industry. It’s the ultimate long-term play.

Building world-class recycling infrastructure is just as vital as building gigafactories. One makes the batteries; the other ensures we can keep making them without being held hostage by the global scramble for raw materials.

The Gritty Business of Battery Resurrection

Recycling a high-voltage EV battery is a world away from tossing a few tins in your recycling bin. It's a highly technical, and potentially hazardous, process. While it's a complex topic, you can learn more about the fundamentals in our guide to EV batteries and their crucial role in sustainable energy.

The process generally follows a few key steps. First, the battery pack has to be made completely safe by discharging any residual energy to prevent, let's just say, any unexpected bangs or sparks.

Next comes the careful work of dismantling the pack. This is often a job for a combination of robotics and highly skilled technicians who separate the individual battery cells from the protective casing, wiring, and cooling systems.

Once the cells are isolated, the real work of extraction begins. There are two primary methods used today:

- Pyrometallurgy: Think of this as the brute-force method. The battery components are smelted in a massive furnace, allowing the valuable metals to be separated from the molten slag. It gets the job done but requires a huge amount of energy.

- Hydrometallurgy: This is a more precise, chemical-based approach. The shredded battery materials are dissolved in a solution, and the different metals—lithium, cobalt, nickel—are then chemically separated and recovered. This process is generally more efficient and can retrieve a higher percentage of the materials.

Whichever path is taken, the end goal is to produce a substance known as 'black mass' . This fine powder is incredibly rich in the key metals needed for new batteries. It can then be fed directly back into the manufacturing pipeline, turning the supply chain from a straight line into a continuous, sustainable circle.

Your EV Supply Chain Questions Answered

Alright, we’ve journeyed through mines, toured gigafactories, and navigated the complex web of the electric vehicle supply chain . You might still have a few questions rattling around. Let's tackle some of the most common ones.

Is the EV Supply Chain Really Greener?

This is the big one, isn't it? While an EV has zero tailpipe emissions, making one is a different story. Mining for materials like lithium and cobalt definitely leaves an environmental mark, and battery manufacturing is a very energy-hungry process.

But here’s the crucial part: over the vehicle's entire life, an EV is still significantly cleaner. That initial carbon "debt" from manufacturing usually gets "paid off" after just a couple of years of driving. It’s not a flawless system, but it's a huge step up from the internal combustion engine.

Why Are EV Batteries So Bloody Expensive?

It really boils down to two things: the raw materials and the incredibly complex manufacturing. Key ingredients like lithium, cobalt, and nickel are in high demand, which keeps their prices firm. Then you have to factor in the billions it costs to build a single gigafactory.

The battery pack can account for up to 40% of an electric car's total cost. The hope is that as battery tech gets better and recycling becomes more widespread, these costs will finally start to fall.

What Happens if China Stops Supplying Materials?

Now that's the billion-pound question keeping automotive bosses up at night. China has a stranglehold on the processing of most critical battery minerals. If that supply were suddenly cut off, the global EV industry would screech to a halt.

This is exactly why the UK and Europe are scrambling to build their own, independent supply chains. From mining and refining all the way to recycling, it’s become a critical issue of economic security.

At VoltsMonster , we cut through the jargon to bring you the real story on electric vehicles. For more straight-talking guides, car reviews, and industry news, explore our latest articles and videos at https://www.voltsmonster.com.