Tesla Salary Sacrifice: A Sneaky Guide to Cheaper EV Driving

Let's be honest, you've seen them. The silent, sleek Teslas gliding down the street like smug, battery-powered ghosts. Maybe you've pictured yourself behind the wheel, basking in the minimalist dash and that neck-snapping acceleration. Then, the price tag brings that daydream to a screeching, wallet-imploding halt.

But what if you could get into a brand-new Model Y for a fraction of the showroom price? What if the payment came straight from your payslip, and you could legally give HMRC the swerve at the same time?

This isn’t some dodgy loophole whispered about in pub corners. It’s a completely legitimate, government-endorsed employee benefit called a Tesla salary sacrifice scheme, and it's quickly become the smartest, cheekiest way for UK employees to drive a premium electric car.

So, How Does This Voodoo Actually Work?

Think of it like an ultra-efficient company car scheme, but for the 21st century. You agree to give up, or 'sacrifice', a chunk of your gross salary —that’s your pay before any income tax or National Insurance vultures get their claws into it. In exchange, your employer leases a brand-new Tesla for you.

Because the payment for the car is taken from your pre-tax earnings, it lowers your overall taxable income. Less taxable income means a smaller bill from HMRC. Simple as that.

The core principle is fiendishly clever: you pay for your car before the taxman gets his slice. This lowers your tax and National Insurance contributions, and those savings directly slash the monthly cost of your shiny new Tesla.

The Numbers Don't Lie (Unlike Some Politicians)

We're not talking about saving a few quid here and there. The savings are massive. For many people, a salary sacrifice scheme can chop the monthly cost of a Tesla by 30-60% compared to a personal lease.

Industry figures show that a new Tesla Model Y can be nabbed for as little as £472 a month through these schemes. With Tesla holding a huge 17.5% share of the UK's battery-electric car market, it’s no surprise this has become the go-to funding method.

Even a basic-rate taxpayer can see their costs plummet by over 40% compared to leasing the car privately. For a deeper dive, our sceptic's guide to EV salary sacrifice breaks down the costs in more detail, but the financial argument is so strong it’s practically shouting at you. It's a genuine game-changer.

How Does Salary Sacrifice Actually Work?

Right, let's cut through the jargon. Most explanations of salary sacrifice schemes are full of mind-numbing terms like 'gross emoluments' and tedious references to HMRC legislation. Forget all that. We’ll break it down with an analogy any self-respecting Brit can appreciate: a pint.

Imagine your monthly salary is a freshly pulled pint. Before you even get a sip, the taxman swoops in and skims a hefty, frothy chunk off the top for Income Tax and National Insurance. What's left in the glass is your net pay—the money you actually get to spend. A bit of a tragedy, really.

With a salary sacrifice scheme, you get to have a word with the barman before the taxman arrives. You tell your boss, "Hold on. Before anyone touches that pint, use some of it to pay for my new Tesla."

The Pre-Tax Power Play

This is the crucial bit. The payment for the car is taken from your gross salary – the full, untouched pint. By doing this, the amount of salary that HMRC can see and tax is now smaller.

Let's say you earn £4,000 a month. You 'sacrifice' £500 for the Tesla. HMRC no longer sees you as a £4,000-a-month employee; in their eyes, you're earning £3,500 . As a result, you pay less Income Tax and less National Insurance on that smaller amount. These savings are what make the car so much cheaper.

In essence, you're using money that would have otherwise gone straight to the taxman to pay for a big chunk of your car. It’s a brilliant, government-approved bit of financial wizardry.

The Benefit-in-Kind (BIK) Secret Weapon

"Aha!" I hear you cry. "But if my employer is giving me a car, isn't that a 'perk' I'll get taxed on?" You're absolutely right. This perk is called a Benefit-in-Kind (BIK) , and it's where the real magic of a Tesla salary sacrifice scheme happens.

For traditional petrol or diesel company cars, the BIK tax rate is painfully high, often wiping out any potential savings. But the government is desperate for us all to go electric. To give us a nudge, they've set the BIK tax rate for electric vehicles at a ridiculously low 2% .

So, what does this actually mean for your wallet?

- Petrol/Diesel Cars: The BIK tax can be as high as 37% of the car's value, which can cost you thousands every year. Painful.

- Electric Cars (like a Tesla): The BIK tax is just 2% . This means the tax you pay on this fantastic 'benefit' is often less than the cost of a few posh coffees each month.

This tiny BIK rate is the secret sauce. It ensures the tax you pay for the 'perk' is minuscule, allowing the massive savings from your gross salary to really make a difference. It’s the powerful one-two punch of a pre-tax payment and a negligible BIK rate that makes driving a brand-new Tesla surprisingly affordable.

Crunching the Numbers: A Real-World Cost Breakdown

All this talk of pre-tax earnings and BIK rates is great in theory, but what does a Tesla salary sacrifice deal actually mean for your bank balance? Let's move past the financial jargon and run some real-world numbers to see exactly how much you could save.

Brace yourself, because the difference is genuinely staggering. This isn’t just about saving a few quid on fuel; it’s about fundamentally changing the cost of getting behind the wheel of a brand-new car.

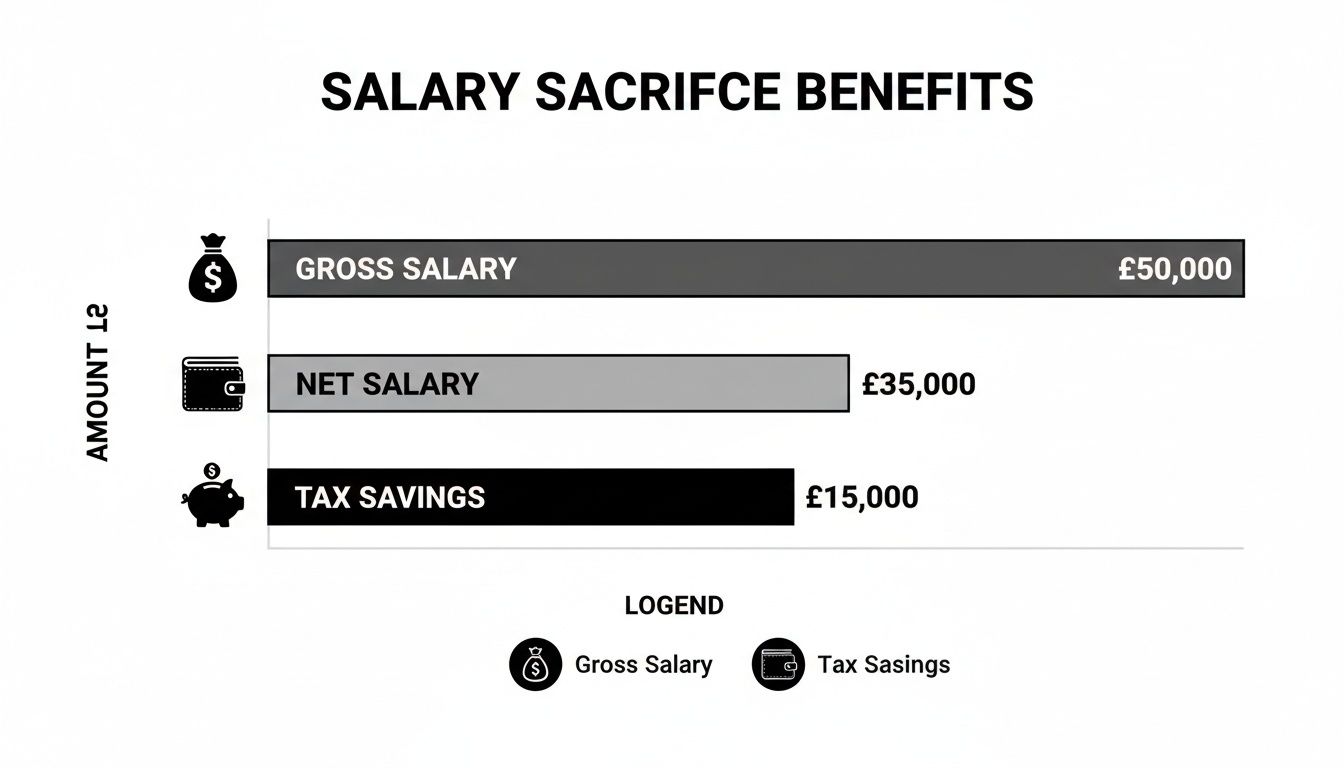

This infographic neatly illustrates how your salary is split. It shows how you pay for the car before HMRC gets its slice, which is the secret to the whole thing.

As you can see, the chunk of your gross salary that would normally go straight to the taxman is instead redirected to cover the car. This dramatically softens the blow to your take-home pay.

The Ultimate Showdown: Model Y Salary Sacrifice vs Personal Lease

To really bring this to life, let’s compare the monthly cost of a shiny new Tesla Model Y RWD. We'll pit a typical salary sacrifice deal against a standard Personal Contract Hire (PCH) lease for both a basic-rate ( 20% ) and a higher-rate ( 40% ) taxpayer.

For a fair fight, we've assumed a standard all-inclusive package that bundles the car, insurance, and maintenance into one monthly figure. This shows the true cost of running the car, not just a misleading headline price. If you want to dive deeper into all the associated expenses, you can explore the real cost of owning an EV compared to petrol cars in our detailed guide.

Here's how the numbers stack up.

Tesla Model Y Cost Showdown: Salary Sacrifice vs Personal Leasing

A side-by-side comparison of the estimated monthly cost for a Tesla Model Y RWD for a basic (20%) and higher (40%) rate taxpayer, contrasting a salary sacrifice scheme with a standard personal lease. Assumes a typical inclusive package (insurance, maintenance).

| Metric | Salary Sacrifice (20% Taxpayer) | Salary Sacrifice (40% Taxpayer) | Personal Contract Hire (PCH) |

|---|---|---|---|

| Gross Salary Reduction | £680 | £680 | N/A (Paid from net salary) |

| Income Tax & NI Saving | - £218 | - £286 | £0 |

| Benefit-in-Kind (BIK) Tax | + £30 | + £60 | £0 |

| Final Net Monthly Cost | £492 | £454 | £750 |

| Total Monthly Saving | £258 | £296 | Baseline |

The results are, frankly, ridiculous.

A basic-rate taxpayer saves £258 every single month . Over a three-year agreement, that’s a colossal saving of £9,288 . For a higher-rate taxpayer, the numbers are even better: a monthly saving of £296 , which works out to an incredible £10,656 over the same period.

This isn't smoke and mirrors. The table clearly shows how the huge savings on Income Tax and National Insurance completely dwarf the tiny BIK tax charge. You end up with the same car, with all the major running costs included, for significantly less than you could ever get it on a personal lease. It's the closest thing to a free lunch in the motoring world.

The Pros and Cons: Is This Scheme Right For You?

Right then. So far, a Tesla salary sacrifice deal sounds almost too good to be true, doesn't it? Massive tax savings, a shiny new car, and all the main costs bundled into one payment.

Let's be clear: anyone telling you it's a flawless plan with zero downsides is probably trying to sell you one. While it's a fantastic arrangement for many, we need to have a brutally honest look at the good, the bad, and the slightly inconvenient bits.

No sugar-coating here. This is about working out if it’s the right financial move for your specific circumstances.

The Glorious Upsides

First, the pros. And frankly, they’re pretty compelling. This isn’t just about getting a cool car; it's about the sheer financial efficiency of the entire setup.

- Jaw-Dropping Savings: This is the big one. By paying from your pre-tax salary, you're using money that would have otherwise gone straight to HMRC. The savings on Income Tax and National Insurance are huge, often knocking 30-60% off the real cost of a new Tesla.

- All-Inclusive Motoring: Most schemes roll everything into one neat monthly payment. We're talking the car itself, insurance, servicing, maintenance, and even breakdown cover. It's refreshingly simple—you just add electricity.

- No Hefty Deposit: Unlike personal leasing or PCP deals that often demand thousands of pounds upfront, salary sacrifice schemes typically require no deposit at all. You just start making the monthly payments.

- The Magic of BIK Tax: The secret weapon is the ridiculously low Benefit-in-Kind (BIK) tax on electric cars, currently fixed at just 2% . Our complete guide to UK electric car tax benefits dives deeper into this, but it’s the key ingredient that keeps costs so low compared to a petrol or diesel company car.

In short, you get a premium, all-inclusive electric car package for a fraction of the high-street price, with zero upfront cost. It’s a very attractive proposition.

The Not-So-Great Downsides

Now for the potential snags. It's crucial to go into this with your eyes wide open, because a Tesla salary sacrifice scheme isn't a perfect fit for every single person. These are the points you absolutely must consider.

First and foremost, the car is tied to your job. If you decide to leave your company, you can’t just take the car with you. An early termination clause will be in the contract, and you'll likely face a hefty fee to hand the keys back. Many providers now offer protection insurance for this very reason, but it's a critical point to clarify from the outset.

Another thing to think about is the potential knock-on effect on your wider finances. Because you are technically reducing your gross salary, it can affect certain calculations:

- Mortgage Applications: Lenders look at your gross salary when deciding how much you can borrow. A lower official salary on paper could reduce your borrowing capacity.

- Pension Contributions: If your pension contributions are a percentage of your salary, a lower gross figure could mean smaller contributions from both you and your employer.

- Life Cover: Company life insurance or 'death in service' benefits are also often calculated as a multiple of your salary.

These factors won't be a deal-breaker for everyone, but they are serious financial considerations. You have to weigh the incredible car savings against any potential impact on these other areas before you sign on the dotted line.

Alright, you're sold. You’ve crunched the numbers, you’ve imagined yourself gliding silently past packed petrol stations, and you're ready to swap a chunk of your gross salary for a brand-new Tesla.

There’s just one small hurdle: your boss.

Getting your company to introduce a new employee benefit can feel like pushing water uphill. But here’s the thing: you’re not asking for a favour. You're actually handing them a business opportunity on a silver platter.

It's all about how you frame it.

Step 1: Do Your Homework First

Before you corner your manager by the coffee machine, a little prep work goes a long way.

First, find out if your company already has a salary sacrifice provider. A quick search on the company intranet or a quiet word with someone in HR should tell you what you need to know. If they already have one, great—your job is pretty much done.

If they don't, your task is to show them just how easy and beneficial setting one up can be. Crucially, don't start the conversation by talking about how much you want a Tesla. This needs to be about the wins for the business, not your dream car.

Step 2: Build the Business Case

When you get your five minutes with the decision-maker, lead with the benefits to the company. This isn't about asking for a perk; it's about proposing a smart business move. Your pitch should rest on three key pillars that any savvy manager will find difficult to argue with.

- It saves the company money. This is your knockout opening punch. For every single employee who joins the scheme, the company pays less in Employer’s National Insurance contributions because the employee's salary is notionally reduced. It’s a direct, bottom-line saving for the business on every car.

- It’s a huge draw for talent. In today’s competitive job market, great benefits make all the difference. A Tesla salary sacrifice scheme is a seriously impressive perk that helps attract and keep the best people. It says 'we're a modern, forward-thinking employer', not 'we still communicate by fax'.

- It’s low effort, high reward. Your boss's first thought will be about the admin nightmare. Put their mind at ease. Modern providers handle almost everything, from setting up the payroll side of things to managing the vehicles. The administrative load on the company is surprisingly light.

The trick is to present this as a strategic financial and HR tool, not just an employee perk. You're helping them save money and boost their employer brand at the same time. It’s a complete no-brainer.

Step 3: Make it Incredibly Easy for Them

The final piece of the puzzle is to remove all the friction. Don't just present the idea; offer the solution.

Have the names of a couple of reputable UK salary sacrifice providers handy. Mentioning specific companies like The Electric Car Scheme , Octopus EV , or Tusker shows you've done your research and gives them a clear, simple next step.

Offer to pull together more information or even to help arrange an introductory call with a provider. By making the whole process as painless as possible, you shift from being an employee asking for something to a proactive team member bringing a valuable solution to the table.

Do that, and you’ll have that Tesla on your driveway before you know it.

The Best UK Tesla Salary Sacrifice Deals Today

Theory is one thing, but seeing the actual numbers is what really matters. You want to know what the deals look like, and we get it. So, we've done the legwork, scouring the offers from the UK's top salary sacrifice providers to find the most attractive Tesla deals on the market right now.

This is where the rubber meets the road. We’re naming names and showing you the figures. Forget vague promises; this is a snapshot of what you could actually be paying for a brand-new Tesla, straight from your payslip.

Let's break down a couple of genuine bargains we’ve spotted, giving you a proper look at what you get for your sacrificed salary.

Deal Spotlight: The Tesla Model Y RWD

The Model Y is the UK's best-selling electric car for good reason, and providers are scrambling to put together competitive deals. One of the strongest offers we've seen comes from The Electric Car Scheme , a major player in the salary sacrifice space.

- Provider: The Electric Car Scheme

- The Car: Tesla Model Y Rear-Wheel Drive (Standard Range)

- Net Monthly Cost (40% Taxpayer): Around £472

- Net Monthly Cost (20% Taxpayer): Around £515

- What's Included: The car lease, fully comprehensive insurance, all servicing and maintenance, breakdown cover, and even replacement tyres. You just add electricity.

- Contract Terms: This is typically for a 36-month term with a 10,000-mile annual allowance. Early termination protection is usually included as standard, which is a great safety net.

Our Verdict: This is a seriously hot deal. For a higher-rate taxpayer to get behind the wheel of a brand-new, fully-insured-and-maintained Model Y for under £500 a month is, frankly, incredible. It brilliantly showcases the financial power of a Tesla salary sacrifice plan.

Deal Spotlight: The New Tesla Model 3 'Highland'

The refreshed Model 3, nicknamed 'Highland', brings a sleeker design and a much-improved interior. It's the one everyone is talking about right now, and Octopus EV has a compelling offer that makes it surprisingly accessible.

- Provider: Octopus EV

- The Car: Tesla Model 3 Rear-Wheel Drive

- Net Monthly Cost (40% Taxpayer): Approximately £530

- Net Monthly Cost (20% Taxpayer): Approximately £580

- What's Included: A similar all-inclusive package covering insurance, maintenance, breakdown cover, and servicing. They also throw in a free home charger installation, which is a fantastic perk worth hundreds of pounds.

- Contract Terms: This price is usually based on a 48-month term to get the lowest monthly figure, with different mileage options available to suit your needs.

Our Verdict: A fantastic package, especially when you factor in the free charger. While it's a touch more than the Model Y, you're getting the very latest model with a premium feel. It represents exceptional value compared to any personal lease deal you could find on the open market.

Remember, these prices are estimates and can shift based on your exact salary, your company's specifics, and any optional extras you choose. However, they paint a clear, real-world picture of the monumental savings on offer today.

Got Questions? We’ve Got Answers

We’ve unpacked a lot about how a Tesla salary sacrifice scheme can seriously cut the cost of driving a new EV. But with any financial agreement, there are always a few "what if" scenarios that need clearing up.

Let's dive into the most common questions we get asked. Think of this as the straight-talking, no-jargon section to iron out any final queries.

What Happens If I Leave My Job?

This is the big one, and rightly so. The car is linked to your employment, so if you decide to move on, you can't just drive off into the sunset with the Tesla. The car goes back, which means triggering an early termination clause.

But don't panic. The industry has caught up with this common concern. Most good salary sacrifice providers now include early termination protection, either as standard or as a small add-on. This insurance is designed to cover you for things outside of your control, like redundancy, saving you from a hefty bill. Just make sure you read the fine print on what's covered before signing.

Can I Add Options to My Tesla?

Of course. If you’ve got your eye on the bigger wheels, a different colour, or the full self-driving capability, go for it. Any factory-fitted extras you choose are simply rolled into the total cost of the car.

The best bit? Because the cost of these options is part of the single monthly payment, they also qualify for the exact same tax and National Insurance savings. This makes upgrading your Tesla far more affordable than if you were funding it personally.

The entire cost of the car, including any factory-fitted options, is covered by the salary sacrifice arrangement. This means you save a significant percentage not just on the car, but on all the desirable extras too.

Who Is Responsible for Insuring the Car?

One of the real draws of these schemes is just how simple they make everything. In nearly all cases, a fully comprehensive insurance policy is bundled into your monthly payment. The provider handles it all, so you can forget about spending hours on comparison sites.

This isn't just basic cover, either. It’s typically a very comprehensive policy that includes business use. This all-in-one package removes a major hassle and means your insurance costs also benefit from those fantastic tax savings.

Does Salary Sacrifice Affect My Pension Contributions?

This is a really important point to check. A salary sacrifice scheme works by reducing your gross salary on paper, and if your pension contributions are based on a percentage of that salary, it could lower them. This might mean both you and your employer pay a little less into your pot each month.

However, many employers are aware of this and will agree to maintain their contributions based on your original salary, before the car is taken into account. It's a critical detail to confirm with your HR or payroll team before you sign up. For most, the savings on the car will easily eclipse any small change to their pension, but it’s always best to be fully informed.

Is There a Mileage Limit?

Yes, just like any other car lease deal, your monthly cost is calculated based on an agreed annual mileage. You'll typically see options ranging from 8,000 to 20,000 miles a year, but this can usually be tailored to your specific needs.

Try to be realistic about how much you drive. If you go over your allowance, you'll face an excess mileage charge at the end of the term, which is priced per mile. It's always cheaper to pick the right mileage from the outset than to pay a penalty later on.

At VoltsMonster , our goal is to cut through the jargon and give you the clear, practical advice you need for your electric car journey. If you're ready to see how much you could save, dive into our latest guides and reviews. Find your perfect EV with us at https://www.voltsmonster.com.