UK Electric Car Tax Benefits: A Simple Guide to Dodging HMRC

Forget saving the planet for a moment—the most compelling reason to get an electric company car is to stop HMRC from emptying your pay packet.

The main event here is Benefit-in-Kind (BiK) tax . It's essentially the taxman's way of saying, "Nice perk, mate. We'll have a slice of that." For a petrol car, that slice is a hefty chunk of your salary. But for an EV? It’s comically, almost laughably, small.

Understanding The Benefit-In-Kind (BiK) Tax Perk

Right, let's get into it. Benefit-in-Kind , or BiK, is the tax you pay on juicy non-cash benefits your employer gives you, and a company car is often the juiciest of them all.

Think of it like this: your boss hands you the keys to a brand-new motor instead of a pay rise. HMRC, not wanting to miss out, assigns a cash value to this perk and then taxes you on that value as if it were extra income. Simple as that.

For a traditional petrol or diesel car, the BiK percentage is based directly on its CO2 emissions. The dirtier the car, the higher the percentage, and the more of your hard-earned cash vanishes into the tax ether. It’s a system that has long made a company car feel less like a perk and more like a financial ball and chain.

But this is where the government decided to throw electric car drivers a massive, tax-shaped bone.

Why The Government Made EVs So Tax-Friendly

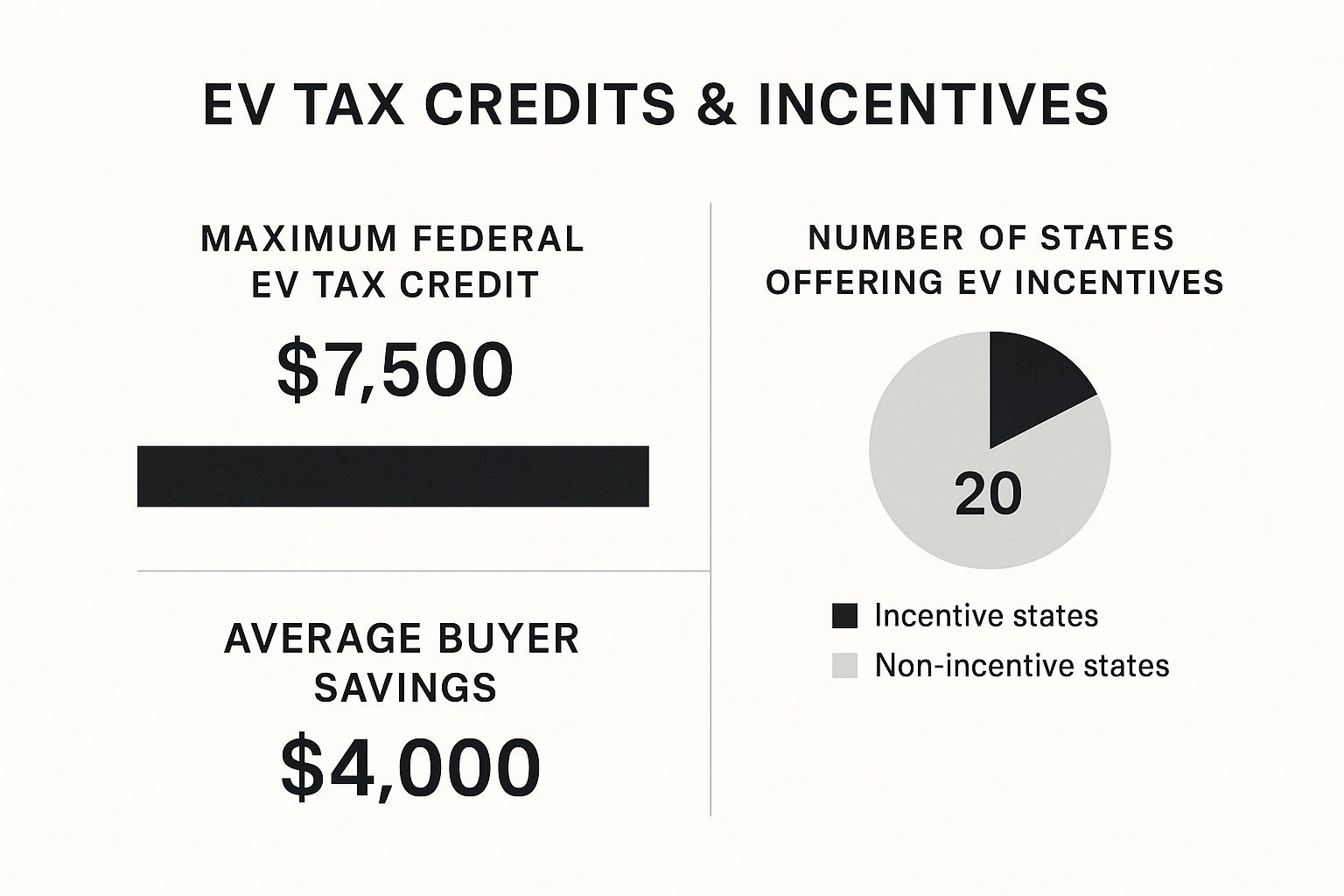

To nudge everyone towards a zero-emission future, the government has rigged the BiK system heavily in favour of electric vehicles. Instead of facing rates that can climb towards an eye-watering 37% , pure electric cars get a ridiculously low rate.

By keeping the Benefit-in-Kind tax rate for electric cars at a bare minimum, the government has created one of the most powerful financial incentives available to UK employees. It transforms the company car from a tax liability into a massive saving.

This isn’t just a small discount; it’s a monumental saving.

BiK Tax At A Glance: Petrol vs Electric

To really see the difference, let’s put some numbers side-by-side. The table below shows a typical example for a higher-rate taxpayer. You might want to sit down for this.

| Vehicle Type | Example P11D Value | BiK Rate (2025/26) | Annual Tax for 40% Taxpayer |

|---|---|---|---|

| Petrol Car | £35,000 | 30% | £4,200 |

| Electric Car | £35,000 | 2% | £280 |

The numbers don't lie. The savings are astronomical, making the financial case for switching incredibly strong.

For the 2024/25 tax year, the BiK rate for electric company cars is just 2% . It's set to rise by 1% each year until it hits 5% in 2027/28, but even then, it's a world away from the rates for petrol and diesel models.

This means thousands of pounds that would have been swiped from your payslip for a petrol car now stay right where they belong: in your bank account. It’s less about eco-warriordom and more about pure, unadulterated financial savvy.

This single tax perk is so powerful that it's completely changed the game for company car schemes. It's also a key factor in how electric vehicles are revolutionising fleet management. The savings are so substantial, it makes choosing anything else look like a charitable donation to the Treasury.

The End of Free Road Tax for EVs

For what felt like a glorious eternity, driving an electric car came with a certain smug satisfaction. As your petrol-guzzling neighbours grumbled about their annual road tax bill, you could bask in the warm glow of paying precisely sod all. It was a brilliant, tax-free party.

Well, the government has officially flicked the lights on and called last orders. The era of free-wheeling, zero-cost Vehicle Excise Duty (VED) for EVs is screeching to a halt.

From 1st April 2025 , the free ride is over. Zero-emission cars will, for the first time, be expected to cough up and contribute to the nation's pothole fund, just like everyone else. This is one of the most significant policy shifts in the world of electric car tax benefits, bringing an end to a major perk that early adopters rightly cherished.

What The New VED Rules Mean For You

So, what does this actually mean for your wallet? The government has decided on a phased approach. New zero-emission cars registered after 1st April 2025 will face a small initial VED charge of £10 in their first year. After that, it jumps to the standard annual rate, which is currently £195 . It’s a bit of a shock to the system, but it's still a pittance compared to the tax on a thirsty V8. You can learn more about how the 2025 changes are reshaping EV ownership costs in this detailed explainer from Gridserve.

This change also reaches back to affect existing EVs.

- EVs registered between 1 April 2017 and 31 March 2025 will also start paying the standard rate of £195 per year.

- EVs registered before 1 April 2017 , which were in a different tax band, will move from paying £0 to the new light passenger vehicle rate—a mere £20 .

It’s a comprehensive shake-up designed to level the playing field as EVs become a more common sight on our roads.

The Dreaded Expensive Car Supplement

Just when you thought it was safe to configure that high-spec Tesla, there’s another layer to this tax onion. The government is also removing the exemption from the ‘Expensive Car Supplement’ for electric vehicles.

This is a rather unsubtle tax grab aimed squarely at premium models. From April 2025, if your new electric car has a list price over £40,000 , you’ll be slapped with an additional annual charge for five years.

This supplement currently stands at a painful £410 per year. It kicks in from the car's second year of registration and runs until its sixth. For a premium EV, that means you'll be paying the standard rate plus this supplement, bringing your total annual VED to a hefty £605 . Suddenly, that options list looks a lot more intimidating.

Here's a straightforward look at how the new VED rates will apply from April 2025.

New VED Rates for Electric Cars From April 2025

| EV Registration Period | VED Rate from 1st April 2025 | Notes |

|---|---|---|

| New EVs (from 1/4/25) | £10 (Year 1), then £195/year | Subject to Expensive Car Supplement if list price is >£40k |

| Existing EVs (1/4/17 - 31/3/25) | £195 per year | Also subject to the supplement if original list price was >£40k |

| Older EVs (before 1/4/17) | £20 per year | A small but notable increase from the current £0 rate. |

While the end of free road tax stings, it's crucial to remember the bigger picture. The running costs of an EV, thanks to cheaper "fuel" and minimal maintenance, still massively undercut those of a comparable petrol or diesel car. The party might be over, but the financial hangover is surprisingly manageable.

Putting Real-World Numbers on Your EV Savings

Alright, let's get down to brass tacks. Percentages and policies are one thing, but what do these electric car tax benefits actually mean for your bank balance? It’s time to move from theory to tangible savings—the actual pounds and pence that stay in your pocket instead of going to HMRC.

This is where the real magic happens. We’re going to run the numbers on a classic company car dilemma: a shiny new electric SUV versus its petrol-powered cousin. No jargon, no fluff, just a straight-up comparison to see how much cash you really stand to save.

The Company Car Showdown

Let's imagine two employees, Dave and Sarah. Both are higher-rate taxpayers (paying 40% income tax) and have been offered a new company car with a P11D value of £45,000 . Dave, being a traditionalist, goes for a smart petrol SUV. Sarah, on the other hand, decides to embrace the electric future with a comparable EV.

Here’s how their finances stack up over a typical three-year lease.

The Knockout Blow: Benefit-in-Kind (BiK) Tax

First up, the big one: Benefit-in-Kind (BiK) tax. This is where the EV absolutely demolishes the competition.

- Dave's Petrol SUV: Thanks to its CO2 emissions, his car falls into a hefty 32% BiK band. This makes his taxable benefit £14,400 per year. As a 40% taxpayer, he'll pay a whopping £5,760 in BiK tax annually.

- Sarah's Electric SUV: Her EV qualifies for the incredibly low 2% BiK band (for 2024/25). Her taxable benefit is just £900, meaning her annual BiK tax bill is a tiny £360 .

Over three years, Dave will hand over a staggering £17,280 to the taxman just for the privilege of driving his car. Sarah will pay a mere £1,080 .

That’s an unbelievable saving of £16,200 for Sarah before we even look at anything else.

This isn’t just a small discount; it's a financial game-changer. The BiK advantage is so massive that it often makes the choice between petrol and electric a simple matter of arithmetic for any clued-up employee.

Don't Forget the VED Changes

Now, let's factor in road tax (VED). The days of free VED for EVs are ending in 2025. Since both cars are new and cost over £40,000, they're both hit by the 'Expensive Car Supplement' from their second year onwards.

Assuming they get their cars in late 2024, here’s how the new rules will affect them in years two and three.

- Dave (Petrol): His Year 1 VED is high due to emissions, let's say £645. For years 2 and 3, he’ll pay the standard rate (£190) plus the supplement (£410), totalling £600 per year.

- Sarah (Electric): Her Year 1 VED is £0. But for years 2 and 3, the new 2025 rules mean she’ll also pay the standard rate plus the supplement, costing her £600 annually.

Over the three-year term, Dave’s total VED comes to £1,845 , while Sarah’s is £1,200 . It’s still a saving for Sarah, but it’s nowhere near the landslide victory she scored on BiK tax.

The Final Tally: Adding Up the Savings

Finally, the most obvious saving: fuel. Assuming both Dave and Sarah drive 10,000 miles a year, the costs are worlds apart. Dave’s petrol SUV, doing 40 mpg with petrol at £1.50 per litre, will set him back around £1,705 a year.

Sarah, charging mostly at home on a cheap overnight tariff, might spend only £400 a year on electricity. That’s an annual fuel saving of over £1,300 .

When you add it all up—the colossal BiK saving, the modest VED difference, and the significant fuel cost advantage—Sarah is better off by nearly £22,000 over the three-year term. That's enough for a new kitchen, a few luxury holidays, or just a much healthier bank balance. The numbers really do speak for themselves.

And this is before even diving into maintenance and other expenses, which you can explore in our guide on the real cost of owning an EV compared to petrol cars.

Uncovering Other Hidden EV Tax Perks

While the Benefit-in-Kind (BiK) savings and the soon-to-be-extinct Vehicle Excise Duty (VED) exemption get all the attention, there are a few other brilliant tax benefits for electric cars tucked away in the details. Think of them as the encore after the main show—often missed, but incredibly valuable if you know where to look.

Getting to grips with these extra perks is a bit like finding a secret menu at your favourite restaurant. It’s where those in the know find the best deals. For both businesses and their employees, these additional savings can make the financial case for switching to an EV completely airtight.

Capital Allowances: The Business Superpower

Here’s a huge one for business owners. When a company buys a brand-new, zero-emission electric car, it can claim something called First Year Allowances . This is a seriously generous tax relief that lets the business subtract the full cost of the car from its pre-tax profits in the year of purchase.

Let's put that into perspective. Say your company buys a new £50,000 electric car. Thanks to the 100% First Year Allowance, it can deduct that entire £50,000 from its profits before the taxman comes knocking. If the company's Corporation Tax rate is 25% , that single move just slashed its tax bill by a cool £12,500 .

This isn't just a simple discount; it's a powerful financial tool for any business. It effectively makes a brand-new electric car significantly cheaper, rewarding companies for investing in a green fleet.

This perk is specifically for new electric cars, so used models don't qualify, but it’s a colossal incentive for businesses to start electrifying their fleets. These kinds of policies are a prime example of the clever strategies governments use to get more EVs on the road, a topic we explore in our look at the role of government policies in accelerating EV adoption.

Free Fuel Without The Tax Headache

Another fantastic perk for employees is the complete exemption from the Fuel Benefit Charge . This is a separate tax that normally applies when an employer pays for the fuel an employee uses for their private journeys. With a petrol or diesel car, this can easily add hundreds, or even thousands, of pounds to an individual's annual tax bill.

But with an electric car, it's a different story. If your employer is good enough to pay for all your electricity—including charging up at home for personal trips—HMRC considers the cash equivalent to be zero. That's right. Zero .

It means you get the benefit of "free fuel" for all your personal mileage without paying a single extra penny in tax. It’s a loophole big enough to drive a Tesla through and another huge win for company car drivers who go electric.

Tax Relief On Workplace Charging

The government is also keen to see more chargers popping up at workplaces. To give businesses a nudge, there’s a tax relief available to cover the cost of installing electric vehicle charge points.

Under this scheme, a business can claim a 100% First Year Allowance on the money it spends installing charge points for its staff. Just like buying a new EV, the entire cost can be deducted from pre-tax profits. It's a simple and effective incentive that makes it much easier for businesses to support their teams in making the switch.

Common Mistakes That Cost You Money

Navigating the world of UK tax rules can feel like trying to assemble flat-pack furniture without the instructions. It’s fiddly, often frustrating, and surprisingly easy to get wrong. The world of electric car tax benefits is no different; one wrong move and those expected savings can evaporate.

Let's be clear, getting this right isn’t rocket science. But there are a few classic tripwires that catch people out time and time again. Think of this as your guide to sidestepping those pitfalls, ensuring you pocket every penny you're entitled to without any nasty surprises from HMRC.

Forgetting The Extras On The P11D Value

This is easily the most common and costly blunder. When it comes to Benefit-in-Kind (BiK) tax, everything hinges on the car's P11D value . This isn't just the sticker price you see in the showroom; it includes the delivery charge, VAT, and, crucially, the cost of any optional extras you couldn't resist.

That panoramic sunroof, the fancy paint job, and the upgraded sound system all get added to the total. It’s painfully easy for these tempting additions to push the final P11D value over the dreaded £40,000 threshold.

Once you cross that line, your shiny new EV becomes subject to the 'Expensive Car Supplement' from its second year onwards. This adds a hefty chunk to your annual road tax bill for five years. It’s a classic case of a few thousand pounds in options costing you much more in the long run.

Getting the P11D value right is non-negotiable. Before you sign on the dotted line, confirm the total value including all extras to ensure you haven’t accidentally promoted your car into a more expensive tax bracket.

Assuming Zero Emissions Means Zero Paperwork

It’s a tempting thought: a zero-emission car means a zero-effort approach to record-keeping. Unfortunately, that's not how HMRC sees it. This is especially true if you plan to claim back the cost of electricity used for business mileage.

The taxman isn't just going to take your word for it. To claim these expenses legitimately, you need to keep meticulous records. This means:

- A Detailed Mileage Log: You must separate your business miles from your personal trips. Plenty of apps can help, but a simple logbook works just fine.

- Proof of Costs: Keep your home electricity bills handy to show the rate you pay per kilowatt-hour (kWh).

- Accurate Calculations: You’ll need to work out the exact cost of the electricity used for those specific business journeys.

Without this paper trail, your claim is built on shaky ground. If HMRC decides to take a closer look, a vague "I did about 500 business miles last month" simply isn't going to cut it.

Ignoring The Salary Sacrifice Small Print

Salary sacrifice schemes are a fantastic way to get behind the wheel of an electric car, offering substantial tax savings. However, they are complex agreements, and diving in without reading the small print can lead to some unwelcome financial shocks.

Be sure to watch out for early termination fees, which can be eye-wateringly high if you leave your job unexpectedly. You should also be crystal clear on what’s included in the monthly payment. Insurance, maintenance, and even tyre replacement are usually covered, but it's vital to confirm. Assuming everything is included without checking is a recipe for a very expensive mistake.

Your Electric Car Tax Questions Answered

We've thrown a lot of acronyms and tax jargon your way, so it's perfectly normal if your head is spinning a bit. All this talk of BiK, VED, and P11D values can feel like learning a new language.

Not to worry. Here are some straight, no-fluff answers to the most common questions we hear about UK electric car tax. Think of this as your cheat sheet for sounding like you know what you’re talking about down the pub.

Are There Still Government Grants To Buy An Electric Car?

For the average person buying a car for themselves, the short answer is no, not anymore. The main Plug-in Car Grant, which used to knock a tidy sum off the sticker price of a new EV, has been phased out for passenger cars. The government’s view is that the market is now mature enough to stand on its own two feet.

That said, the grant hasn't vanished entirely. It’s been refocused on specific vehicles to encourage uptake in other areas, including:

- Wheelchair accessible vehicles

- Vans and lorries

- Motorcycles and mopeds

For most of us, though, the real financial incentive has simply shifted. Instead of giving you a discount to buy the car, the government is now rewarding you through tax savings after you get one. The super-low Benefit-in-Kind rate on company cars is the undisputed champion here. Always check the official government website for the latest updates on grants.

Does A Salary Sacrifice Scheme For An EV Really Save Me Money?

In most cases, yes – and often by a frankly astonishing amount. A salary sacrifice scheme is one of the most tax-efficient ways for an employee to get behind the wheel of a brand-new electric car. It’s not some dodgy loophole, either; it’s a perfectly legitimate arrangement.

So, how does it work? You agree to "sacrifice" a portion of your gross salary each month. In return, your employer uses that money to lease an electric car for you. Because the payment comes out of your salary before tax and National Insurance are calculated, your taxable income drops.

This is the crucial part. You're effectively paying for a brand-new car with untaxed money, which immediately makes it cheaper. Combine this with the ridiculously low 2-3% BiK tax rate for EVs, and the overall monthly cost is almost always significantly lower than leasing the exact same car yourself.

It's a powerful one-two punch of tax savings that makes a shiny new EV surprisingly affordable for many people.

What Happens To The BiK Rate After 2028?

Ah, the million-dollar question. The government has kindly laid out its plans for Benefit-in-Kind tax, but only up to the 2027/28 tax year. We know the rate will climb by 1% each year until it hits 5% . Beyond that, it’s all officially ‘to be confirmed’.

This uncertainty can feel a bit unnerving, especially if you’re signing a three or four-year lease. However, the general consensus across the industry is that while the rates will inevitably continue to creep up, a sudden, dramatic jump is highly unlikely. The government has legally binding net-zero targets to hit, and making EVs financially punishing for company car drivers would be like shooting itself in the foot.

For the foreseeable future, electric cars will almost certainly remain the most tax-efficient company car choice by a country mile. But will the rate be 6% or 7% in 2029? Your guess is as good as ours for now.

If I Buy A Used EV, Do I Still Pay The 'Expensive Car Supplement'?

Yes, and this is a critical point that catches a lot of second-hand buyers out. The 'Expensive Car Supplement' is tied to the car's original list price when it was new, not its current value or owner. This extra VED charge applies for five years, starting from the car's second tax renewal.

Let's put that into perspective. Say you’re buying a three-year-old premium electric car. Its list price when new was a hefty £50,000. Even if you're only paying £25,000 for it now, you will still be liable for the standard VED rate plus the supplement for two more years.

This is a crucial cost to factor in when browsing the classifieds. That seemingly great deal on a used premium EV might come with an unexpected annual tax bill of over £600 , so always, always check the car's original list price before you commit.

At VoltsMonster , we cut through the noise to bring you the real story on electric vehicles. From honest reviews to practical advice on maximising your electric car tax benefits, we've got you covered. Check out our latest content and join the conversation at https://www.voltsmonster.com.