Electric car benefit in kind: The essential BiK savings guide

Let's be honest, you're probably here because you've heard the whispers around the office coffee machine: getting an electric company car is ridiculously cheap on tax. And you're dead right. The electric car Benefit-in-Kind scheme is the government's not-so-subtle bribe to get you out of that sad, clattering diesel. Spoiler alert: it works brilliantly.

Your Wallet Will Thank You for Going Electric

If you've ever glanced at a colleague's payslip and wondered why they're grinning like a Cheshire cat, the answer is almost certainly Benefit-in-Kind (BiK). Think of it as the taxman's way of acknowledging you're getting a sweet perk—a company car—and taking his slice.

For traditional petrol and diesel cars, that slice is more like a massive wedge of the cake, often costing thousands of pounds a year directly from your salary.

But for electric cars? It’s a sliver. A crumb. It’s so small, it’s almost laughable. This isn't an accident; it's a deliberate government incentive designed to push drivers towards zero-emission vehicles. And for once, it’s a government plan that genuinely benefits your bank balance.

Understanding the Key Players: P11D and BiK Rate

To really get your head around the magic, you only need to know two key terms:

- P11D Value: This is simply the official list price of the car, including VAT and any optional extras you’ve added. It’s the starting number for all the tax sums.

- BiK Percentage: This is the all-important figure set by HMRC, which is based entirely on a car’s CO2 emissions. The dirtier the car, the higher the percentage.

For electric cars, the BiK rate is comically low, which makes the tax you end up paying almost negligible. The numbers don't lie: switching to an electric company car through the UK's BiK scheme can save you thousands every single year.

For the 2025/26 tax year, the EV BiK rate is set at just 3% . This is a world away from the punishing 25-37% bands that hit most new petrol and diesel cars. On a typical £40,000 EV, a basic rate taxpayer pays just £240 a year. Someone in a similar petrol car could easily be facing a bill over £2,400. You can discover more insights about BiK savings at Pearson May.

To make this painfully clear, let's look at a simple side-by-side comparison.

At a Glance: EV vs Petrol Car Annual BiK Tax

Here’s a quick look at the annual tax a higher-rate (40%) taxpayer would pay for a company car with a P11D value of £40,000.

| Car Type | Example BiK Rate | Taxable Value | Annual Tax for 40% Taxpayer |

|---|---|---|---|

| Electric Car | 3% | £1,200 | £480 |

| Petrol Car | 25% | £10,000 | £4,000 |

The difference is staggering, isn't it? That £3,520 saving isn't a one-off bonus; it's money back in your pocket every single year.

This is the foundation of becoming a tax-savvy EV driver. You get to cruise towards a fatter wallet while your petrol-guzzling colleagues are left weeping into their spreadsheets.

How Your Company Car Tax Is Calculated

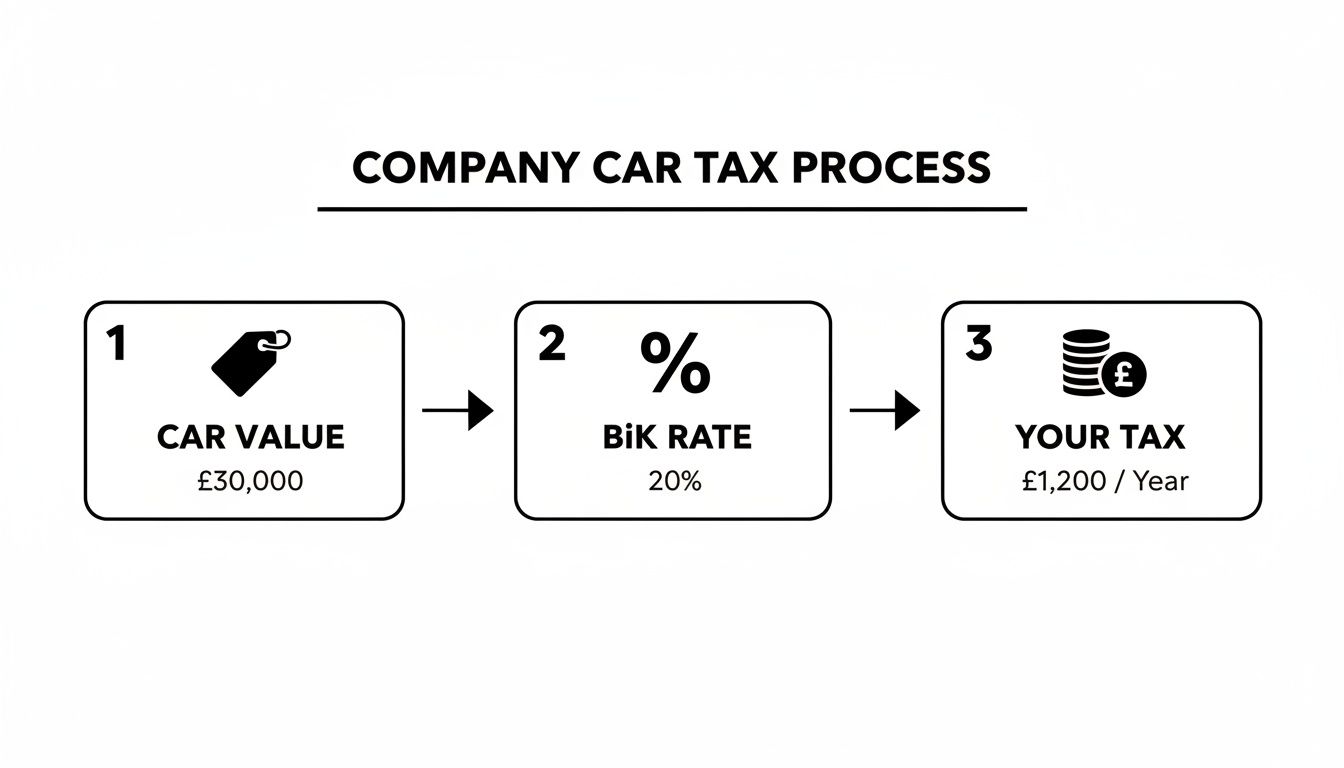

Right, let's get under the bonnet. Calculating your company car tax, better known as Benefit-in-Kind (BiK), sounds like a job for a tweed-wearing accountant who still uses an abacus. In reality, it’s surprisingly simple once you cut through the HMRC jargon.

It all boils down to a basic, three-step formula. Forget complex spreadsheets; think of it as a simple recipe for saving a serious amount of cash.

This flowchart maps out the entire process. It shows exactly how the car's value and its BiK rate combine to determine what you owe each year.

As you can see, a lower BiK rate directly translates into a smaller tax bill. This is precisely where electric cars have an almost unfair advantage.

Step 1: Find the P11D Value

First up, you need the car’s P11D value . This isn't just the sticker price; it's the official list price of the car including VAT and delivery charges, plus any shiny factory-fitted options you’ve chosen, like that panoramic sunroof you absolutely must have. It’s the starting block for the whole calculation.

Step 2: Find the BiK Rate

Next, you need the BiK percentage rate . This is the crucial number, and it’s determined by the car's official CO2 emissions. For traditional petrol and diesel cars, this figure can soar up to a wallet-punishing 37% .

For a zero-emission electric car in the 2024/25 tax year, however, this rate is a tiny 2% . Yes, you read that right. It’s the tax equivalent of a gentle pat on the back from the government for being so green.

The core formula is wonderfully straightforward: P11D Value x BiK Percentage Rate x Your Income Tax Rate = Your Annual Company Car Tax. It’s the secret sauce that reveals just how much you’ll save by ditching petrol.

Step 3: Multiply by Your Tax Bracket

Finally, you multiply the result by your personal income tax rate – that’s typically 20% for basic rate taxpayers or 40% for higher rate taxpayers. Scotland has slightly different bands, but the principle is identical. And that's it. That’s the final number that will (or won't) be disappearing from your payslip each year.

Let’s run the numbers on a few real-world examples to show just how this works in practice.

Example 1: The Feisty EV Hatchback

Imagine you're eyeing up a sporty Cupra Born V2 (57kWh), a brilliant little EV with a P11D value of around £38,390 .

- P11D Value: £38,390

- BiK Rate (2024/25): 2%

- Taxable Value: £38,390 x 2% = £767.80

So, for a higher-rate (40%) taxpayer, the annual tax bill would be just £307.12 . That works out to a ridiculously low £25.60 per month for a brand-new, stylish electric car.

Example 2: The Premium Electric Saloon

Now let's step it up a gear. You fancy something sleeker, like a Polestar 2 Standard Range Single Motor , which has a P11D value of roughly £44,950 .

- P11D Value: £44,950

- BiK Rate (2024/25): 2%

- Taxable Value: £44,950 x 2% = £899

A 40% taxpayer would pay a mere £359.60 per year , or just £29.97 per month . Again, that’s less than most people spend on coffee.

Example 3: The Petrol Equivalent

To truly hammer home the savings, let's compare this to a petrol equivalent. A well-specced Volkswagen Golf R-Line has a similar P11D value of around £34,000 , but its CO2 emissions land it in a much harsher BiK band of 32% .

- P11D Value: £34,000

- BiK Rate (2024/25): 32%

- Taxable Value: £34,000 x 32% = £10,880

For that same 40% taxpayer, the annual tax bill rockets to a painful £4,352 . That’s £362.67 per month .

Let's put that side-by-side to see the full picture.

| Car | Taxpayer Rate | Monthly BiK Tax | Annual BiK Tax |

|---|---|---|---|

| Cupra Born (EV) | 40% | £25.60 | £307.12 |

| Polestar 2 (EV) | 40% | £29.97 | £359.60 |

| VW Golf (Petrol) | 40% | £362.67 | £4,352.00 |

The difference is astronomical. By choosing either of the electric cars over the petrol Golf, our driver saves over £4,000 in tax every single year. This isn’t a marginal gain; it’s a complete game-changer, turning premium vehicles into genuinely affordable options, all thanks to the electric car Benefit in Kind system.

The Unstoppable Rise of the Electric Company Car

Think an electric company car is still a niche choice for the eco-conscious few? That thinking is about three years out of date. This isn't just a slow-burning trend; it’s a full-blown revolution taking place in company car parks across the UK. The era of diesel dominance is officially over, replaced by the quiet, confident hum of electric power.

And this isn't just chatter from around the office. The government's own figures—the very numbers that shape tax policy—reveal a seismic shift in how we drive for work. While your mate Dave is still grumbling about the price of diesel at the pump, hundreds of thousands of clued-up drivers have already made the switch, lured in by the almost unbelievable savings from low electric car benefit in kind tax.

The change has been swift and, for diesel, utterly brutal. Once the undisputed king of the company car fleet, its reign has crumbled. It’s a spectacular fall from grace, and the reason is painfully simple: eye-watering tax bills.

The Data Doesn't Lie

Forget what the petrolheads are saying; UK stats prove that electric company cars are the ultimate BiK hack, and they've sent adoption rates soaring for drivers and businesses. In the 2023/24 tax year, a staggering 340,000 company car drivers were behind the wheel of a fully electric vehicle.

That's a monumental jump from 220,000 the previous year. To put that in perspective, diesel has crashed down to just 105,000 drivers from its peak of 595,000 only a few years ago. That means 41% of all company car drivers are now cruising with zero emissions. You can dive into the full government research and see these jaw-dropping figures for yourself.

This isn't just a gradual shift; it's a mass migration. For every one person choosing a diesel company car today, more than three are plugging in an EV. It’s a complete rout, driven by smart financial decisions.

This mass movement tells a bigger story than just numbers on a page. It’s not simply about saving a few quid on your payslip each month, though that’s certainly a welcome bonus. It's about a fundamental change in how we view company cars. The smart money has already moved, and it’s electric.

A Look at the EV Hotspots

What's fascinating is that this EV revolution isn't spread evenly across the country. The data often highlights hotspots of adoption, particularly in regions with strong tech and professional services industries. The South East, for example, consistently shows a higher concentration of electric company car drivers.

Why does this matter? Well, this clustering has a powerful knock-on effect. It creates demand that forces improvements in local public charging infrastructure, which in turn makes it even easier for the next wave of drivers to make the switch. It becomes a virtuous cycle: more EVs lead to better charging, which encourages even more people to go electric.

What’s crystal clear from all this is that choosing an electric company car is no longer the "alternative" choice. It's now the mainstream, intelligent, and financially sensible decision. The revolution is already here, and if your company car still runs on fossil fuels, you're officially part of the old guard.

Using Salary Sacrifice to Your Advantage

So, you’ve got your head around just how low the Benefit-in-Kind (BiK) tax is for electric cars. Now, let’s talk about the next level of smart financing: salary sacrifice . Forget dusty old pension schemes; this is the modern way to get behind the wheel of a brand-new EV for a fraction of the usual cost.

It might sound complicated, like something cooked up by a tax accountant, but the idea is actually brilliantly simple. You agree to ‘sacrifice’ a chunk of your gross salary—that’s your pay before HMRC takes its cut—and in return, your employer leases you a shiny new electric car.

Because the lease payment comes out of your pre-tax earnings, your taxable income is lower. This means you end up paying less Income Tax and less National Insurance. It’s essentially a huge, government-approved discount on your dream car.

The Win-Win Scenario

This isn’t just a clever perk for employees; employers love it too. They also save money because their own National Insurance contributions are calculated based on your (now lower) salary.

It's one of those rare situations where everyone genuinely comes out ahead:

- For You (The Employee): You get a brand-new electric car, often with insurance and maintenance bundled in, for a fixed monthly cost that's far cheaper than a personal lease. You save a packet on tax and can forget about the ever-rising price of petrol.

- For Them (The Employer): They reduce their National Insurance bill for every single employee who joins the scheme. It's also a fantastic perk that helps them attract and retain top talent.

This is exactly why these schemes are becoming so popular. It’s a powerful, cost-effective way for a business to offer a seriously desirable benefit without it costing them a fortune.

A salary sacrifice scheme essentially lets you pay for a premium product with your untaxed income. By taking advantage of the low electric car benefit in kind rates, the savings on tax and National Insurance can reduce the net monthly cost by as much as 30-50% .

A Worked Example to Make It Real

Let's crunch some numbers to see the magic in action. Imagine you're a higher-rate (40%) taxpayer, and you’ve got your eye on an EV that costs £500 per month through your company's salary sacrifice scheme.

Here’s a simplified look at how the savings stack up:

- Gross Salary Sacrifice: -£500

- Income Tax Saving (at 40%): +£200

- National Insurance Saving (at 2%): +£10

Right away, this drops the effective cost from your net pay to just £290 (£500 - £200 - £10). But we’re not quite finished—we still need to account for the BiK tax.

Let's assume the car has a P11D value of £45,000. As we already know, the BiK tax is tiny.

- BiK Tax Calculation: £45,000 (P11D) x 2% (BiK Rate) x 40% (Your Tax Rate) = £360 per year.

- Monthly BiK Tax: +£30

Now, we just add that small tax bill back into our calculation.

The Final, Glorious Saving

| Description | Monthly Amount |

|---|---|

| Gross Salary Sacrifice | -£500 |

| Tax & NI Savings | +£210 |

| Cost Before BiK | -£290 |

| Add Monthly BiK Tax | +£30 |

| Final Net Cost to You | £320 |

And there you have it. That £500-a-month car is only costing you £320 from your take-home pay. You're saving a massive £180 every single month , which adds up to £2,160 a year , compared to just paying for a lease out of your already-taxed salary.

That’s even before you factor in the thousands you'll save by never visiting a petrol station again. This is the true power of combining salary sacrifice with the minuscule electric car benefit in kind tax. It’s simply the smartest way to drive a new EV today.

What Does the Future Hold for EV Tax Perks?

Let's be honest, the current rock-bottom BiK rates for electric cars feel a bit like a party that can't last forever. And you'd be right. The government's generosity has a shelf life, but before you panic, the good news is that they’ve laid all their cards on the table for us to see.

HMRC has published a clear roadmap for Benefit-in-Kind rates all the way up to the 2029/30 tax year. This isn't some vague promise; it’s a set-in-stone schedule that gives you the certainty you need to commit to a three or four-year lease without worrying about a nasty tax shock halfway through.

The plan involves slow, predictable, and frankly quite gentle increases. This isn't a rug-pull. It's a gradual tapering of one of the best tax perks we've seen in a long time.

HMRC's Planned BiK Rate Increases for Electric Cars

The government's own data shows just how popular these low rates have been. In the 2023 to 2024 tax year, fully electric cars accounted for a massive 41% of all employees receiving a car benefit. You can dig into the full government statistics yourself to see the trend. These planned rate rises are designed to manage that popularity without killing the incentive.

So, here’s how the BiK percentage for zero-emission cars is scheduled to climb over the next few years.

| Tax Year | BiK Percentage Rate |

|---|---|

| 2024/25 | 2% |

| 2025/26 | 3% |

| 2026/27 | 4% |

| 2027/28 | 5% |

| 2028/29 | 7% |

| 2029/30 | 9% |

As you can see, even by the end of the decade, the BiK rate will still be a single-digit figure. When you compare that to the eye-watering 25% to 37% bands that most new petrol and diesel cars fall into, the financial advantage remains colossal.

What This Means for Your Wallet

So, how does this actually translate into pounds and pence? Let's revisit our earlier example of the Polestar 2 with a P11D value of £44,950 and see how the annual tax bill for a 40% taxpayer changes over time.

- Now (2024/25 at 2%): Your tax is a tiny £359.60 per year .

- In 2026/27 (at 4%): It will rise to a still very manageable £719.20 per year .

- By 2029/30 (at 9%): It will reach £1,618.20 per year .

Yes, the bill goes up, but even at its highest point in 2030, it’s still thousands of pounds less than you’d pay for a comparable petrol car right now. The BiK tax on a similarly priced VW Golf today would be over £4,300 a year, and that’s assuming its own BiK rate doesn’t get any worse.

The key takeaway is this: the huge electric car benefit in kind advantage is locked in for years to come. These planned increases are minor adjustments, not a fundamental shift. The electric company car will remain the undisputed champion of low-tax driving for the foreseeable future.

This long-term certainty makes choosing an EV a safe and incredibly smart financial move. You can sign that lease agreement with complete confidence, knowing exactly what you’ll be paying not just this year, but for the entire life of your contract. The party isn't over; it's just calming down a bit.

Voltsmonster's Deal of the Week

Right, enough with the theory and spreadsheets. It’s time to see how all this financial know-how translates into getting a fantastic new car on your drive for less than you might think. We're putting the electric car benefit in kind rules to the test with a real-world example.

This week, we’ve tracked down a brilliant salary sacrifice offer on a car that’s making some serious waves: the Volvo EX30 Single Motor Extended Range .

Forget any preconceptions of dull electric cars. The EX30 is a seriously quick, beautifully designed piece of Scandinavian engineering. It has that cool, minimalist interior that feels futuristic, and its acceleration can give a few hot hatches a genuine shock. Most importantly, this version has an official range of up to 295 miles , which is more than enough to handle the weekly commute, school runs, and weekend trips without breaking a sweat.

The Numbers That Actually Matter

Let’s get straight to the point. Here’s a typical salary sacrifice breakdown for a higher-rate ( 40% ) taxpayer. The final figure might surprise you.

| Deal Component | Monthly Figure |

|---|---|

| Gross Salary Sacrifice | £550 |

| Income Tax & NI Savings | -£231 |

| Tiny BiK Tax Payment | +£32 |

| Final Net Cost to You | £351 |

You read that right. A brand-new, premium electric SUV for a net monthly cost of just £351 . That’s the power of combining your pre-tax salary with the ultra-low BiK rate for EVs. If you tried to get the same car on a personal lease, you’d be looking at a much higher monthly payment, and that would be coming out of your already-taxed pay packet.

This isn't some dodgy loophole; it's a government-backed incentive designed to make driving electric more accessible. It effectively turns a premium EV into a genuinely affordable option.

Now, in the spirit of a proper review, it's not perfect. The EX30's heavy reliance on its central touchscreen for almost every function might delight tech lovers but could frustrate those who prefer a simple button. There's no separate driver's display behind the steering wheel, meaning everything from your speed to the climate controls is on that one screen.

But for this kind of money? It’s a quirk many would happily learn to live with. This deal is a perfect, real-world illustration of how getting your head around BiK can turn theoretical savings into a shiny new Volvo on your driveway.

Your BiK Questions Answered

Right, we've covered a lot of ground. It's completely normal for your head to be spinning with percentages, tax codes, and P11D values at this point.

Let's tackle some of the most common questions that crop up. We'll keep it simple and get straight to the point.

What if I Only Use the Company Car for Business Trips?

You might think that if you only use the car for getting to client meetings, you're exempt from BiK. Unfortunately, HMRC sees things very differently.

The key phrase is "available for private use." This includes your daily commute. Unless the car is physically left at your workplace every night and weekend, and you genuinely have no access to it, it’s considered available for private use. In practice, this means 99% of company car drivers will be liable for BiK tax.

Are Hybrids a Good Deal for BiK Tax?

Compared to a standard petrol or diesel car? Absolutely. Compared to a fully electric car? Not even close.

Plug-in Hybrids (PHEVs) occupy a middle ground. Their BiK rate is calculated based on how far they can travel on battery power alone. A longer electric range means a lower BiK rate, but even the best PHEVs fall into bands ranging from 8% to 21% . A full EV, sitting at just a few percent, is always going to be the hands-down winner for minimising your tax bill.

Who Pays to Charge an Electric Company Car?

This is a brilliant question, and the rules are surprisingly generous for EV drivers. Let's break it down:

- Charging at home: If your employer pays for a charge point to be installed at your house, this is a tax-free benefit . A fantastic perk.

- Charging on business trips: When you claim back the cost of electricity used for business mileage, these reimbursements are also tax-free .

- Charging for personal trips: Here's the real kicker. If your employer pays for the electricity for your private mileage (e.g., with a company-provided charging card), this is treated as a fuel benefit. But because the BiK rate for electricity as a fuel is currently 0% , you pay no extra tax on it.

Does the Car's P11D Value Go Down Over Time?

No, it doesn't. The P11D value is fixed from day one. It's the car's list price when new, including VAT, delivery, and any factory-fitted optional extras.

This value doesn't decrease with the car's age or depreciation for the entire time you have it. This is why paying close attention to the P11D value when choosing your vehicle is so crucial – it forms the basis of your tax calculation for years to come.

At VoltsMonster , we cut through the noise to give you the real story on electric cars. Check out our latest reviews and guides at https://www.voltsmonster.com to find your perfect EV.